Wellness Checks

It’s the week of doctor’s visits at the Yakel household…these two handsome guys just had birthdays and have each had wellness checks to be sure they were growing up healthy:

While annual checkups are just a part of life, they can be a little painful—Milo is on a little diet and Ethan had to get shots. Neither is very happy. But, both have a clean bill of health.

An annual financial checkup can feel about the same—necessary but painful. However, knowing you are financially healthy –or at least knowing areas that can be improved on—can be very mentally freeing.

At Meridian, we review our clients’ financial plans annually to check progress, note new challenges and opportunities, and make a plan for the year ahead. Here are a few “health stats” we check:

- Net worth statement: To easily calculate your net worth, write down all of your assets (bank accounts, investment accounts, retirement accounts, real estate, etc) on one side of a piece of paper. On the other, write down all liabilities (credit card debt, student loans, car loans, mortgage debt, etc). Difference between the two is your net worth. We review progress annually—generally, we are looking for falling liability balances (or for a legitimate reason for an increase…i.e. purchased a home for the first time…new car…). We are also looking for growth on the asset side—a solid emergency fund, a growing retirement account, etc.

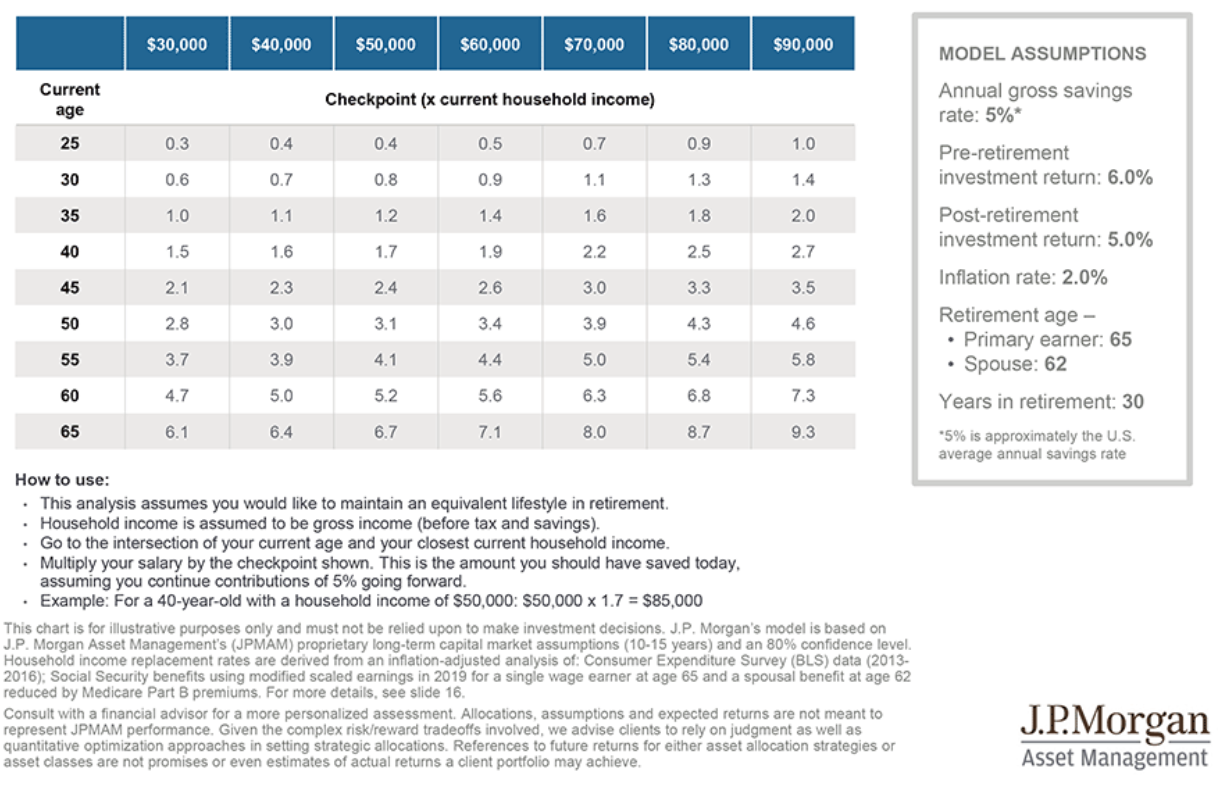

- Retirement savings checkpoints: With the net worth statement in hand, and an idea of annual income, we calculate if our clients are on track for retirement. While we do a little more detailed analysis, JP Morgan has a wonderful ‘rule of thumb’ guide for how much you should have saved for retirement by various ages:

Retirement Savings Checkpoints

- Savings rate: We calculate the percentage that our clients are saving for retirement between their own contributions to IRAs, company retirement plans, investment accounts, as well as the percentage that their employer matches. When we do a full financial plan, we arrive at the target savings rate by calculating how much is necessary to save based on retirement goals, investment growth, and other factors. But as a general guide, here is the JP Morgan table with approximate savings rates at various income levels/ages:

During an annual financial “check up”, we also review baseline goals for emergency savings, insurance coverages, and estate plans. Our goal is to make sure our clients’ financial picture is growing healthy…even if it may need a shot every now and then!