Your Investment Time Horizon is Longer Than You Think

Recently, my wife’s grandmother (my grandmother-in-law?), affectionately known as Ging, celebrated her 94th birthday. While she has had some medical complications along her journey, her quality of life has mostly been very good if not excellent. She is certainly lucky to have a loving family to not only look after her, but also to throw her some great birthday parties! As you can see from the picture below (with my youngest photobombing!), she had a great time at her most recent celebration.

Ging’s advanced age and good health is a reminder to me that retirement can last a very long time. A lot of our clients often say something like, ‘at my age, I can’t afford to take anymore risk with my investments.’ In fact, the exact opposite may be true. As we all know, there are tradeoffs between risk and return: the more risk you take, the more return you should get over time, and the less risk you take, the less the return you can expect over time. If you are relying on a certain lump sum of money to last all of your retirement years, you likely need to have some of that money invested for the “long term.”

According to recent data from the US Census bureau, the average length of retirement is 18 years and lasts from age 63 to age 81. Many pre-retirees think that they should be invested in all conservative assets by the time they reach retirement age, when in reality, much of that money has a 10+ year time horizon. Yes, some will likely be needed in the short-term to provide for living and other expenses, but it’s not like all of the money will be spent in the first year of retirement.

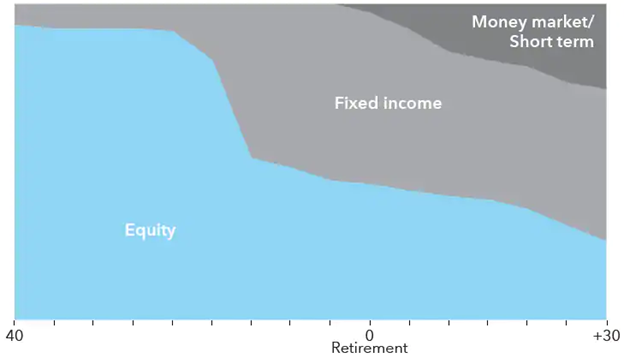

A good example of a potential strategy for investing in retirement is the “glide path” of target date funds. These types of funds are often found in company retirement plans, because they offer set-it-and-forget-it diversification. In short, they start out investing aggressively (stocks) when the retirement horizon is far away (long timeframe) and automatically get more conservative (bonds) over time.

You will note that even 30 years into retirement, there is still some money invested in equities (the more aggressive category).

A Typical Glide Path is Diversified Across Stocks and Bonds

Example is hypothetical.

Source: 2017 American Funds Distributors, Inc.

The reasoning is that in order to maintain your money’s purchasing power over time, some risk must be taken in order to achieve the required return. You might be getting a very safe 1% in your bank account, but your money is losing about .8% of purchasing power each year (based on currently inflation of 1.8%).

Make sure your investment mix matches up with a potentially longer-than-you-think retirement!