Odds Are…

Some people made a lot of money during the historically awful stock market last week. Eighty-four people made over $1,000,000 on their $2 investment in this past Wednesday’s Powerball lottery drawing, with total winnings of over $1 billion.

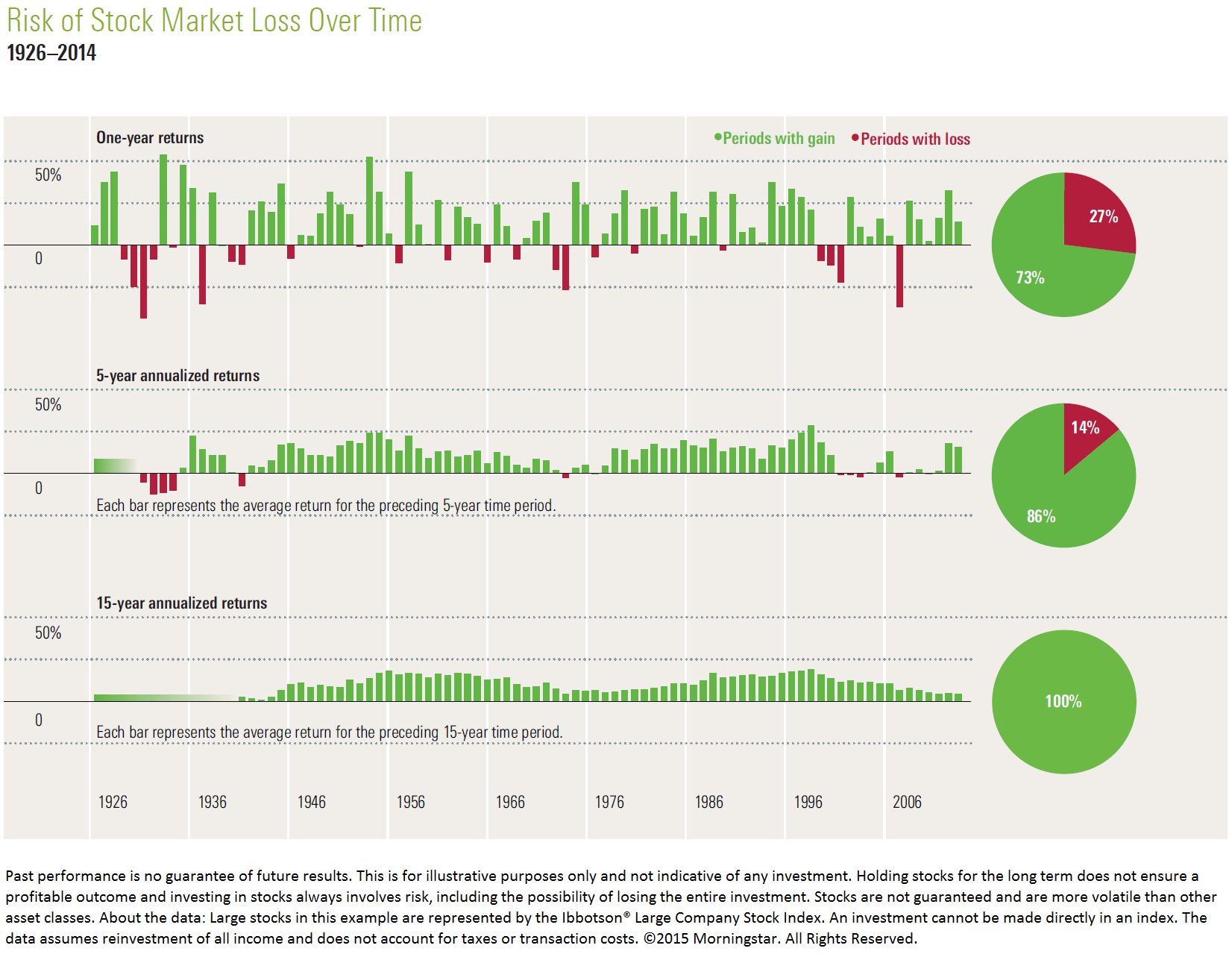

The national fascination with the huge Powerball lottery was interesting to watch, given our excitement to plunk down our money for nearly 100% odds that we would lose 100% of our money. At the same time, we were fretting over the 8% drop in the stock market, with many of us debating whether to sell entirely. Yet, the odds are that 77.8% of the time the S&P turns negative during the year, it ends positive. Those seem like fine odds.

