Silver Lining Opportunities

The past few days have given lots of reprieve from the colder weather, but the roller coaster in the markets seems to continue. Needless to say, investors have been put through an emotional ringer the last 2 years through stomaching the lows of the market drop in 2020, the unknowns of a pandemic, feeling the highs of the sharp V-shaped recovery in 2020 and 2021 when almost everything was up, and now … 2022. We have been reminded as investors that there is inherent risk in any type of investment, including cash (purchasing power risk) , and as Nathan covered in his blog from last week, part of investing and reaping the rewards / returns of a prudently allocated portfolio is preparing for and accepting volatility.

However, it is only human nature to feel like something needs to be done, particularly when there has been so much going on in the world recently. So, what are some things that we here at Meridian are doing and are suggesting to our clients right now?

Stick with the plan (not to be confused with “doing nothing”)

A well thought out financial and investment plan will incorporate the:

- “whys” for investing – (i.e. – “to outpace inflation”, “grow investments to achieve long-term goals”, “to leave a legacy to my heirs”, etc.)

- “how” the investments will aid in reaching goals – (i.e. – buckets of investments to accomplish short-term, medium-term, and long-term goals)

- “what” investments will be used – (stocks, ETFs, mutual funds, CDs, actively managed funds, passively managed funds, etc.)

- “when” goals need to be met or when large life events will occur (pretty self explanatory 😊)

