The Pitchers’ Duel

I had the brilliant idea to take my two oldest kids (6 and 4) to the Nationals game this past Sunday. I use the term ‘brilliant’ sarcastically as things didn’t go all that well. More time was spent in front of the cooling mist fan behind right field than in our actual seats. And, no amount of over-priced junk food or Nats gear could stem the alternating complaints of “I’m too hot,” and “I want to go home!” In their defense, it was a bit hotter than forecast, our seats were in direct sunlight, and the game was downright boring for a kid (or a non-baseball purist parent for that matter).

The good news, however, is that the Nationals did win. Tanner Roark somewhat unexpectedly outdueled the much more accomplished Madison Bumgarner. The one run that was scored in the game came from the Nationals’ Wilson Ramos who hit a solo home run in the 7th inning. Of course, our family was long gone by that time. Although I feel strongly that leaving early was the best for everyone’s sanity, it did remind me of people’s natural reaction to leave the market “early” when things don’t go as expected or planned. In the case of a baseball game, leaving early may cause you to miss that game-winning home run or record-breaking comeback, but it certainly won’t have long term effects on your retirement goals!

Creating a good financial plan means putting a plan in place and doing your best to stick with it. Sometimes adjustments need to be made, but those adjustments should only occur with a proper time frame in mind and long term goals taking precedence over short term market volatility. The baseball analogy again rings true here: Roark (the Nats’ pitcher) didn’t pitch the entire game and needed help from his teammates to get the win. Dusty Baker (the Nats’ manager) made some adjustments to the line-up in order to reach the end goal, which was a victory.

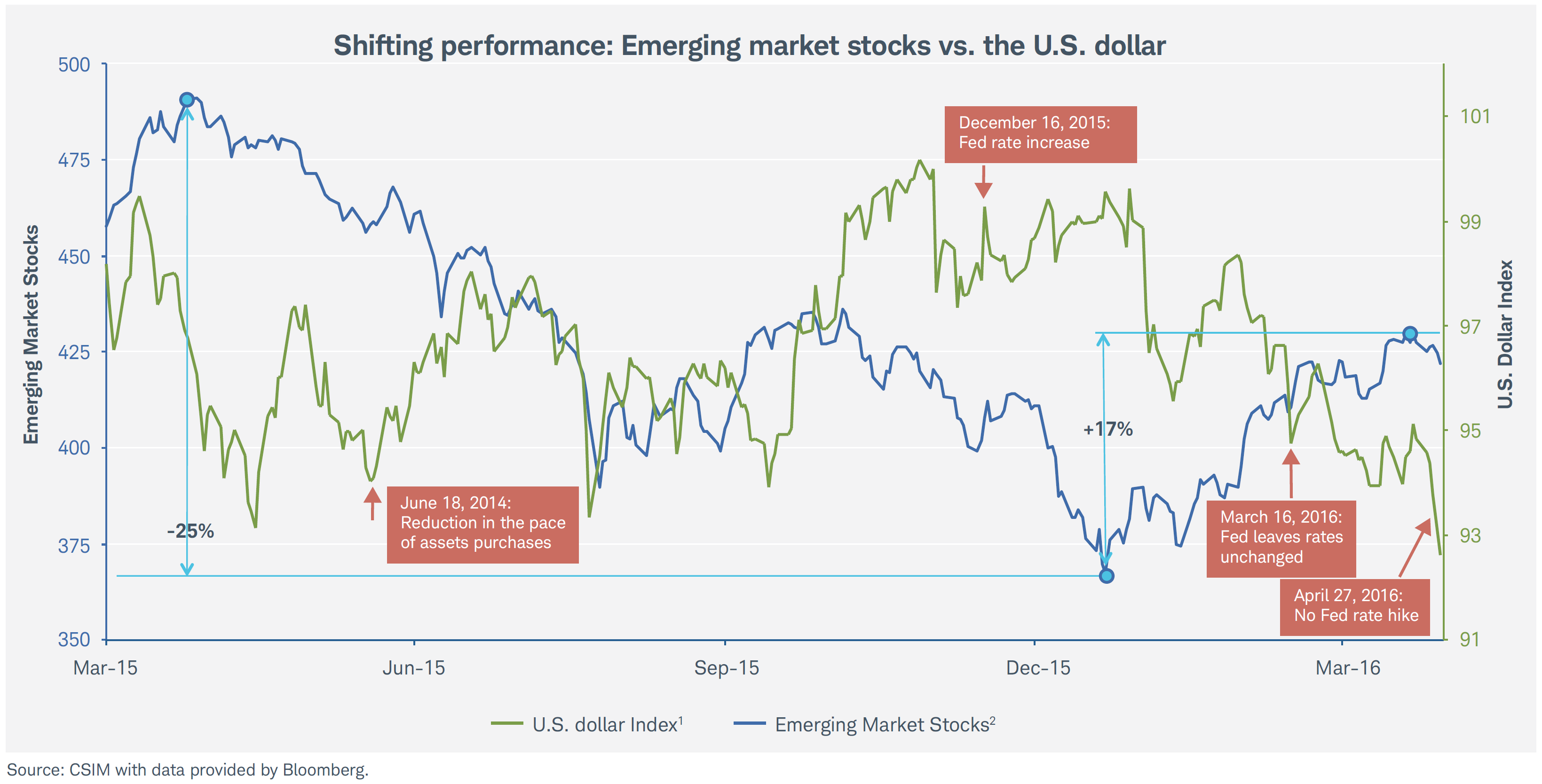

One interesting example of a potential pitfall in short-term decision making is the performance of emerging markets. This was mentioned in a previous post, but generally a weaker U.S. dollar means better performance for emerging markets. Late last year, the dollar strengthened significantly and helped to create significant losses (lower oil prices didn’t help either). See the chart below:

The somewhat natural (but flawed) reaction would have been to abandon emerging markets completely, however you would have missed the significant recovery and added portfolio performance. This category of investing is very volatile when it stands alone, however adding a portion to your overall mix can not only increase returns but also reduce volatility in many cases.

Proper diversification can sometimes seem like a pitchers’ duel, as it can be less than exciting. Inevitably, one part of the market will look very enticing and produce unsustainable returns over the short term. This can make a well-diversified portfolio seem like a boring and low-scoring game, but in the long term, it should lead to a win.