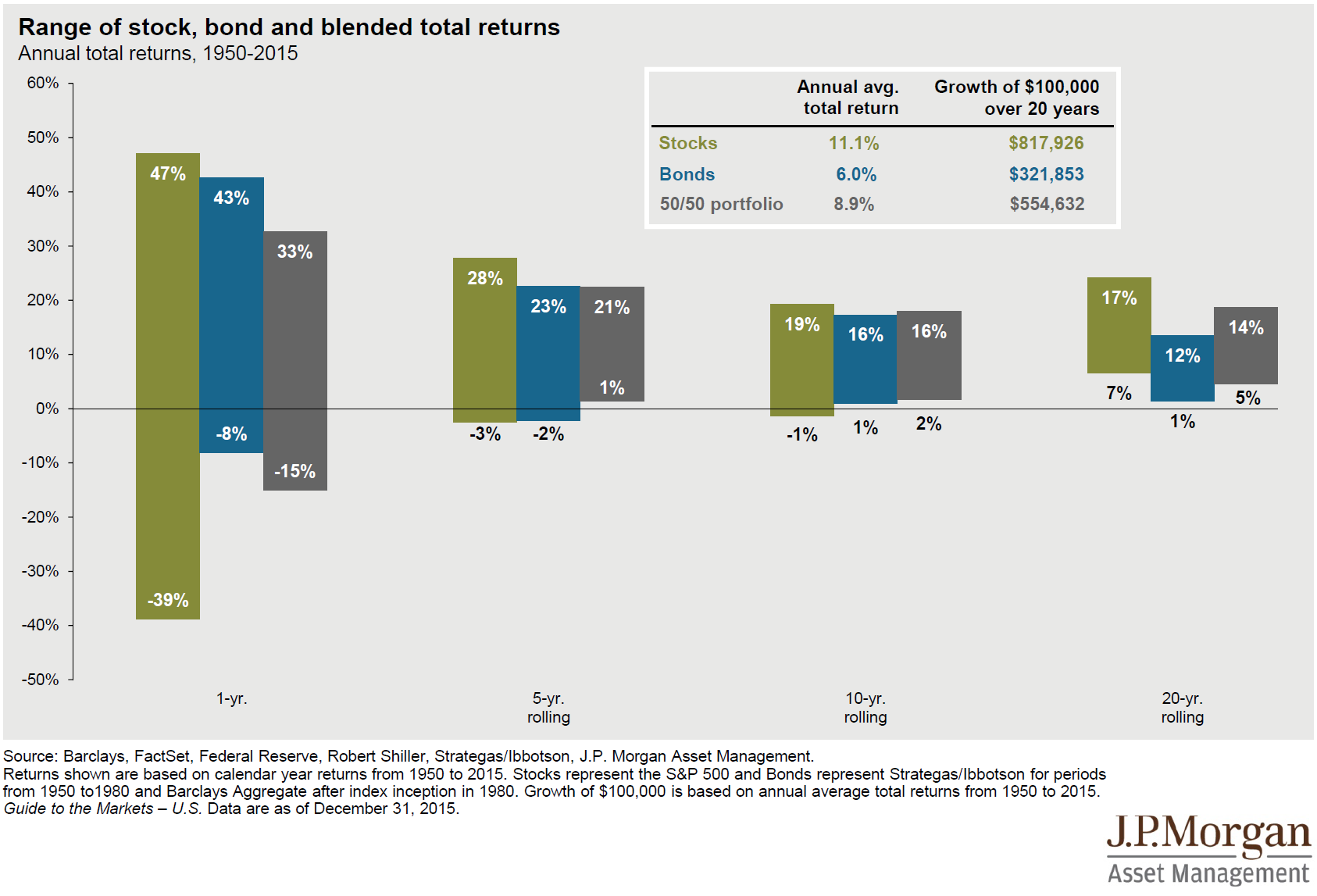

Better yet, looking at the chart below, we see that the odds of a balanced portfolio, composed of half stocks and half bonds, having a positive average return over any 5 year period from 1950-2015 is about 100%. Again, pretty good odds…

We certainly understand that drops like this week in the stock market are frightening and disconcerting. And we also are fully aware that the odds of correctly predicting the day to day movements of the stock market are about as good as our local weatherman’s ability to predict Friday’s forecast on Monday. But, there are a few things that we do know with relative certainty:

