Light at the End of the Tunnel?

After months in and out of the headlines, the issues surrounding the debt ceiling have come into sharp focus, as the U.S. could become unable to pay its bills as soon as June 1. There’s nothing like an impending deadline to force action.

What is the debt ceiling?

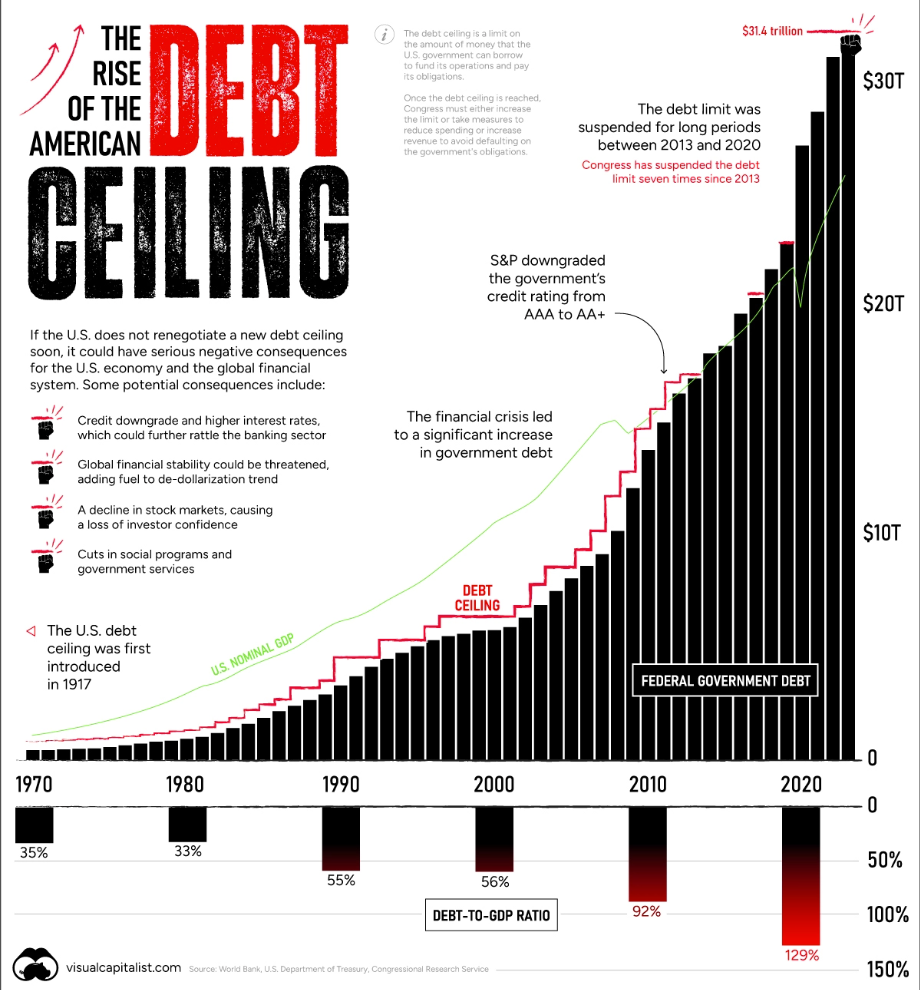

The debt ceiling is the amount of money the U.S. is authorized to borrow to pay its bills. Since the U.S. runs a budget deficit, the government is forced to borrow to make up the difference. Since Congress has the “power of the purse,” it sets spending limits and must approve any increase.

Why is this an issue?

A debt ceiling “crisis” is nothing new. Historically, Congress has always suspended or raised the debt limit to ensure the U.S. avoided default. But as happens frequently with divided government, Washington D.C. is currently at an impasse. Republicans in the House passed a bill that would raise the debt limit in exchange for spending cuts. Democrats, on the other hand, are looking for a bill without conditions. A deal will need to be reached where both sides make concessions.

What if a deal is not reached?

The U.S. failing to pay its bills in full and on time would have serious economic repercussions. In theory, a default could result in delayed payments of federal benefits, job losses, higher borrowing costs as U.S. debt is downgraded, and a global recession. The ramifications would be hard-hitting and unprecedented, which is why it hasn’t happened before, and probably won’t this time.

Where do we stand now?

In spite of the uncertainty surrounding the debt ceiling, the S&P 500 and Nasdaq had their best weekly performance last week since March. President Biden and Speaker Kevin McCarthy will meet again today to continue negotiations. This is a good sign that, despite the harsh rhetoric from both sides, a deal will get done.

“If you’re a long-term investor, there’s a strong case to do nothing. If history is a guide, a deal to avoid a default will be struck. Adam Turnquist, chief technical strategist at LPL Financial, says that, if there is a prolonged battle similar to 2011’s, watch for large-caps to outperform small-caps, growth to top value, and defensive sectors to outpace more cyclical ones.” – Barron’s

We know the markets don’t like uncertainty, so getting the debt ceiling issues behind us will be one less thing for markets to worry about. As your financial professional team, we’re here to help handle whatever is thrown at you and keep you focused on your financial goals.

Speaking of reaching “ceilings” I’m enjoying the week down in Hollywood, Florida at the Inside ETF conference with Sarah Irving and her family. While Sarah and I have been having long days learning from global experts, her kids have been alternating between the beach to pool(s) and back.

Chae was really looking forward to ice cream and while walking the boardwalk to find dinner we found about 5 different options for the perfect dessert. Poor guy fell asleep at dinner after hitting his ceiling of activity for the day and missed out on Häagen-Dazs with the rest of the family. Luckily last night he wasn’t too wiped out to enjoy ice cream before walking on the beach to end the day in Florida. So, keep calm and remain invested, an agreement will likely be reached at the deadline. And there’s always ice cream the next day to look forward to.