How To Tell Good Debt Versus Bad Debt

It might sound strange, but not all debt is “bad.” Certain types of debt can actually provide opportunities to improve your financial future. To make smart decisions about if, when, and how much to borrow, you need to understand the difference between “good” and “bad” debt and how to manage it.

GOOD DEBT

If there is a legitimate wealth-building use for that debt, it could fall into the “good” category. Good debt is low-interest debt that helps you increase your income or net worth. But too much of any kind of debt — no matter the opportunity it might create — can turn it into bad debt. Good debt should ideally be in low amounts, low cost, help you achieve your financial goals, and have potential tax advantages.

With student loans, rates are comparatively low, and interest can be tax-deductible, depending on your income. Benefits of attending include enhanced career opportunities, which may increase your earning potential in the long run thus making taking on student loan debt worthwhile.

The average college graduate earns 56% more than high school grads, and the difference is increasing. This is a monstrous wage gap, and a whole lot of incentive to get your diploma, even if it means taking out some debt to do so.

The big caveat in this is the differing income ranges depending on your field of study. You need to weigh the cost of attending a specific school versus how much you plan to make when you graduate. You don’t want to attend a high-priced private institution if your desired career is in a lower-paying field.

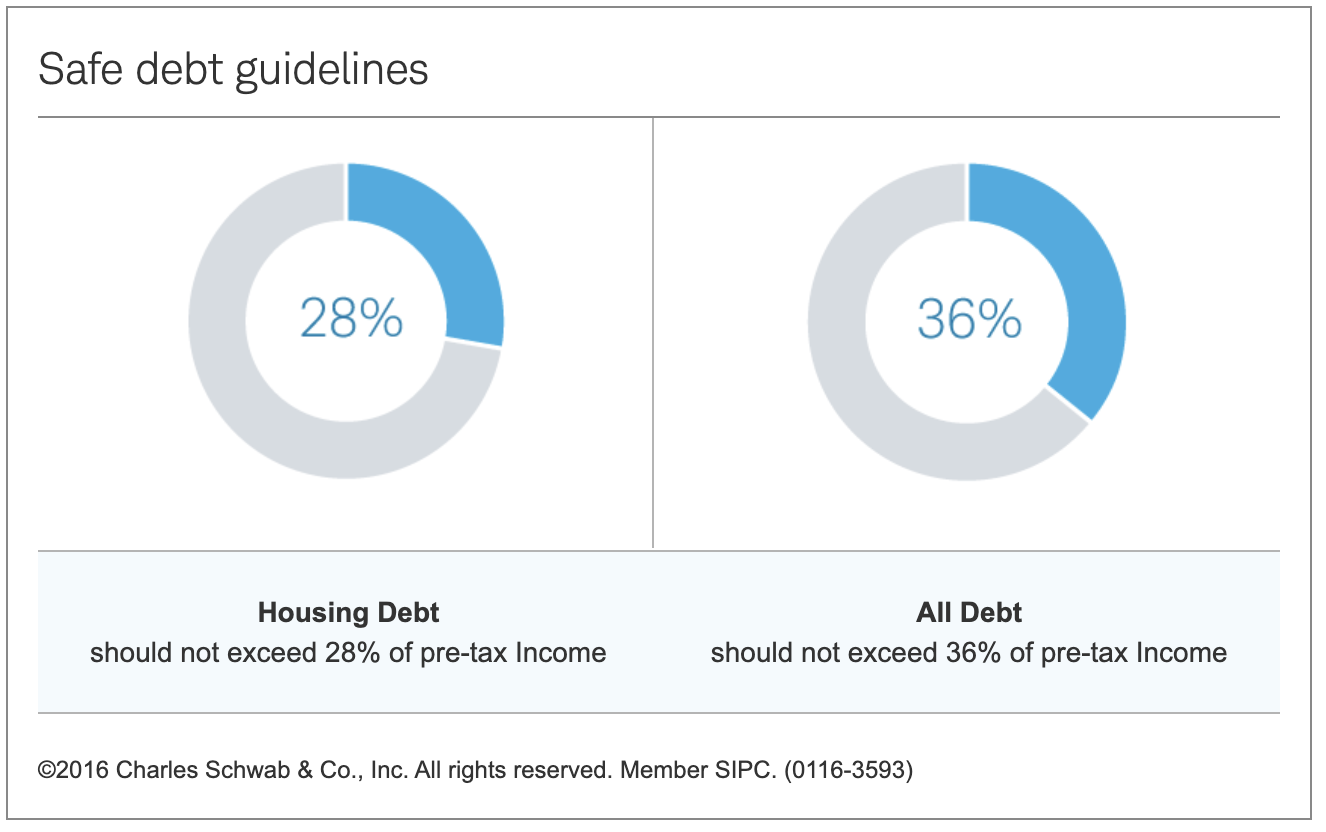

Mortgages, interest rates are low compared to other types of consumer debt, and owning your own home can help you build wealth over time as well as improve your quality of life. For example, it could shorten your commute or allow you to move into a better neighborhood or school district. Mortgage interest may be deductible. If you use a home equity line of credit or HELOC for home improvement, you may still be able to deduct the interest if the money is used for improving your residence. As always, be sure to check with your accountant and financial advisor. With rates at all time lows, now might be the time to purchase a home or refinance!

BAD DEBT

Expensive debts that drag down your financial situation are considered bad debt. Examples include debts with high or variable interest rates, especially when used for discretionary expenses or things that lose value.

Sometimes, bad debts are just good debts gone awry. Credit card debt is an example of this: If you have a high-interest credit card and pay off your balance each month, no problem. But if high-interest credit card debt builds up, you could be in trouble.

The following areas should be avoided as much as possible.

Credit Card Debt

Credit cards are one of the easiest ways to get yourself into financial trouble. It’s so easy to pull out our credit card and swipe away without realizing how much debt you are racking up. Eventually, your statement comes in and you get hit with a real eye-opening balance.

It’s best to pay off your credit cards each month and avoid the high interest rates associated with this form of debt.

Be careful when getting a store credit card. While the offer might seem enticing, they tend to have higher interest rates and can harbor deferred interest.

Car Loans

For most buying a car is a necessity especially if you commute to and from work and don’t have access to public transportation. The problems arise when people overextend themselves with how much they purchase. And you start to get into really dark territory when you use auto loans to purchase new cars.

The problem isn’t the loan itself; it’s that when you buy a new car it immediately loses value the moment you drive it off of the car lot. This means you’ve paid for a vehicle with debt, which has immediately lost value! Not exactly a great use of debt, and certainly not a good “investment.”

The only positive is that you are at least using this purchase to help you earn an income. We recommend buying used and getting a 3-4 year loan with 20% down over a 5 or 6 year loan, which can have a larger negative impact on your credit score.

The surest way to avoid getting yourself into trouble with debt is not using it at all. From my experience, if properly utilized, debt can be a great way to help build wealth. It’s just important to understand how each type of debt can either hurt you or benefit you. And even if you are establishing “good debt,” you still need to be careful with how much you are taking out, and not get in over your head.