Borrow or Use Cash?

Thank you to one of our loyal readers for the suggestion of this topic! It’s a good question and one we get a lot from people, especially those nearing or in retirement. And, it usually involves whether or not to pay off the mortgage on a primary residence (or use saved money to buy outright vs. a mortgage).

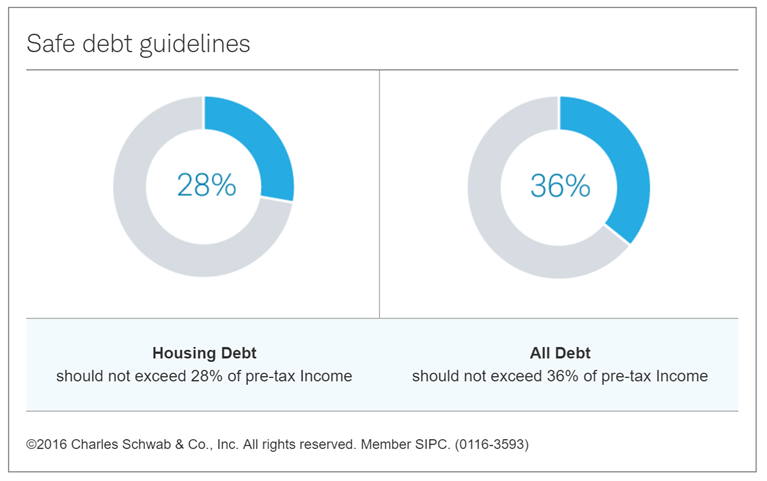

Before we delve too quickly into this topic, it’s important to note safe levels of debt. A commonly accepted practice is the 28/36 rule, which says that your annual housing debt (mortgage payments plus taxes and insurance) shouldn’t exceed 28% of your pre-tax income. And your total debt (housing plus auto loans and credit cards, etc.) shouldn’t exceed 36% of your pre-tax income.

Soooo, what’s the answer?

Sometimes the financial answer and the psychological answer/feeling do not align, and I have learned not to discount the psychological aspect. People want to pay off their mortgage, because it feels better to own your home outright; if all else fails, at least you have somewhere to live, and I certainly understand that.

The financial answer, is ‘it depends.’ Ugh, I hate that answer to any question, but in the world of financial planning, it certainly applies. To me, the answer centers around two main points:

- The level of current interest rates (or rate on your current mortgage)

- The expected rate of return on investments over the life of the loan

In our current environment, the first point is easy to address. Mortgage rates remain at historic lows, so it’s a pretty darn good time to borrow money. For the purposes of this brief discussion, let’s assume you can get a 30-year mortgage at a fixed rate of 4.00% (I have seen lower rates advertised).

The second point is harder to answer, because investment performance is unpredictable. But, I think it would be hard to argue that a prudent investment mix wouldn’t return better than 4% per year over a 30 year timeframe. So, if you are fortunate enough to have saved up money and have it invested, you would likely want to leave that money invested, rather than pay off the mortgage.

Spray paint mural from the Inside ETFs conference

Not only does leaving the money invested potentially earn you a higher rate of return than you are paying on your mortgage, but it also helps with liquidity (or quick access to money). If you were to have an emergency need for cash, and most of your savings were tied up in your residence, then it would take some time to sell that property (or get a home equity line) in a short timeframe. Most investments can be sold and moved into a checking account within a few business days.

Lastly, keep in mind that this does not have to be an all or nothing proposition. If paying down some of your mortgage principal helps reduce your payment to a more comfortable level, that might make sense. As always, it depends on your situation and financial plan.