Headed Up the Mountain

This past weekend, my family and I headed into Shenandoah National Park for a camping weekend. It was very nice to get away to nature and have no choice but to be out of cell range. I think it was healthy for all of us to take a break from the plethora of devices we all use ALL the time. We were also fortunate enough to have access to a cabin with electricity and running water – it wasn’t quite “glamping,” but it was a happy medium between roughing it and staying in a fancy house replete with amenities.

The cabin location could not have been better for an outdoorsperson. It sat next to a beautiful river with swimming holes and boulders to climb on, and it was right along a trail that led (if you were so inclined) all the way to the Appalachian Trail. While not an avid fly fisher myself, it also offers some of the best trout fishing in the area. The kids spotted many a colorful trout in the clear waters of the river.

Obviously, hiking is the main attraction/activity to camping in this area. What was challenging for us was figuring the endurance differences between a 5, 8, and 10-year-old. During our Saturday hike, we made a slight miscalculation in our kids’ ability to “suck it up.” And, unfortunately there is no way to just get in a car and call it a day; you have to hike back from whence you came! The only silver lining was that we hiked up the mountain, so the walk (sometimes carrying kids) back was at least downhill.

While we were out of cell range, I was able to keep track of our steps and distance via my Apple watch. Needless to say, I think we may have pushed things a bit too far! I ended up having to hike down the last part of the trail myself, picking up the old suburban from the campsite (you had to have 4-wheel drive) and driving back up as far as I could to scoop up the family.

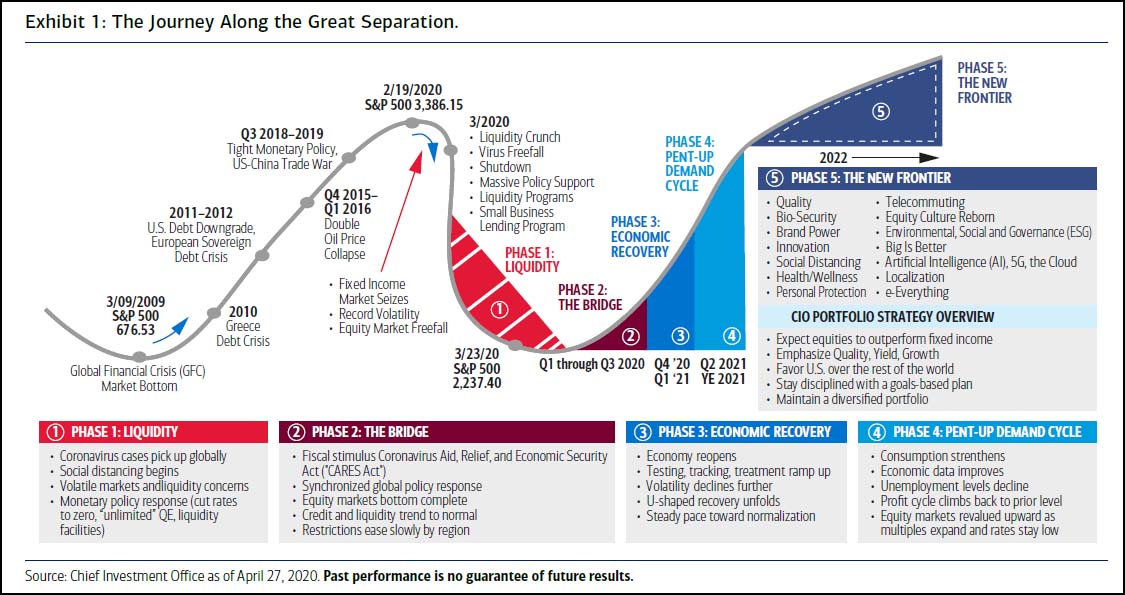

Lately, investing in the equity markets has been a lot like hiking 6 miles on a mountain trail at 5 years old, really hard! Those of us who stayed invest through the worst of the March market decline have been rewarded with significant recovery. And, while bifurcated significantly (see Sarah Yakel’s blog The Rest of the Story from last week) the S&P 500 has now tipped back to positive for the year.

I ran across an amazingly accurate chart from Bank of America/Merrill Lynch that they put out in April (believe it or not). Here’s hoping the rest of this chart’s predictions are dead on!

We will learn a lot this week as a huge amount of major companies will be reporting earnings. News flash: many will likely be very bad, but the question will be what the outlook is for the next year or more. Can these companies continue to stomach the economy’s delayed reopening and enjoy the rebound that will come on the other side? As we have already seen, certain sectors will do much better than others, but the companies that have led the way thus far (Microsoft, Apple, Amazon, Alphabet, and Facebook) cannot do so forever.

Suffice it to say our next family hike will be a one-mile loop on flat ground. If you asked me today, I would also take the market remaining flat for the remainder of 2020!

Nathan