Learning New Things @ Exchange

Yes, finding an excuse to go to a conference in Miami in February is generally a good idea. As is the case with most events like these, we are still spending the lion’s share of our time inside conference rooms, but it’s still a great location for this time of year. The annual Exchange conference that we attend is always informative and interesting. The topics are mostly focused on the ETF (Exchange Traded Fund) industry, but there are also many other new ideas and industry trends that are discussed.

Dr. David Kelly with JP Morgan is always a favorite presenter. His positive outlook and thoughtful presentation style is refreshing in the doom and gloom that often finds its way into the industry headlines. Some of my favorite quotes/thoughts from Dr. Kelly included:

Predictions for 2024 – 2% economic growth, 0 recessions, 2% inflation, and 4% unemployment

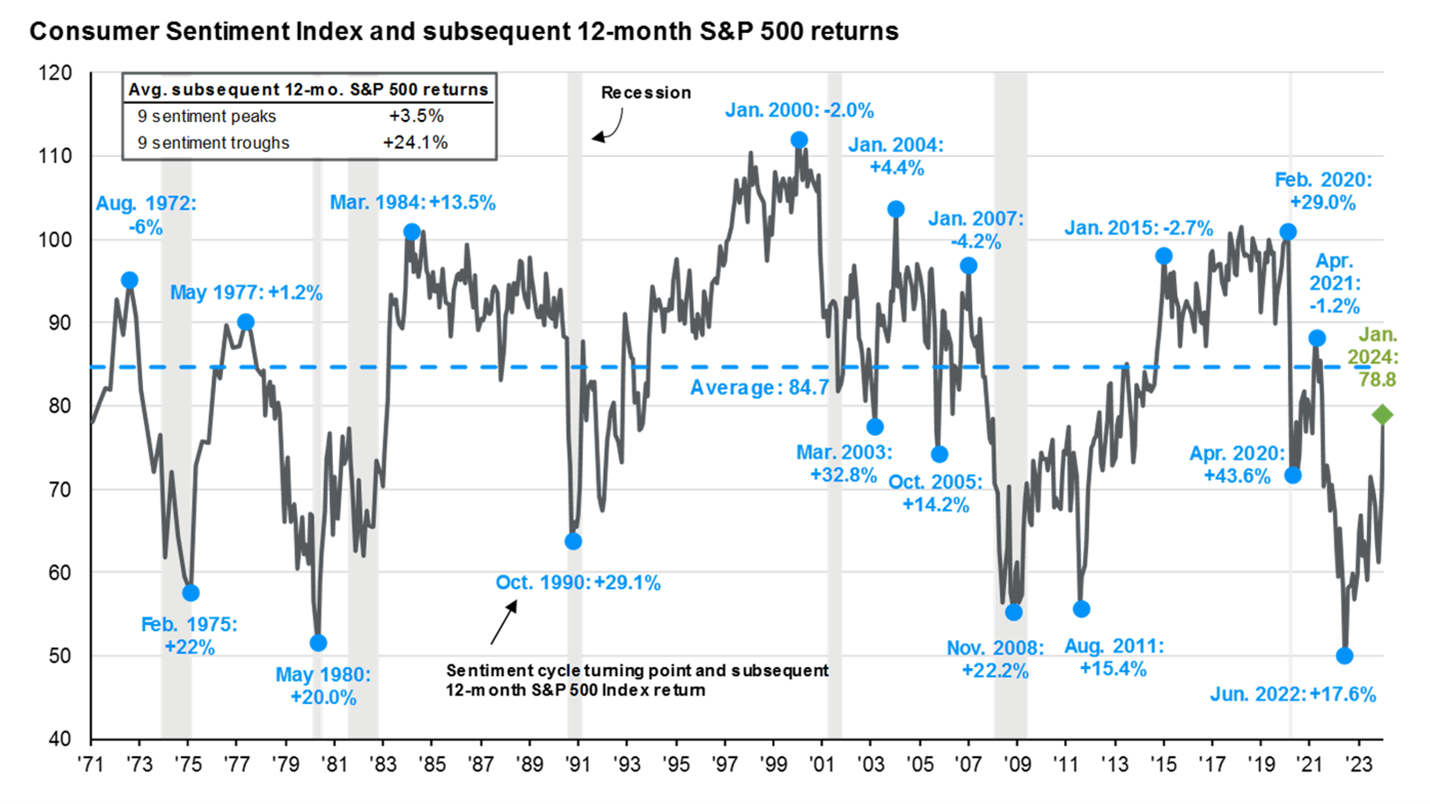

The news cycle tells us to both be very scared and very angry, which sells ads but is not a basis from which to make investment decisions. ‘I will invest with things feel better’ is a different way of saying I will buy high and sell low.

