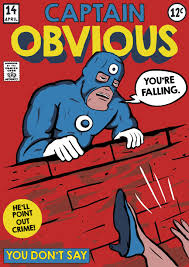

Department of Labor AKA…

…Captain Obvious

Good news everybody! Our friends at the Department of Labor (DOL) finalized a rule on Wednesday that requires financial advisors to act in the client’s best interest when giving retirement advice.

While this seems like an obvious stance, the rule was put into place to prevent advisors from recommending products and/or services that could result in higher fees to the client and potentially higher commissions to the advisor. It is an attempt to remove some very real conflicts of interest in the brokerage industry.

We founded Meridian Financial Partners to be an independent, fee-only fiduciary for just this reason. We strongly believe that listening to each clients’ specific situation and needs, creating a plan, and then making appropriate investments that will best fit each client is the right approach. Further, whether that recommendation is conservative, aggressive, or somewhere in between, there is no monetary incentive to our firm to push any particular product. We absolutely cannot receive any fee from an outside provider. Our only concern is for you, our client.

Before the ruling, advisors were only required to prove that the recommendation for an IRA was a “suitable investment” rather than what will now be a much stricter duty of care. In fact, some IRA transactions will be deemed prohibited if the advisor is not acting in the best interest of the client and/or is receiving an unreasonable amount of compensation. The rule itself is over 1,000 pages long (!), so it will take some time for the industry as a whole to digest all implications.

While the rule sounds good and seems relatively straightforward, it does give us some cause for concern. Our worry is that firms will simply create boilerplate forms that comply with the bare minimum of the rule. And, now anyone can claim to be acting as a “fiduciary,” when in fact they are continuing to do business in the manner they always have. It remains to be seen exactly what effect the ruling will have on the industry, and it does not officially go into place until April of 2017.

What hasn’t changed is that clients seeking financial guidance and advice should do their due diligence, and make sure they are working with someone they trust. The right advisor or planner can be an invaluable resource as long as he or she is always acting in the client’s best interest.