1. The market does experience intra-year declines frequently:

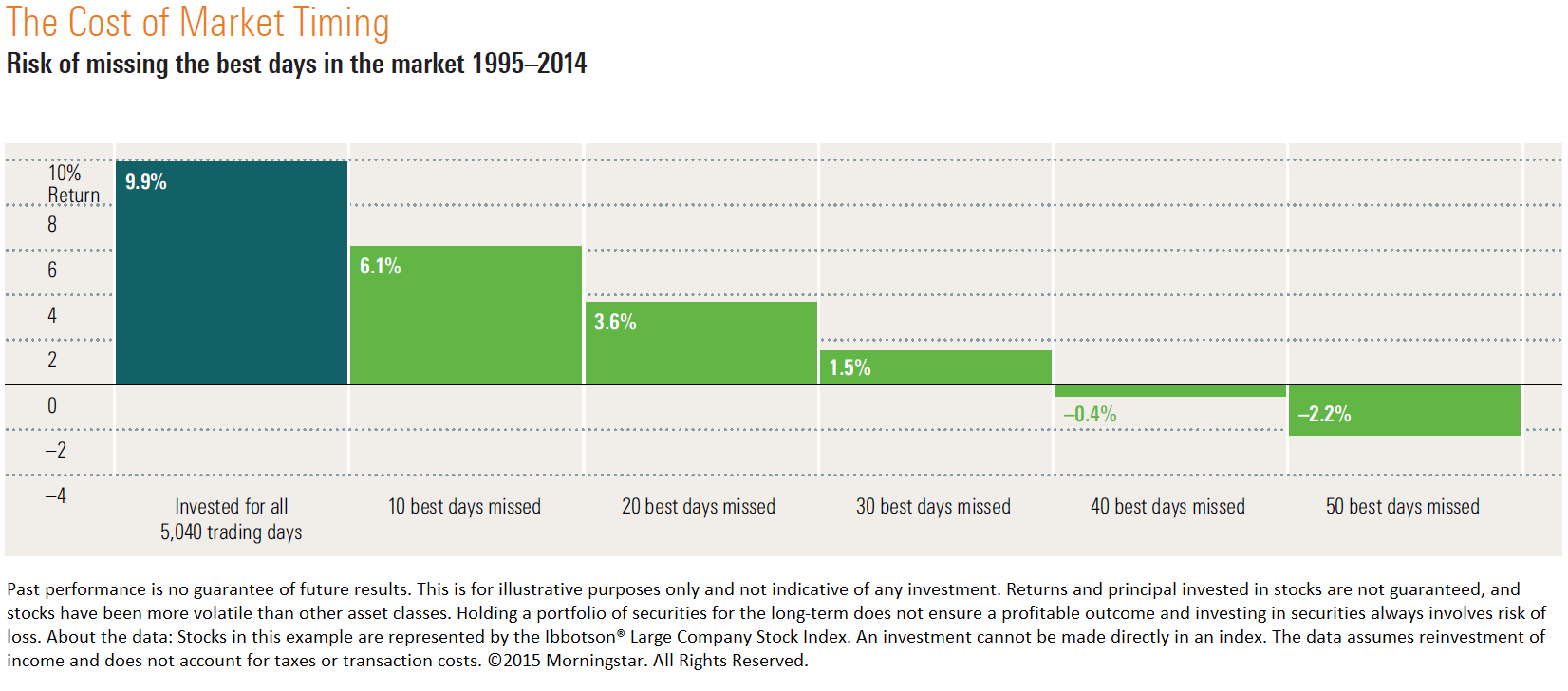

2. Odds of timing the market successfully are not good:

What this chart from Morningstar does not show is that many of the best days in the market were within one week of the worst days of the market…and many were concentrated in one of only a couple of the years in the entire twenty year period…making it extremely difficult to predict where in the twenty year time frame the best twenty or thirty days in the market would occur.

3. The best strategy to combat market volatility is to stay invested:

It is tough to hold the course when the ride is rough—but the same truth we accept with Powerball holds true here as well: you can’t win if you don’t play. So, we encourage you to revisit your portfolio allocation and make shifts as they make sense for your long-term plans. But, we also encourage you to stay invested for the long-term and not exit investing entirely based on short term market movements. Odds are you will be glad you did.