More Daisy (and maybe more stocks?)

As you are probably already aware, stocks have had a strong rally since a very difficult end to 2018. Not surprisingly, this spooked a lot of retail investors (the average investor) and equity (stocks) fund outflows have been sharply negative since the beginning of the year. And, fixed income (bonds) fund inflows have been positive. This means that despite the strong performance in stocks, most retail investors have been running away from the perceived risk of investing in the equity markets.

Even though stocks as a whole have gone up, your allocation to that area may still be below your intended target. David Lebovitz with JP Morgan summed things up nicely in a recent article on July 12:

“One of the most perplexing things about the recent stock market rally is that it has occurred against the backdrop of equity fund outflows and bond inflows. In fact, according to the Investment Company Institute (ICI), from the end of 3Q18 through the first week of July 2019, US equity mutual funds and ETFs had seen nearly -$105 billion in outflows, versus $130 billion of inflows for fixed income.”

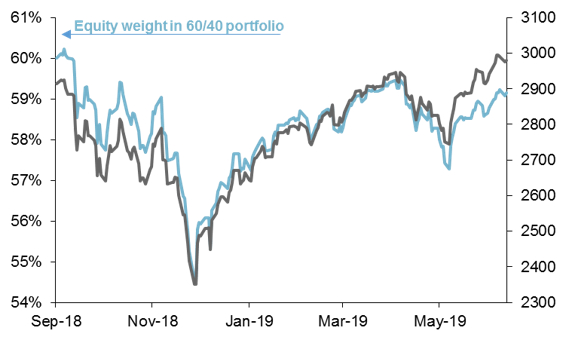

So, if you are an investor with a somewhat generic mix of 60% stocks and 40% bonds and you have yet to rebalance since September of 2018, you are likely still under your target allocation for stocks. See the chart below:

I hope you were one of those rare folks that stuck to a regular rebalance strategy and did so right at the end of last year. If not, you may still need to buy more stocks (gasp!) to get your mix back to the intended target. As we said in our recent quarterly letter, there is no rule that says the markets have to go down just because they have gone up for an extended period of time.

I don’t have a clever tie in to the markets and my personal life this week, so here’s another picture of our new French Bulldog puppy Daisy. Yes, it’s shameless clickbait and probably the reason you clicked on this post in the first place!

Thanks for reading,

Nathan