The World Has Changed, So Have You, Let’s Talk About It

When I started writing this blog, I intended to begin with a summary of the major world events between 2015 when Meridian was founded and now. But in those seven years, so many things have happened that I would likely lose most of my readership before I even make it to the events of 2020. Needless to say, a quite a lot has changed.

And as the world, the market and the economy have changed, so likely so have you as an investor. As we round the corner towards the end of 2023, we are looking to ensure that your investment strategy is best aligned with your financial goals, timelines and comfort levels. All those factors may have remained the same over time, or they may have changed – either way, let’s talk about it!

When each client signs on at Meridian, they take a Time Horizon and Risk Tolerance Questionnaire which generates a Risk Tolerance score that serves as the basis of their investment strategy, along with discussion with their investment advisor.

Risk Tolerance is an individual’s or an organization’s ability and willingness to take on financial risks in pursuit of their financial goals. In short, how comfortable you are with risk.

- Time Horizon: Time Horizon is typically has the most significant impact on risk tolerance. Simply put, time horizon is how long before you need the money. With a shorter time horizon, an investor would be less comfortable accepting risk because there is less time to recover potential losses. Conversely, with a longer time horizon, there is more opportunity to tolerate the ups and downs of the market.

- Age: As with time horizon, a younger investor who has more time to recover potential losses will be more comfortable with risk than an older investor who is concerned about preserving capital.

- Financial Capacity: An individual’s financial capacity, which includes their income, assets, and liabilities, influences their risk tolerance. Investors with more substantial financial resources can typically afford to take on more risk, as they have a larger financial cushion to absorb potential losses.

- Investment Experience and Knowledge: Investors with more experience and knowledge in investment strategies and financial markets tend to have a higher risk tolerance, as they better understand the potential risks and rewards associated with various investment options. In contrast, less experienced investors may be more risk-averse due to their limited understanding of investment risks and strategies.

- Emotional and psychological factors: Emotional and psychological factors, such as an individual’s personality, stress tolerance, and overall emotional well-being, can significantly impact their risk tolerance. Some investors may be more comfortable with risk and uncertainty, while others may prefer more stable and predictable investments.

- Family and Personal Circumstances: Family and personal circumstances, such as marital status, number of dependents, and overall financial stability, can also affect an individual’s risk tolerance. Those with more financial responsibilities may be more risk-averse to protect their family’s financial well-being, while those with fewer financial obligations may be more willing to take on higher levels of risk.

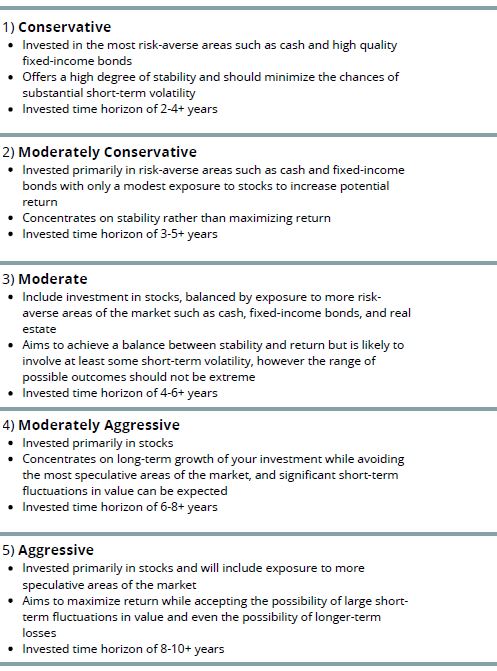

Below is a chart showing the general risk categories that investors fall into – the higher the risk score, the more aggressive the investment strategy.

The data gathered by advisors from the Time Horizon and Risk Tolerance and questionnaire is essential in guiding your investment strategy and asset allocation. For example, a younger investor with years before retirement will likely have a higher risk tolerance score with a longer time horizon. This translates to a more aggressive and equity driven investment model because their accounts have the time to weather market fluctuations. On the flip side, an investor approaching retirement in a short amount of time will be more focused on preserving the wealth they have built and looking for a more conservative investment model.

The factors that generate risk tolerance tend to change over time, which means that investment strategies may need to be adjusted over time as well. If you are our client, be in the lookout for a new Time Horizon and Risk Tolerance Questionnaire as part of your year end review. If you have questions sooner, please don’t hesitate to reach out to your advisor! …If you aren’t a client of Meridian, you should be…JK, your advisor should be talking to you about this too.

It’s an old saying but “the more things change, the more they stay the same”. Joy may have gained 35 pounds in the past two years but her puppy dog begging eyes have not changed a bit.