Serenity Now

I love reading. I like knowing things, so I read all sorts of books, magazines, trade journals, etc. Actually (sadly?), for my birthday and mother’s day, my kids have my husband take them to the grocery store, and they buy random magazines as my gifts. (And I love it.)

And, as most of you know, I really love what I do too. So, it is fun when I get to read a great story about investments, the economy, trends in retirement, new tax strategies. Along these lines, one of my favorite things to read is J.P. Morgan’s research—they present concepts and information in really compelling illustrations. So, I was super excited to read their new 2016 Guide to Retirement. (You can mock me later…)

Even if you aren’t super excited about reading, or reading financial news, I do encourage you to take a look at the whole guide. For those of you that can’t stand to read, it is mostly pictures…

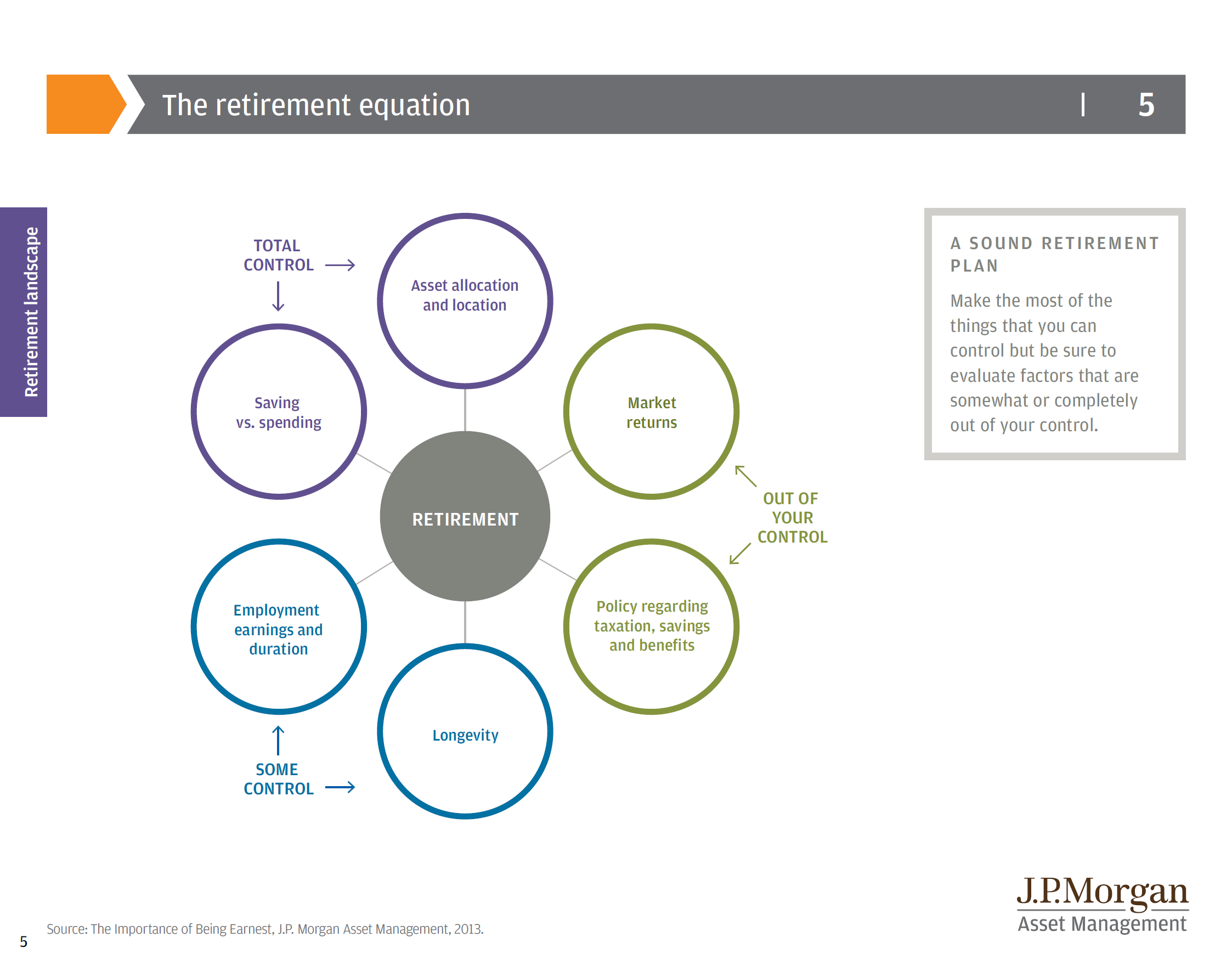

Anyway, today I just wanted to share one of my favorite images from the Guide:

I love this image so much (thank you JP Morgan!), because it truly speaks to what we can (and cannot do) in our retirement planning. In a way, it translates the Serenity Prayer into financial planning, showing how there are just some things that are out of our control. We cannot effect change on the tax system or dictate the stock market returns. But, there are things that we can control—some partially, like how long we work and what career we chose—and some fully.

At Meridian Financial Partners, we focus on what we can fully control, like how much to save, how to invest, and where to invest. We understand how much we cannot control, but we build our plans to focus our energy and resources on things where we are able to influence the outcome.

And, as in the Serenity Prayer—we help our clients gain the wisdom to know the difference between those things that can and cannot be controlled. And, knowing that we are doing everything that we can to build an amazing financial future is often just what is needed to bring peace of mind and serenity.