What Have You Done for Me Lately?

I point the finger at our own industry for training investors to think in the short term. Within our firm our custodian, Charles Schwab, sends out monthly statements. From a compliance perspective, this is a good thing, because it reassures clients that their money is where it’s supposed to be, and that Meridian is doing their job. From a performance-assessment perspective, monthly statements represent far too short a period to determine whether or not a particular strategy or investment is working. Add in online access to the mix and you can view things in real time.

Reacting to a change in your bottom line over such a small timeframe is almost never a good idea. Further, if you are regularly adding to your accounts, why would you stop buying when markets are down? Isn’t the whole idea to buy low and sell high? Not to mention, the financial media constantly preys on our emotions with the endless ticker across the bottom of the TV screen and either RED or GREEN in the bottom right corner. All of this feeds into the ‘What have you done for me lately?’ mentality, which can lead to poor decision making.

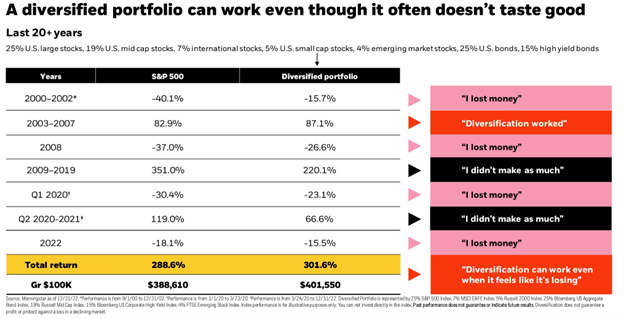

In order to combat this type of behavior, 1) Keep your timeframe and financial plan in mind, and 2) stay diversified even when it doesn’t feel good.

An excellent example of the dangers of irrationally reacting to negative performance is what happened just last week through today. Since investors opened their October statements, stocks have gone up about 5% (depending on the index) and bonds have gone up about 1.8%. For what it’s worth, most diversified portfolios remain positive for the year, despite a bad 3rd quarter.

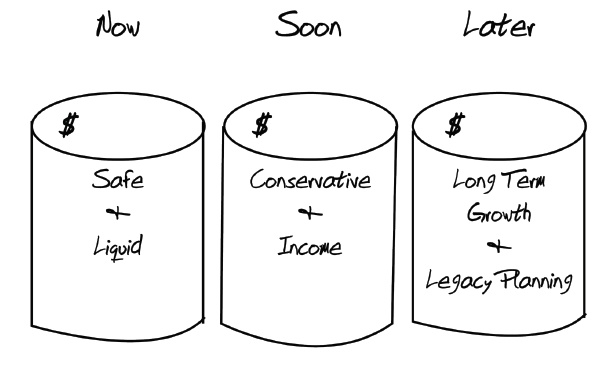

Lastly, as I mentioned in the most recent Meridian Market Minute, most accounts have some short-term money (bucket 1), some medium-term money (bucket 2), and some long-term money (bucket 3). The idea behind the bucket strategy is that the shorter-term money won’t fluctuate much (if at all) and you can rely on that money to be there when you need it. Buckets 2 and 3 are designed to return more over time, but also fluctuate more. Strategic shifts from one bucket to the next should mitigate the need to sell long-term investments for near term needs. However, human nature sends our eyes to the bottom line number that summarizes all 3 buckets, and that can distract from what different parts (buckets) of the portfolio are doing.

Source: Clarity 2 Prosperity (C2P)

Including a picture of Niagara Falls with water plunging over the edge of a cliff might seem like a bad idea for an investments blog and invoke scary market thoughts. BUT, my son and I did visit Niagara Falls recently and it was both breathtaking and powerful. Inevitably, it led my son to an internet search down the rabbit hole of people who have made the poor decision to go over the falls in some manner. Apparently, one guy jumped off on a jet ski with a parachute on his back…unfortunately, he did not survive when his chute failed to deploy. Talk about a bad strategy!