Are Inflation Fears Inflated?

As I mentioned in my recent Meridian Market Minute video post, headlines around inflation have started to appear as the next thing we should all be worried about. My colleague Sarah Irving also wrote a great blog around the topic back in early April. Since that time, the rate of inflation has gone from 2.6% in March to 4.2% in April.

As with anything market-prediction related, there are many opinions around this topic. The Federal Reserve’s favorite new term when addressing the recent inflation spike is “transitory,” which means not permanent. This is the Fed’s current justification for not raising interest rates to tamp down inflation. The thought from the Fed is that the increase in economic recovery from COVID is causing demand (and prices) to spike up at an unusually fast pace. Once supply chain issues are resolved, and demand returns to normalcy, the idea is that the inflation rate would retreat closer to the target of 2% (and/or The Fed would be more willing to raise rates).

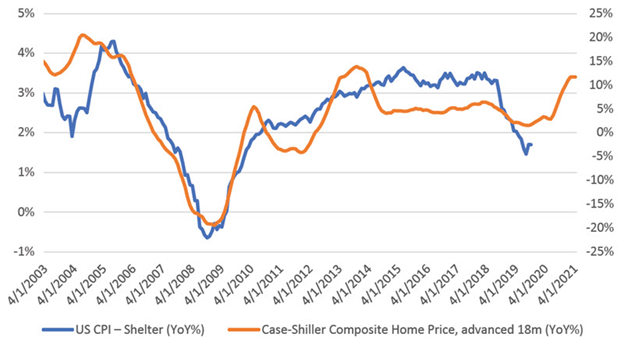

One notable area of the markets where price increases have been very apparent is in the housing market. We have all heard of homes being on the market of only a few days or even hours! And, US existing home prices are in fact up 17% since March of last year. Usually, an increase in home prices is followed by an increase in rents. From Nanette Abuhoff Jacobson at Hartford Funds: “While the relationship among rents, home prices, and broader inflation is inexact at best, a turning point in rents is a potentially big deal for both the CPI and the PCE. It’s also likely to matter to markets and could stoke greater inflation volatility, if not a longer tail to higher inflation than the Fed and many investors currently think.”

Rents Set to Rise?

Note: US CPI Urban Consumers Shelter SA, S&P CoreLogic Case-Shiller 10-City Composite Home Price NSA Index YoY% | Source: Haver, Bloomberg, 5/21.

So, if inflation is not transitory (word of the day!) in nature, then what are some good investment options to potentially hedge against inflation.

- Commodities – this may be a somewhat obvious one, but if the prices of “things” are going up, it makes sense to be invested in things like agriculture and other natural resources

- Stocks – yes, some stocks can be a good hedge. Especially value-oriented, dividend paying stocks

- Real estate – these types of holdings (similar to value stocks) typically have a good dividend yield

- Bonds – short term bonds or Treasury Inflation Protected Securities (TIPS) can be helpful for a portfolio in a rising interest rate/increased inflation cycle.

Also very inflated are prices on tickets to Washington Capitals playoff games! It was more than worth it for me to attend a recent game with my son. Unfortunately, the Capitals have since been eliminated from the playoffs by the Boston Bruins (much to the delight of my colleague, Kira) ☹. Still, it was nice to feel somewhat back to normal, even in a 25% capacity arena. Here’s hoping we’re all back to 100% real soon. And, yes we are both getting haircuts this week! 😊