The Annual Rotary Raffle

This past Saturday, my wife and I were fortunate enough to be guests at the annual Warrenton Rotary Raffle gala and dinner. It was my first time attending this type of event, and it was certainly a lot of fun. The purpose of the evening was to raise money for all of the wonderful causes that Rotary supports in the community, but the highlight was most definitely the “drawdown” raffle for $10,000.

The Rotary sells 200 tickets, and then places each ticket (with purchaser’s name) in a bingo-style barrel that is spun and drawn from over the course of the evening. The goal is to be the one of the last names called. Unfortunately for us, our names were called very early in the proceedings, so we never had a chance. Once there are 10 names remaining, those folks are called up on stage for the final drawdown (there is actually a “last chance” 11th name drawn as well). If you make it this far, I believe you are a least assured of winning $100.

Once the 11 are on stage, the emcee asks each person if he or she would like to draw (meaning pull another name) or split (meaning split the $10k among the remaining contestants). The rules state that it only takes one remaining contestant to say “draw” in order for there to be another name pulled from the barrel. From what I heard, typically at least a few folks ask for a draw when there are over 5 or 6 on the stage, so no one was too surprised when names were pulled to bring the number down to 4.

One woman in particular (name withheld in case the tax man is reading!) said “DRAW!” with conviction every time she was asked. Others on the stage called for draws at different points, but you could tell she was bound and determined to win as much as she could. When there were just two still on the stage, the other remaining contestant requested a split (potentially $5k each) after consulting her spouse sitting off to the left of the stage.

When the microphone was passed to our heroine, yet again she called out “DRAW!” without hesitation. Surely, karma would get her this time…but, NO! Her name was not drawn, and she had the last remaining ticket left in the barrel. She won the entire $10,000!

My lovely wife claimed that she would have asked for a draw every time too; to which some of our clients sitting with us jokingly said to me, “Please keep her away from our money!” 😊

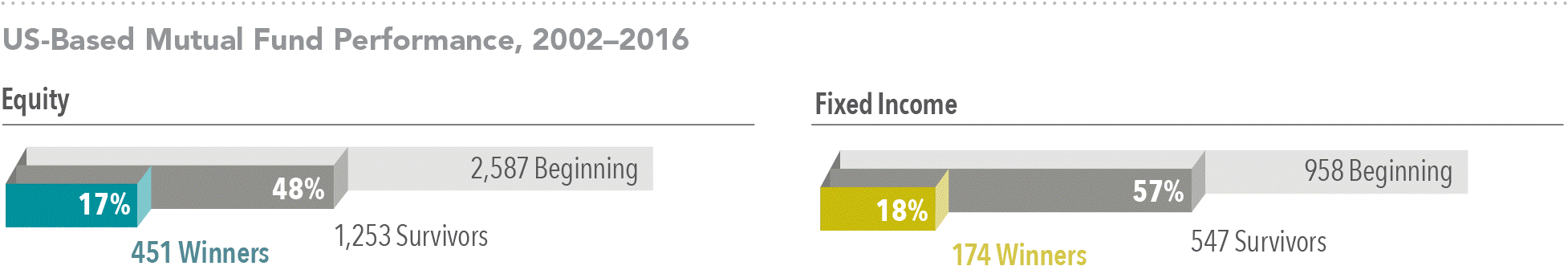

No doubt, taking this type of chance with an investment portfolio is certainly not a good idea! Assuming each person had one ticket, there is a 0.5% chance of winning the entire pot. Trying to pick a US equity managed mutual fund that has outperformed its benchmark has slightly better odds, but not much. Consider the following question and commentary from Dimensional Fund Advisors:

“What are my chances of picking an investment fund that survives and outperforms?

Flip a coin and your odds of getting heads or tails are 50/50. Historically, the odds of selecting an investment fund that was still around 15 years later are about the same. Regarding outperformance, the odds are worse. The market’s pricing power works against fund managers who try to outperform through stock picking or market timing. One needn’t look further than real-world results to see this. Based on research*, only 17% of US equity mutual funds and 18% of fixed income funds have survived and outperformed their benchmarks over the past 15 years.”

Source: *Mutual Fund Landscape 2017, Dimensional Fund Advisors. The sample includes US-based funds at the beginning of the 15-year period ending December 31, 2016. Each fund is evaluated relative to the Morningstar benchmark assigned to the fund’s category at the start of the evaluation period. Surviving funds are those with return observations for every month of the sample period. Winner funds are those that survived and whose cumulative net return over the period exceeded that of their respective Morningstar category benchmark. Past performance is no guarantee of future results.

So, try to avoid stock picking and market timing as it can be almost impossible in the US (especially large cap) equity market. Resist the temptation to keep yelling “DRAW!” when it comes to your investment portfolio decisions. Prudently adding other types of investments to your mix could not only reduce your risk, but also increase your returns over time.

Since this is my last post until after the holiday, Happy Thanksgiving to our and your families!

Nathan