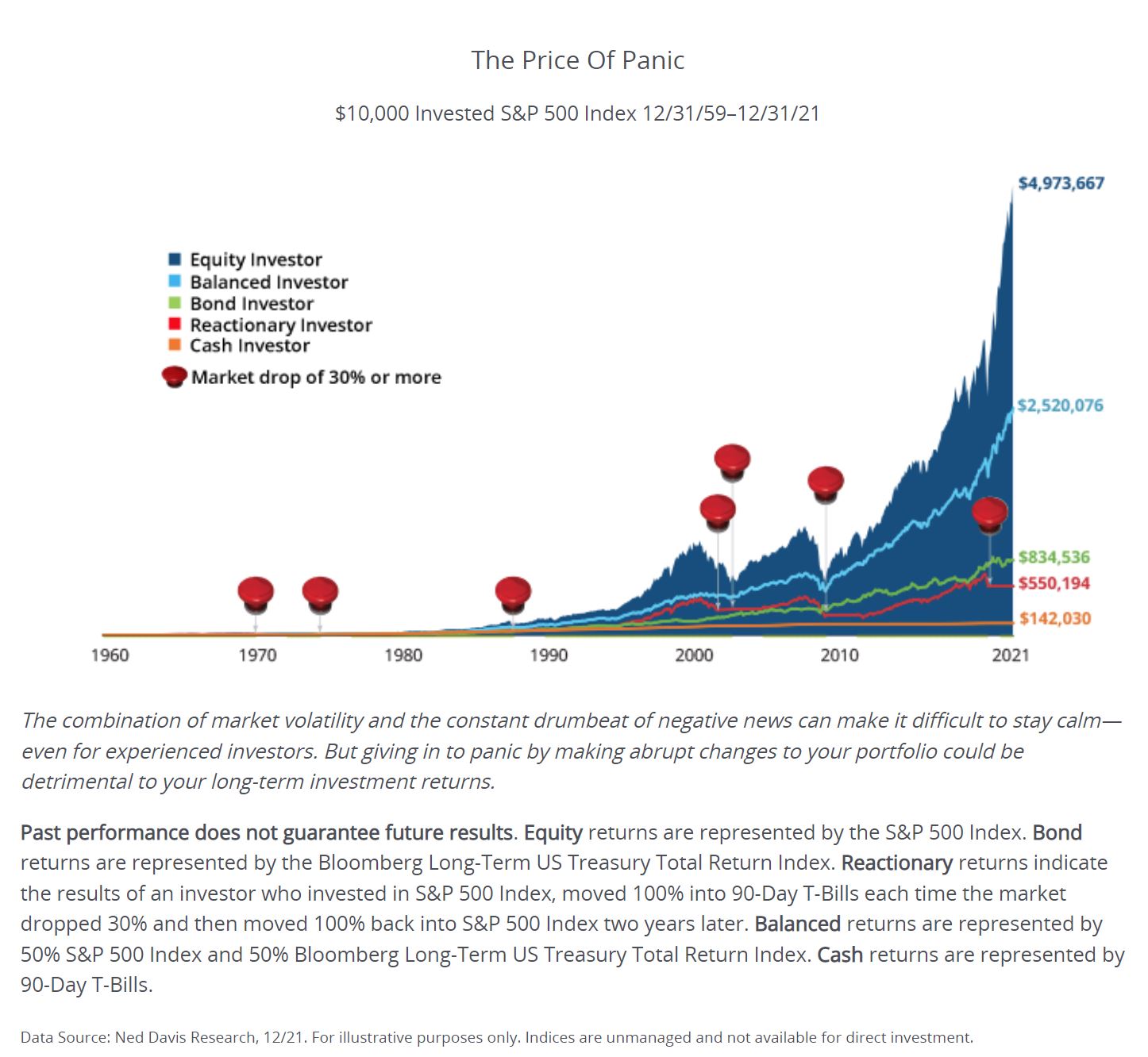

Understandably, plans are ever changing as life throws curveballs, but making reactionary choices based off short term market events can result in some pretty significant under performance in the long-term.

Defining personal risk tolerance and periodically revisiting this tolerance as it relates to the ability of achieving goals rather than revisiting risk appetite due to short term market events can help create a clear path and provide a beacon to reach your destination, even when it gets stormy.

Rebalancing

Part of staying the course and sticking with the plan means staying within the parameters of a target allocation even when it’s hard to do. This not only means rebalancing to the overall allocation between stocks and bonds, but rebalancing within the underlying asset classes as well.

A portfolio without regular rebalancing over time ends up overweight in one or more asset classes creating a possible over exposure to risk and veering away from the original risk tolerance.

And while it may feel counterintuitive to sell some of the “winners”, a prudent rebalancing schedule provides a disciplined way to essentially sell high and buy low while staying within your risk comfort zone.

Tax Loss Harvesting

Just as selling some of the winners can feel counterintuitive with rebalancing, tax loss harvesting is a way to capture a loss on purpose to help offset capital gains in the current year or in any future year. There is no limitation for how many years you can carry over capital losses and up to $3,000 of losses above capital gains can be used to offset ordinary taxable income.

Another benefit to this strategy is it can potentially reduce the risk of missing the recovery period of an asset class by selling an underlying security for a loss and simultaneously purchasing a similar fund or stock. This allows the portfolio to maintain asset allocation as well as benefiting from the future upswing of that asset class or type investment.

Roth Conversions

If converting funds from a pre-tax IRA to a Roth is part of the plan, doing so during down market periods creates an advantage. Investors are able to convert the same dollar amount but with more shares of assets, allowing the assets to recover and continue appreciating in the Roth tax-deferred and withdrawals tax free in the future.

Keep in mind, a Roth conversion doesn’t make sense for every plan and depends on individual tax situations. Also ideally, the taxes on the conversion should be paid out separately from the IRA funds in order to reap the biggest benefit of the conversion.

