An Old Door & Old Interest Rates

About 58 years ago, my grandparents (and my mom and her 4 siblings) moved from Pasadena, California to the Northern Virginia area. The new owner of the Pasadena house planned to have the house demoed in order to build a new, more modern home. According to my family, my grandfather really loved the front door of the old house, and he asked that the owner ship it to him in Virginia. I can only imagine the cost and logistics of getting this done in 1960, but it did happen!

From what I know, the door was never actually used again, but it landed in a barn loft on the Nokesville, Virginia property where my family eventually remained. Fast forward to today, where my mom and her siblings (and my dad) are in the painstaking process of settling the affairs of my now-deceased grandparents. As is typical, there has been a call to family members to come and see if there’s anything they’d like to have from furniture to mementos, etc.

Because we are in the process of finishing our basement, I thought it would be a good idea to try to refinish and re-purpose the old door. So, with the help of my friend, I dragged the (extremely!) dusty door out of the barn loft. My wife and I (and middle daughter) did some sanding, priming, and painting, all while trying not to inhale the potentially toxic 58-year-old dust. Our plan is to use it as a sliding barn door feature that will cover the unfinished portion of the basement.

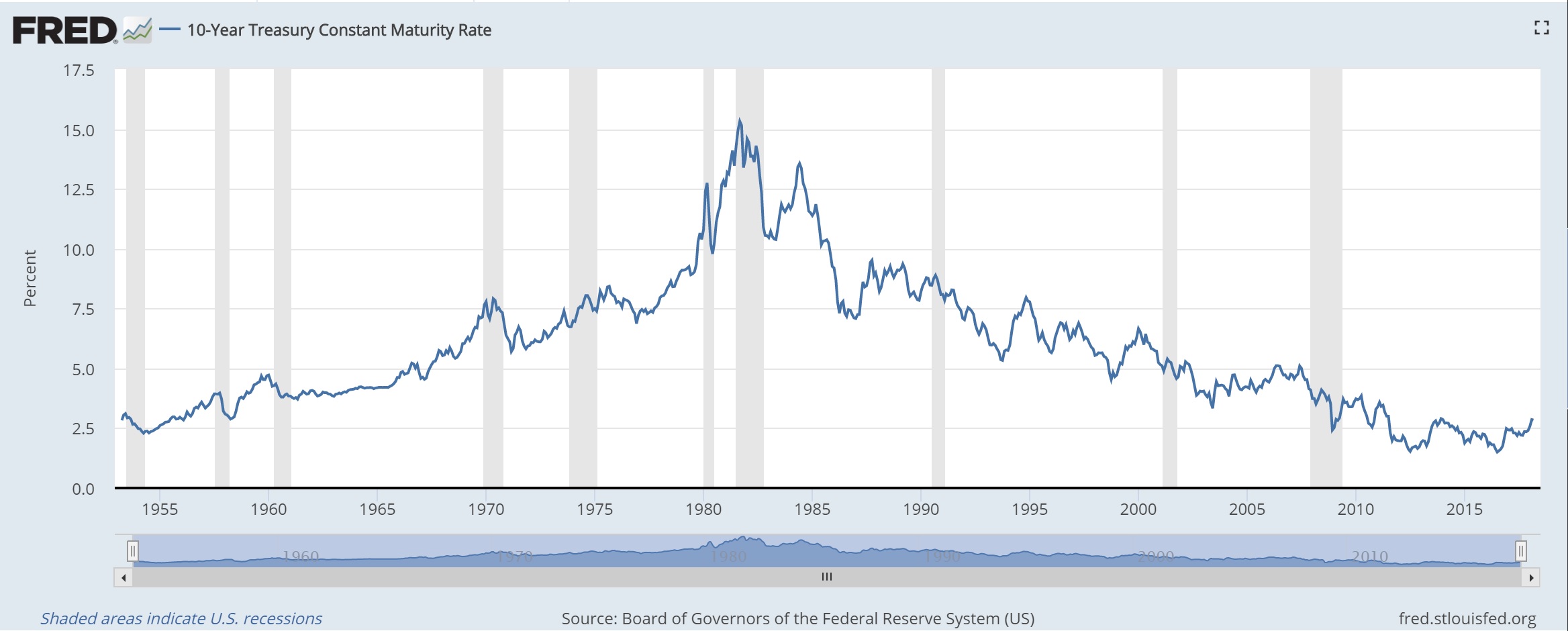

10-year treasury notes have been around longer than 58 years, but somewhat coincidentally, the 10-year rate during my grandparents’ time in Pasadena was like what it is today. In April of 1958, the rate was 2.88%, and today the rate is 2.86%. See the graphic below for a history of the 10-year rate since 1953.

In this current period of market volatility, clients often ask us something like, “Isn’t there something that I can invest in that is safe and will yield 4%?” In short, the answer is no. Investing in (or buying) a 10-year treasury note, means that you will receive 2.88% interest and have your principal returned at the end of the 10 years. Before you ask, if you were willing to commit to a 30-year government bond in this still-low interest rate environment, you would be “rewarded” with about 3% interest.

Conservative investors have been (or should have been) forced to repurpose their investment strategies. If a retiree needs 4% interest to cover living and other retirement expenses, then he or she must look beyond the traditional vehicles of government bonds and/or bank CDs. Much like the old door, the old strategy of investing in government bonds can still be used, but it should be complimented with more up-to-date methods to help boost returns.