Your Social Security Statement is Not in the Mail

As with many providers of statements for all things, the Social Security Administration wants you to “go green.” Many of us have learned by now that’s code for ‘we want to save the trees, but we also want to save money.’ Unless you are receiving benefits or are almost eligible to receive benefits, you won’t get a statement in the mail.

Workers must now go online to set up a My Social Security account in order to view their options. The steps for setting up an account are fairly straightforward. And, once you get an account set up, you can ask for an annual reminder e-mail to log-in and check your statement. I just received mine the other day, which is why it’s the topic of this week’s blog!

You can simply go here to get started: https://www.ssa.gov/myaccount/

The Administration will mail paper statements to workers age 60 and older three months before their birthday if they don’t receive Social Security benefits and don’t yet have a My Social Security account. There is a way via the website to set up paper statements, but you do have to set up an account either way. You are able to download and print your statement as well.

You will notice on your statement a recommendation to review your earnings record and years worked. While it is very rare, we have heard of errors found in these records, so it is important to make sure yours is correct. From the Social Security website: “Some or all of your earnings from last year may not be shown on your Statement. It could be that we still were processing last year’s earnings report when your Statement was prepared. Note: If you worked for more than one employer during any year, or if you had both earnings and self-employment income, we combined your earnings for the year.”

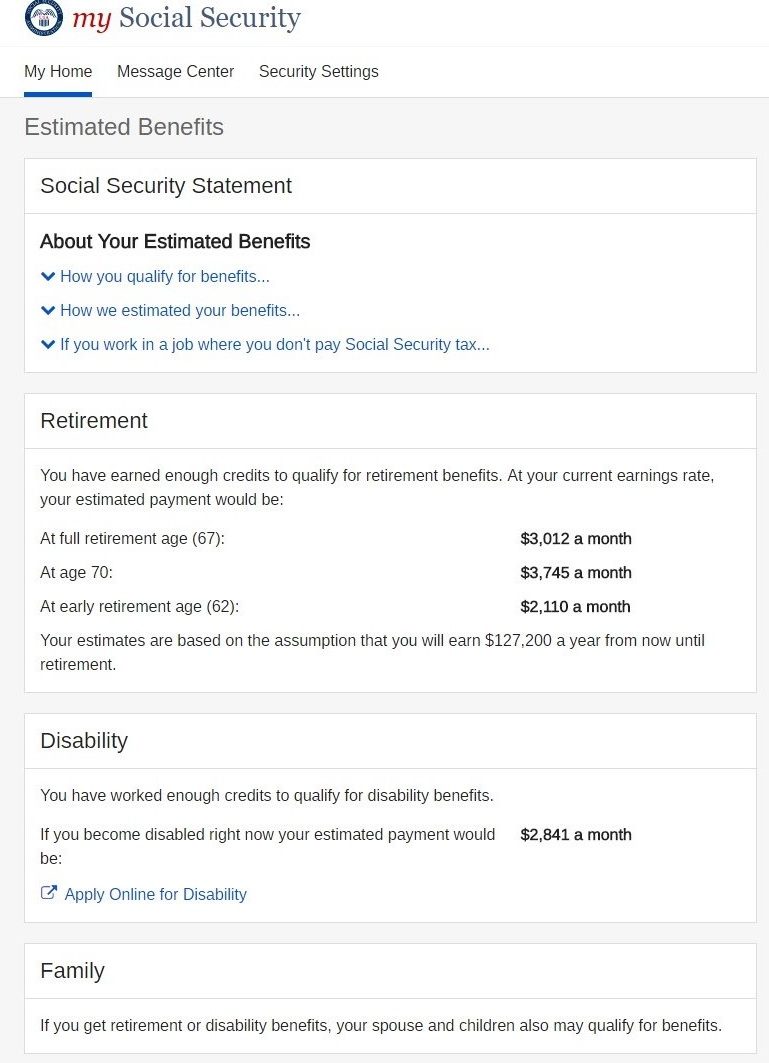

Here’s an example of an estimated benefits statement:

If you have saved on your own for retirement and you are in good health, it is usually best to delay taking payments until age 70. This is because you will get much more money out of the system if you live long enough.

Here is a very nice chart from Christy Beiber at The Motley Fool. From Christy Bieber’s recent article: “This chart shows the reduction or increase in benefits compared with a Full Retirement Age (FRA) of 67, based on the age at which you claim benefits. It also shows the number of years you’d need to receive benefits to break even, compared with claiming at age 62. It’s based on a benefit of $1,404 at full retirement age, which is the average monthly Social Security benefit for workers in 2018, according to the Social Security Administration.”

Finally, and somewhat obviously, Social Security payments will not be enough to satisfy most people’s retirement goals. So, make sure you are on track with your retirement plan and you are taking advantage of your plan options via your employer.