Are You Biased?

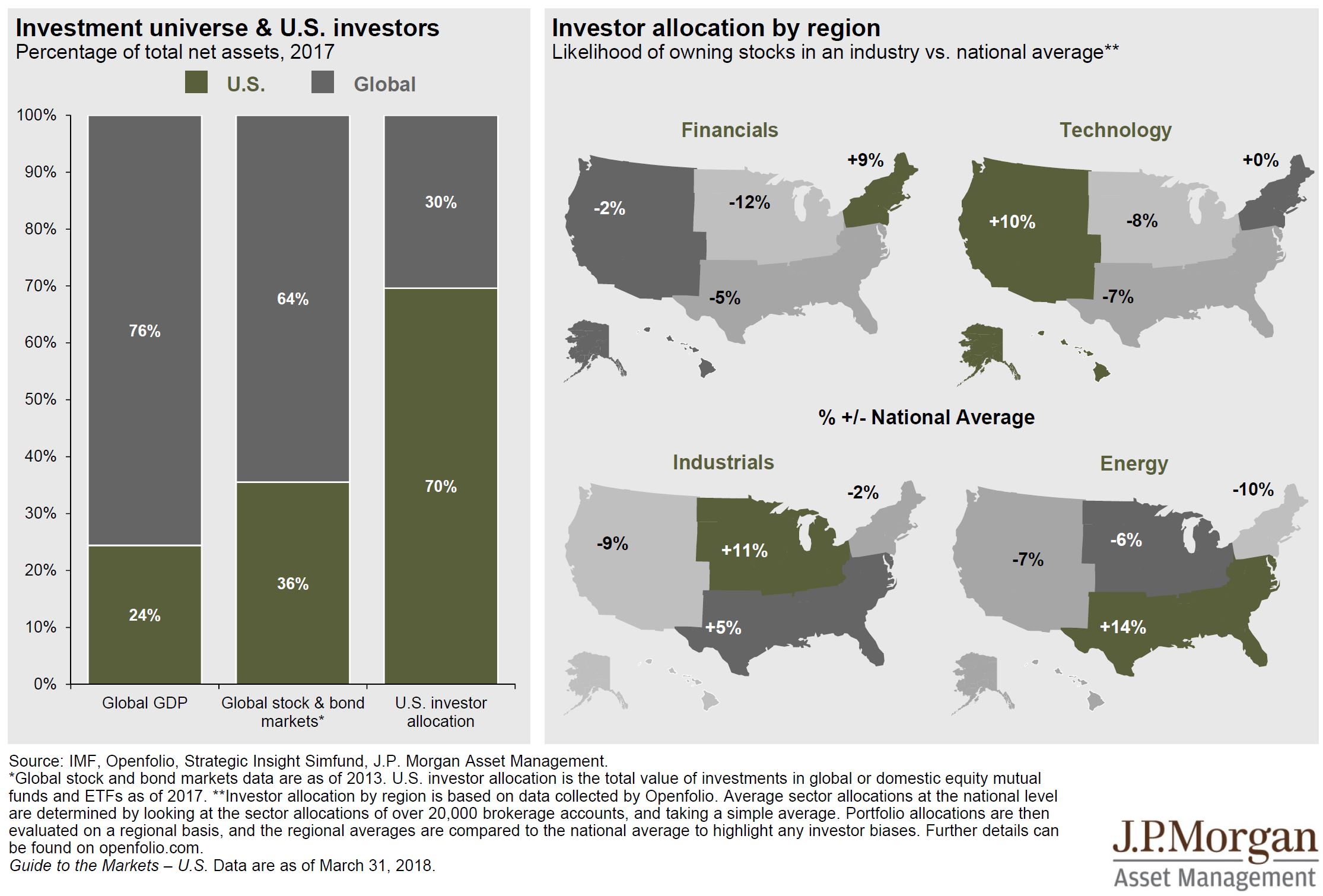

With your investments, I mean. There is an interesting slide from JP Morgan with two charts showing investor allocations by region. There is quite a large disconnect between a US investor’s allocation to non-US investments and the actual make-up of the global markets. As you can see from the chart below, the US makes up just 36% of the global stock and bond markets, but the average US investor has 70% allocated to those markets. This is not necessarily a good or bad thing, but location bias is real. It can likely be attributed to our desire to invest more in what we know, see, and are comfortable with.

It’s certainly an interesting topic. And, it points to potential opportunity for US investors overseas. Taking things a bit further, the chart on the right looks at the regional bias by investors within the United States. For example, if you live in the western part of the country, you might have a 10% more of your money allocated to technology stocks than the national average. Investors that live near New York city have 9% more of their money allocated to financial stocks than the national average.

Coincidentally, my wife is doing some international travel for her company and is currently in Chennai, India. Her report from Chennai is that it’s extremely hot, it’s hard to adjust to the sleep schedule, and the food is delicious! She is in the internal audit world, but I did ask her to do some emerging market research for our Meridian clients! 😊

I think the bottom line for this short blog post is that we all need to be aware that markets outside of the US present opportunity. In fact, many experts agree that the US market is a bit overvalued and many of the overseas markets are still below or near fair value. As we have said at least 100 times before, diversification is the key, and there will always be something in your portfolio that you hate!

I will let you know if my wife comes back with any investment ideas from India!

Nathan