Nothing Like Waiting Till the Last Minute

As with many things in business and in life, deals/projects/agreements/settlements don’t get done in advance of a deadline. Once a deadline is looming, things generally get done at the 11th hour. I have a golfing friend who is perennially late to every tee time, so my other friends and I always tell him our time is earlier than it actually is. Somehow, he still manages to be late, but it gives us all a higher likelihood of teeing off on time.

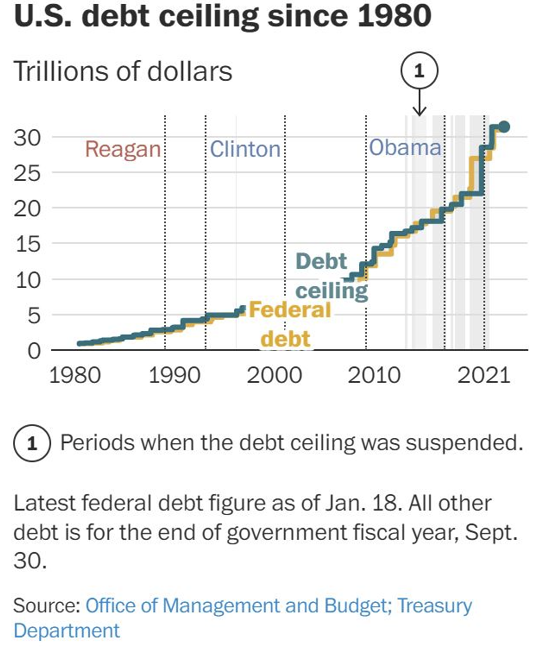

If it weren’t completely dishonest and probably illegal, Janet Yellen would do well to tell a white lie to Washington and indicate the “X-date” (the debt ceiling deadline) is actually sooner than early to mid-June in order to accelerate the dealmaking. From Thomas Urano of Sage Advisory, “The US debt ceiling was established in 1917 through the Second Liberty Bond Act. As it turns out, modifying the debt ceiling is more of a forced negotiation tool rather than an actual long term economic constraint. In fact, legislators have seen fit to suspend or raise the debt ceiling on more than 90 occasions in its 106 years of existence.”

In other words, we have been here before, but “this has often been accompanied by some political theatre. Most notably, the debt ceiling crisis of 2011 led Standard and Poor’s to downgrade federal debt for the first time in U.S. history and another tense negotiation over the debt ceiling brought the country to within days of default in 2013.” (David Kelly of JP Morgan) For what it’s worth, the S&P 500 returns in 2011 = 0% and in 2013 = 29.6%.

The recent headlines around the “X-date” being sooner than initially thought has created some increased handwringing (and of course, political mudslinging). The reason why the date is so hard to calculate is because the flows of tax revenues coming in are unpredictable and not fully known until they are actually deposited in the Treasury’s bank. Ironically, part of the reason the date has been moved to sooner than initially predicted is because of the 2022 stock market returns. From Linda Duessel at Federated Hermes, “Washington rarely acts until the stock market does. An awful year for stock investors means capital-gains tax receipts are coming up short, a key reason the debt-ceiling drama has been pulled forward to mid from late summer.” So, Washington quite literally has a vested interest in getting a deal done to avoid negative market impacts.

Most analysts “base case scenarios” (a new favorite phrase in our industry!) is that there will be continued market volatility leading up to a deal eventually getting done just before the deadline. Again, from David Kelly at JP Morgan, “For investors, it may be tempting to move to the sidelines while debt-ceiling uncertainty remains. However, it should be recognized that this situation will, eventually, be resolved. Partisanship in Washington could push the federal government to the brink of default or, in a worst case scenario, actual default. However, members of Congress won’t have the stomach to perpetuate a fiscal crisis and recession if, by the simple act of suspending the debt ceiling, they can provide relief to their constituents. The passage of such a bill should cause a rebound in the stock market, although some damage to the dollar and the Treasury bond market may be permanent.

Across all of these outcomes, the one potentially common thread is a decline in the dollar and investors may want to make sure they have good exposure to the bonds and stocks of other developed economies, denominated in foreign currency.” If you’d like to read his full post on this topic, it is well written and worth your time.

Assuming the debt-ceiling drama gets resolved, investors will again turn their focus back to inflation, recession or no recession, and interest rates. Beneath all of this noise, earnings have been surprisingly good. From Goldman Sachs, “1Q earnings season has been better than feared. 64% of the S&P 500 by market cap has reported 1Q 2023 earnings, and results have surprised to the upside. 54% of firms have beaten consensus EPS expectations by more than a standard deviation of analyst estimates, well above the long-term average of 46%.”

As we have said before, even in the best of markets, there will always be something to worry about. Most recently, my daughters had to worry about falling…

And, BRACES (actually Invisalign).

As it turns out, she is handling the Invisalign process very well. Going through a little pain now will be rewarding in the long run. The same can be said for investors.