House Odds

I write this blog post from Las Vegas—we are here for a few days to celebrate my husband’s birthday. As a financial planner, I am not a huge gambler. My normal life is filled with assessing odds, the lurking risks and potential rewards, so it is hard to ignore the fact that Vegas has horrible odds. The worst game on the floor is typically the slot machines with a 25% house edge. The best game is blackjack with only a slight house edge of 1%.

Even knowing that, I still get drawn to the flashing lights and exciting sounds of people winning. So, even understanding the horrible odds that we are up against, we still get sucked into playing a lost machine or a hand of blackjack. Granted, the financial planner side of me has set a daily budget for our gambling funds, fully expecting to return home with nothing…but the human side of me still imagines we will return home with our pockets lined with cash!

What I think will happen with my $20 slot machine bet:

What actually happens with my $20 slot machine bet:

Even though gambling in Vegas is known to be a poor investment, there are many other ways to gamble with your money. Here are a few that we see pretty frequently that also have bad odds:

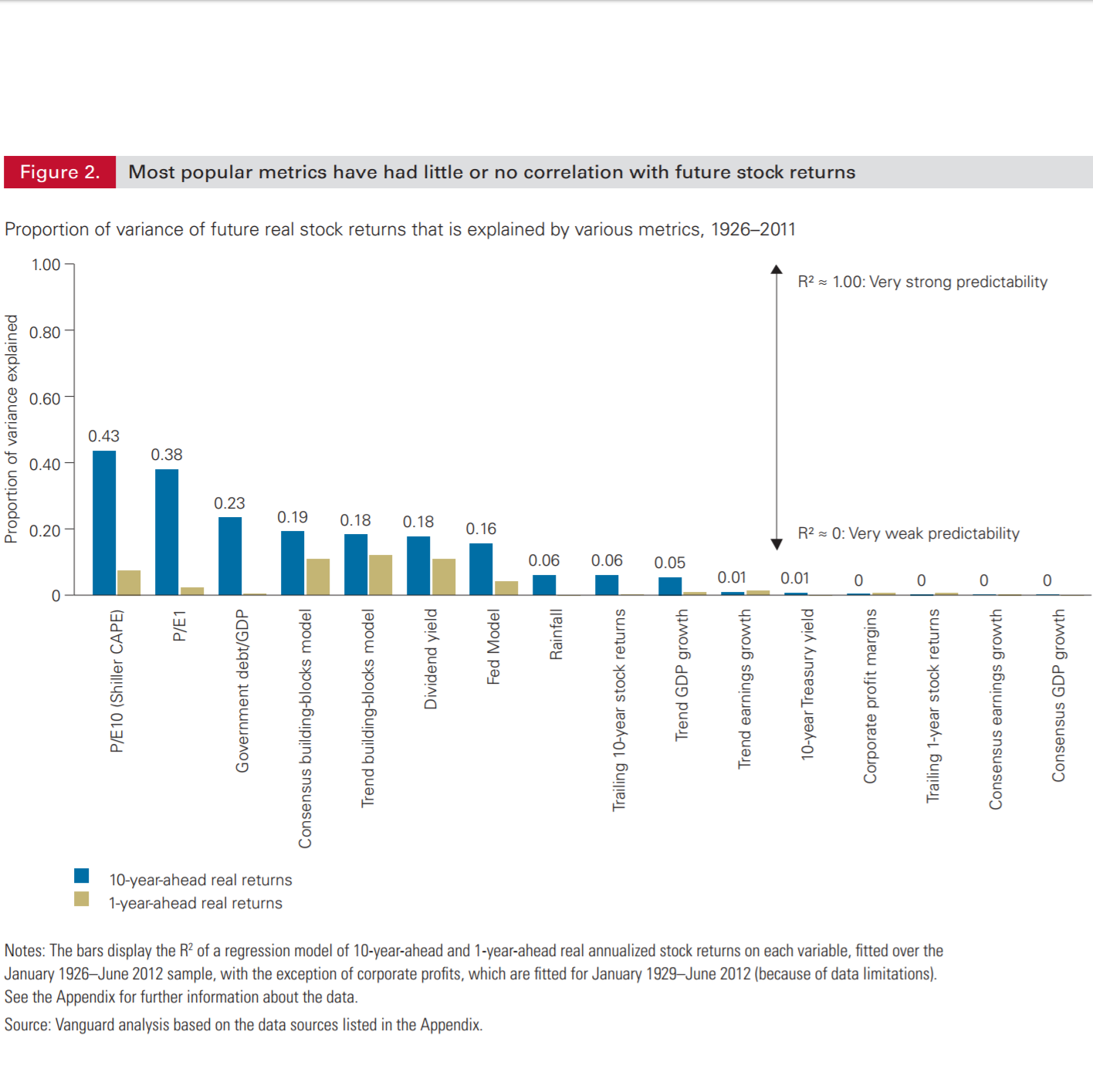

- Investing in the hot, pricey stocks – Like hitting the right number on a roulette wheel, we all want to be the ones that buy the next Apple. So, it is very common to want to buy shares of what we see is the next hot stock. A couple of stocks we hear frequently are Netflix or Tesla. Thing is, hot stocks like those two are typically very expensive. In Netflix’s case, the current Price to Earnings ratio (or P/E) is 189. That means that investors are willing to pay $189 to get $1 of Netflix earnings. In Tesla’s case, they haven’t actually made a profit yet, so there is no P/E ratio. A Vanguard paper in 2012 demonstrated that the P/E ratio is one of the best predictors of future market returns. Stocks that are expensive (over 16-18 P/E ratio) tend to underperform those that have lower P/E ratios over long periods of time. So, while you might hit it big with a hot name or two, odds are that you will underperform over the long run.

