What’s a Soft Landing?

In the financial press, you (if you read such things) have probably read phrases like ‘the Fed is hoping for a soft landing…’ They are referring to a soft landing for the US economy which has been running too hot and causing the price of everything to rise too quickly (aka inflation). The Fed’s hope is that they can increase (have increased?) interest rates just enough to slow down the economy…but not too slow as to create the dreaded hard landing (jobs dry up, the markets crash, and we enter a recession).

It seems as though everyone (us included, to some degree) has been fretting about a recession for over a year. And, about 6 months ago, most prognosticators predicted a high likelihood of a hard landing, but that conversation is quickly changing as inflation comes down more quickly than expected. It’s an odd thing to say that we need the jobs number (jobs available) to come down, but that is exactly what the Fed wants to happen. Ideally, wage increases also need to outpace price growth, which appears to be slowly happening.

From Blaine Rollins at Hamilton Lane, “Inflation-adjusted average hourly wages rose 1.2% in June from a year earlier, according to the Labor Department. That marked the second straight month of seasonally adjusted gains after two years when workers’ historically elevated raises were erased by price increases.

If the trend persists, it gives Americans leeway to propel the economy through increased spending, which could help the U.S. skirt a recession. Since estimates earlier this year, economists surveyed by The Wall Street Journal have lowered the probability a recession will start in the next 12 months.”

The continued inflation cooling could propel the markets into a broader growth period vs. the very narrow growth that has occurred so far this year (as referenced in Sarah Yakel’s latest post). As usual, it is easy to get caught up in all of the negative hype that seems to permeate every conversation, but consumers are starting to see prices come down (and believe that trend will continue). If that is maintained, we will avoid the sometimes-self-fulfilling prophecy of a recession.

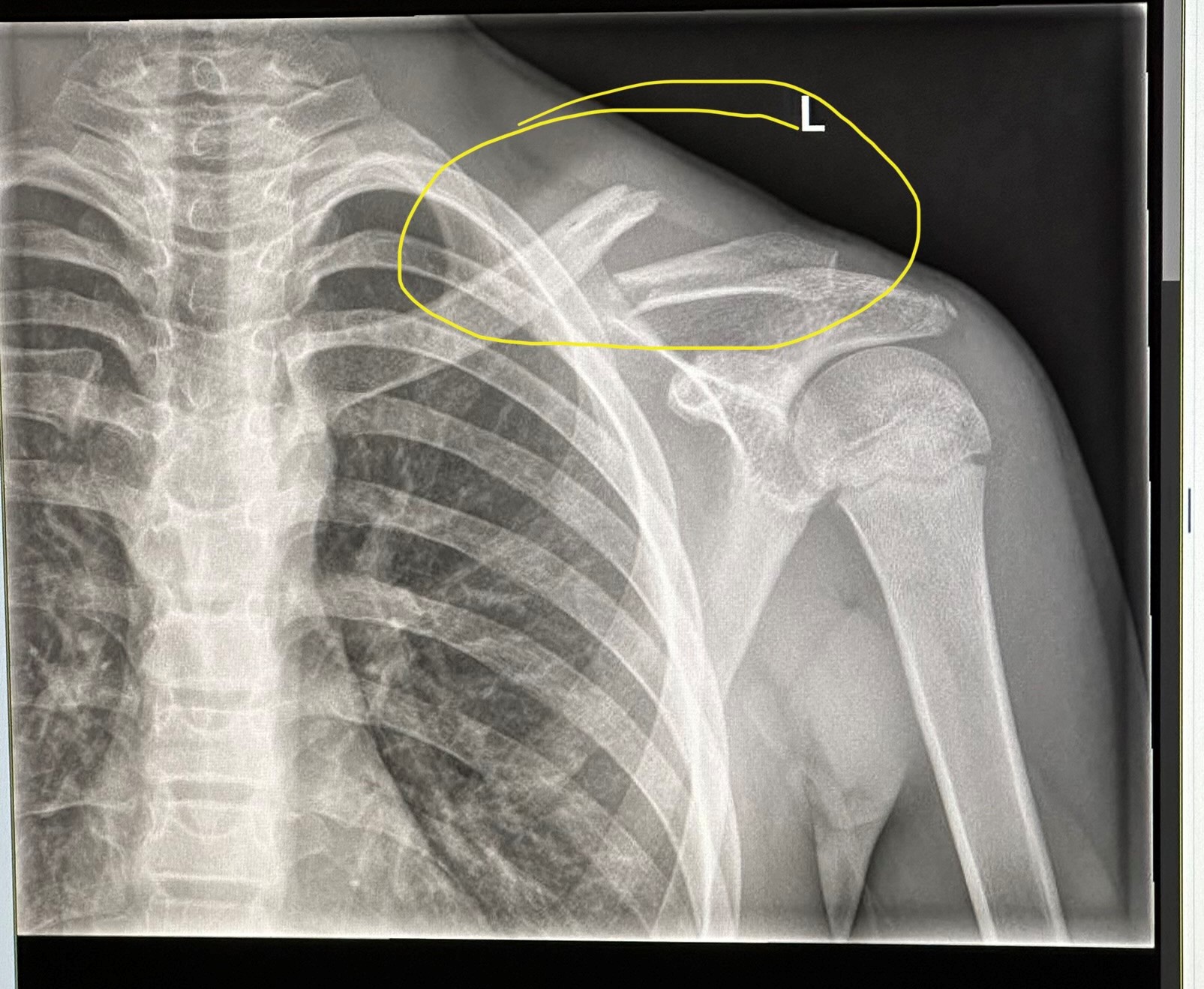

Conversely, my son cannot seem to avoid hard landings these days. His hard-charging ways continue to catch up with him in the form of broken bones and unfortunately surgery this time. His latest injury was a result of him trying a bike jumping trick he saw someone do…you guessed it…online.

OUCH

Increasingly, it seems as though the US economy will avoid any broken bones and continue to heal without the need for further surgery (Fed rate increases).