Finding Opportunities

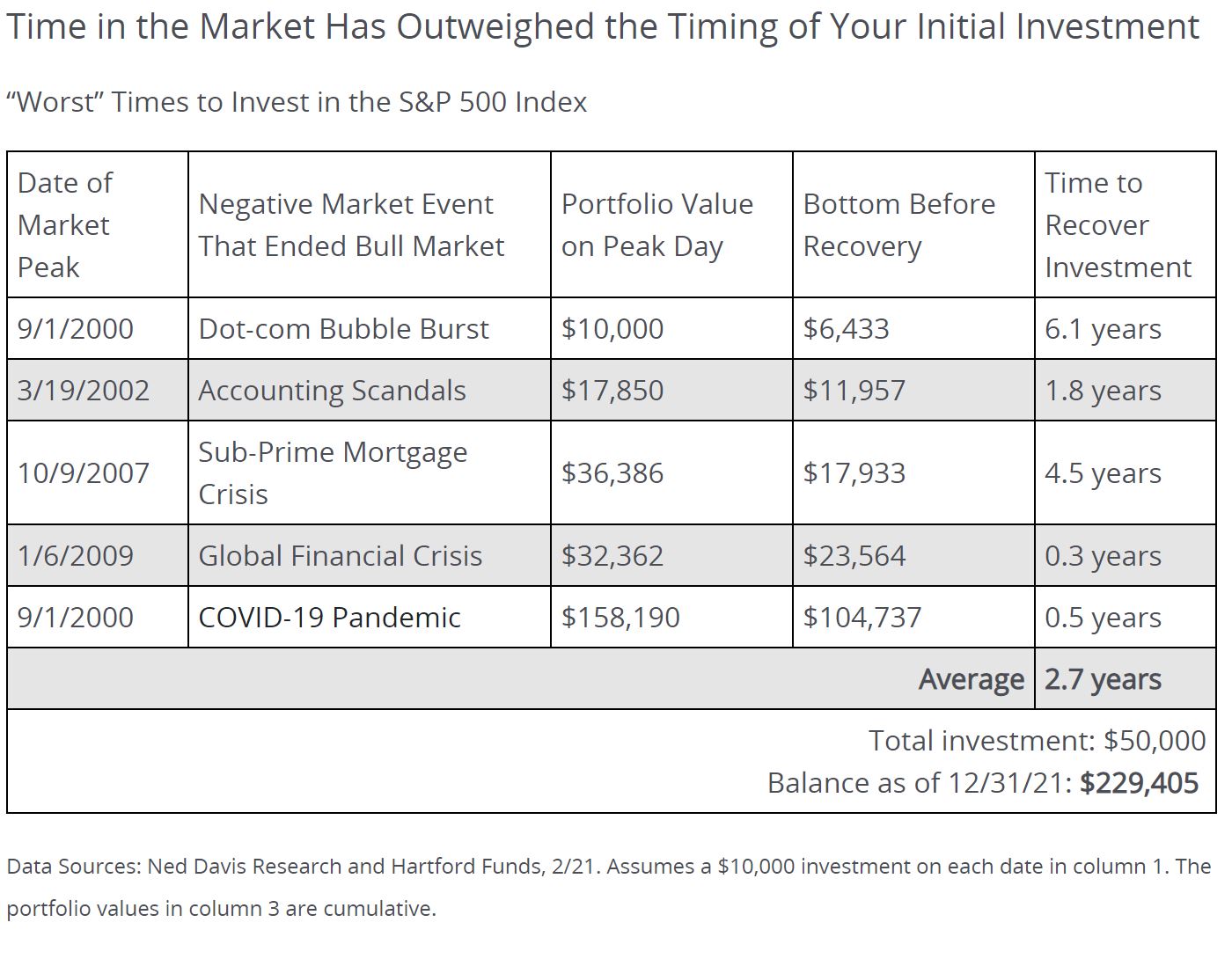

While we wish we could predict the absolute bottom, we know that diligence, patience, and diversification pay off over time. Taking advantage of lower prices now means buying while both bonds and stocks are on sale (for the most part)! Which is particularly Interesting to note that even if you invested at the worst possible time (aka the highest point), on average it has historically taken 2.7 years to recover.

We continue to watch the economic, market, and global landscapes for clues as to what will happen in the coming weeks and months but position ourselves to withstand any further volatility through diversification and staying true to the plan. In the meantime, we are here to act as your guide to help identify these silver lining opportunities and help you stick with your plan!