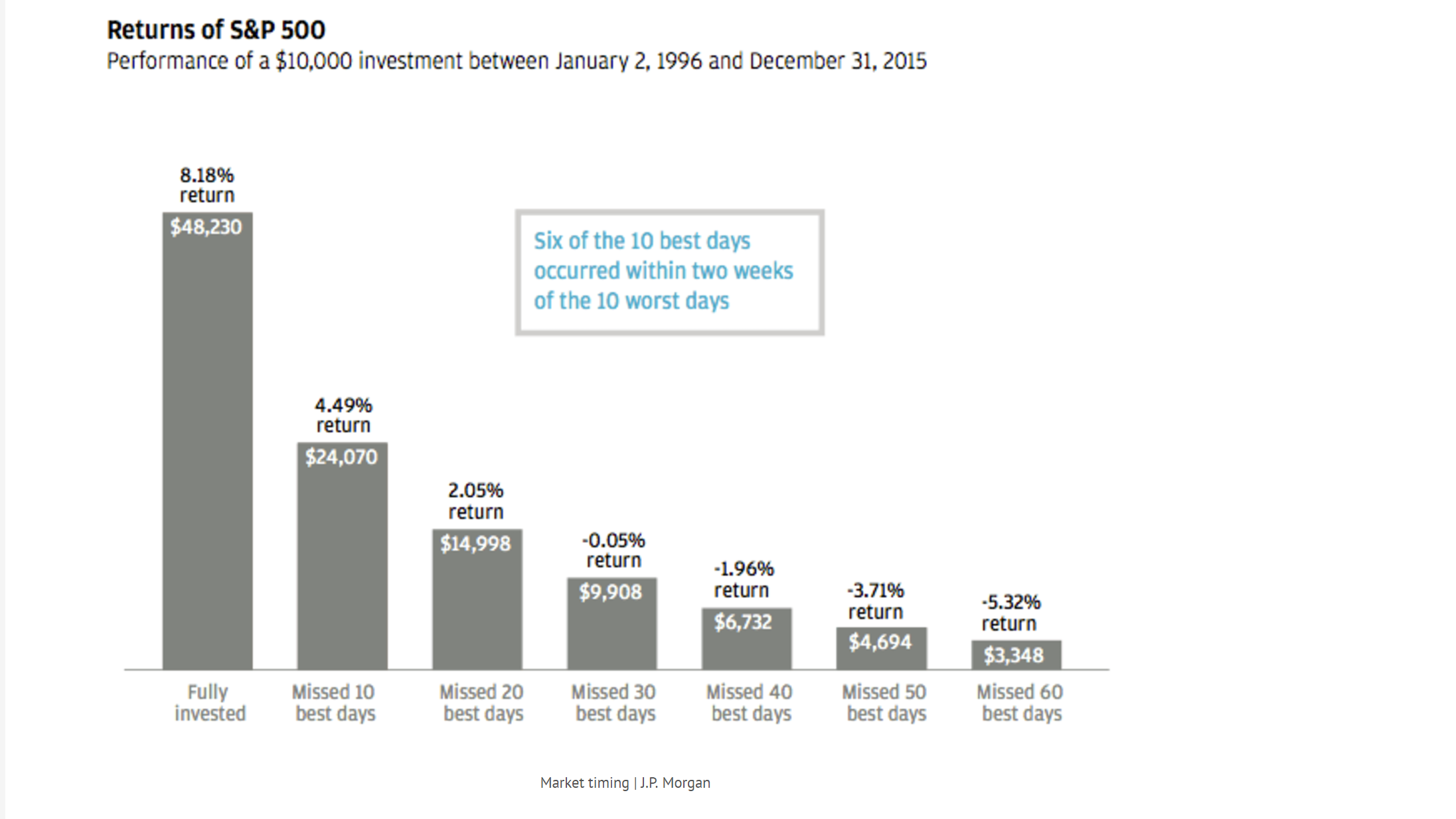

- Timing the market – With the market climbing ever higher for the past 8 years, many investors are calling and asking us if it is time to sell everything and move to cash. While that may sound like a good idea, the odds of success are awful. First of all, you have to make two choices right—one to get out (sell to soon and you miss more of the rally…sell too late and you lose money)…and then again on getting back in (get in too soon and you still lose monry…get in too late and you miss the big rally). As this chart shows, just missing the 10 best days in the stock market over a 20 year period causes you to miss almost half of the market return. Miss 20 best days in the 20 year period, and you will miss almost 75% of the market return. AND, as the chart points out, six of the best days of the market in a 20 year period occurred within 2 weeks of the worst days. Tough to time for sure!

- Following the media “experts”—As we all know, TV news channels are full of opinions, and financial experts abound on CNBC, Fix News, CNN. One of the best know is Mad Money’s Jim Cramer. While some find Cramer fun to watch—a comprehensive study of his stock picks shows that on average, when Cramer recommends a stock, the stock returns an abnormal 1.88% on the day following the recommendation. However, the average stock recommendation return turns negative (about -2%) in days 2-30 following the recommendation. A longer term study of Cramer’s endowment fund (which incorporates all of his buy and sell recommendations from his show and newsletter) finds that his portfolio has underperformed the S&P 500 since its 2001 inception, returning 64% versus the S&P’s 70% over the same time frame. Not the best odds of success!

There are many more ways to gamble with your money, but this post is already too long!!

Just like winning in Vegas, the odds are against of these “investing strategies”. There is chance you might win, but more realistically, you will lose money. In Vegas, it seems everyone is winning because of the bright lights, cheers from the craps table, and coin payout noises from the slots, yet the vast majority of visitors go home with a lighter wallet. Same holds for these other strategies—it seems that everyone has a story about their friend who bought Netflix before it quadrupled in price or got out of the market right before it fell…but most of those stories were the randomly lucky ones. The majority of the time, the ideas listed above are only successful at shaving money off of an investor’s portfolio.

So, if you are inclined to gamble on a hot stock name or try to time the market, treat the money that you have at risk as if you were heading to Vegas. Carve off an amount that you can stand to lose, know that it is a fun hobby, and keep the rest of your responsible grown up money safely in a well diversified portfolio (and maybe even in the hands of a qualified financial planner!)