Cash isn’t king for long term investors – in 2023, a diversified portfolio (60% stocks and 40% bonds) beat cash by 3X

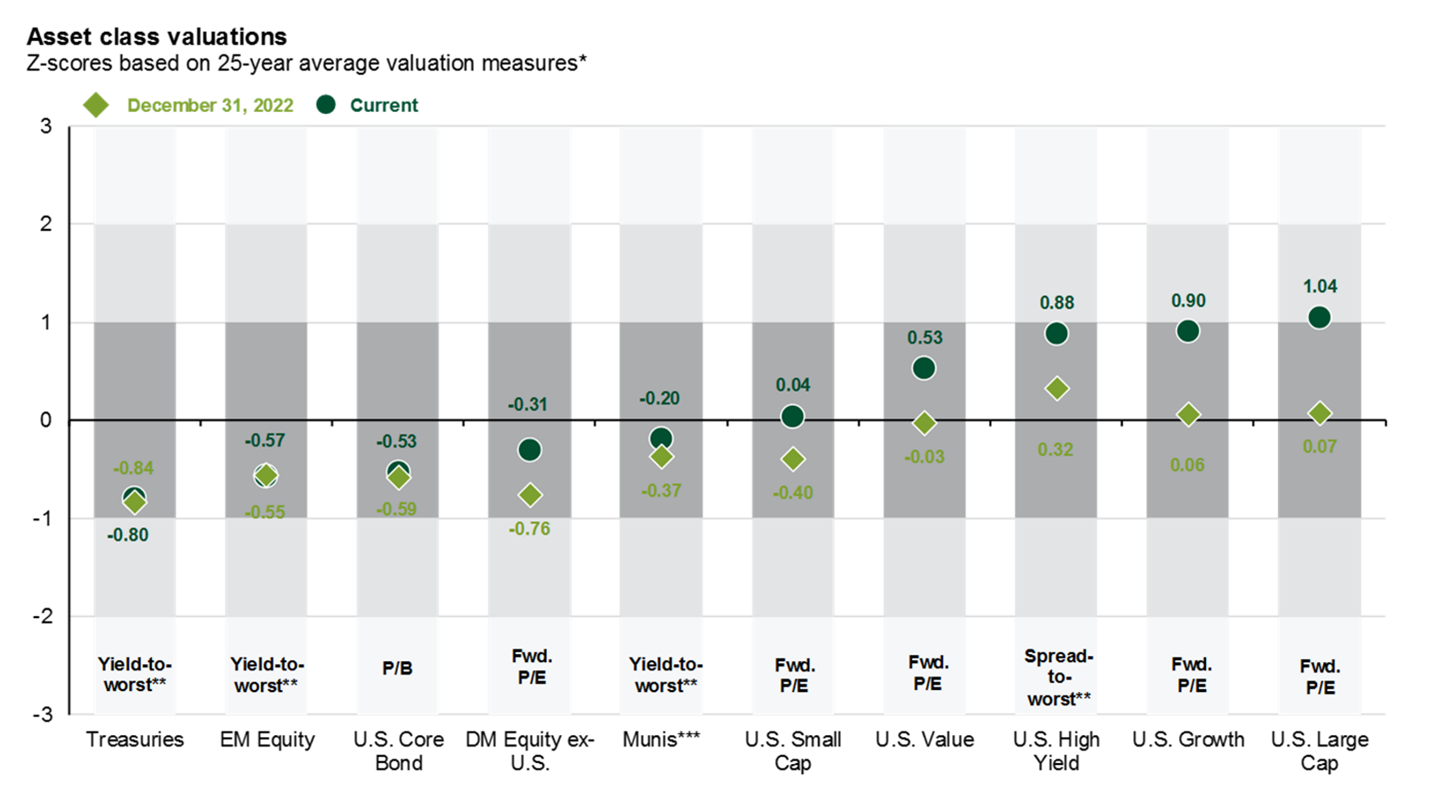

You end up overweight the overhyped – referring to the Magnificent 7 stocks and large US growth companies – over 1/3 of the S&P 500 is now represented by just 10 stocks.

We will continue to explore new ideas and investment strategies on behalf of our clients. Sometimes what we learn at these events is that we are already doing many of the right things, so it is nice to get confirmation that we are on the right track. However, a lot of our job is making sure we are using all of the latest and greatest tools available and exchanging (pun intended) ideas and approaches with others in our profession is always helpful and should result in a better experience for our customers. And, yes…Miami in February!