The Rest of the Story

My dad engrained many things in me from a young age…value of hard work, honesty, family values, etc. But also his love of the Three Stooges, the Marx Brothers movies, Johnny Cash, the Beatles, Neil Diamond, Looney Tunes, Ray Stevens, lots of old movies, and Paul Harvey…

I don’t remember how we started listening to Paul Harvey, but I remember by parents had these huge old radio speakers:

And, I’d lay on the living room floor like a child of the 1930s, listening to Paul Harvey tell me a story with a twist ending.

Paul Harvey would start every episode with “You know what the news is, in a minute you are going to hear the REST of the STORY.” He’d tell a common tale but provide the fascinating and little known back stories, like the origin of Coca Cola or that Agatha Christie reportedly tried to frame her husband for murder. Cool stuff.

So, I’m no Paul Harvey, but you should know “the rest of the story” about this year’s performance of the S&P 500. The headlines tell you that the S&P has nearly regained its pre-COVID peak of 3,386:

And, while this is good news for investors, it is a little puzzling given the economic news is not exactly back to pre-COVID levels. But digging under the surface of these returns, there is a different story.

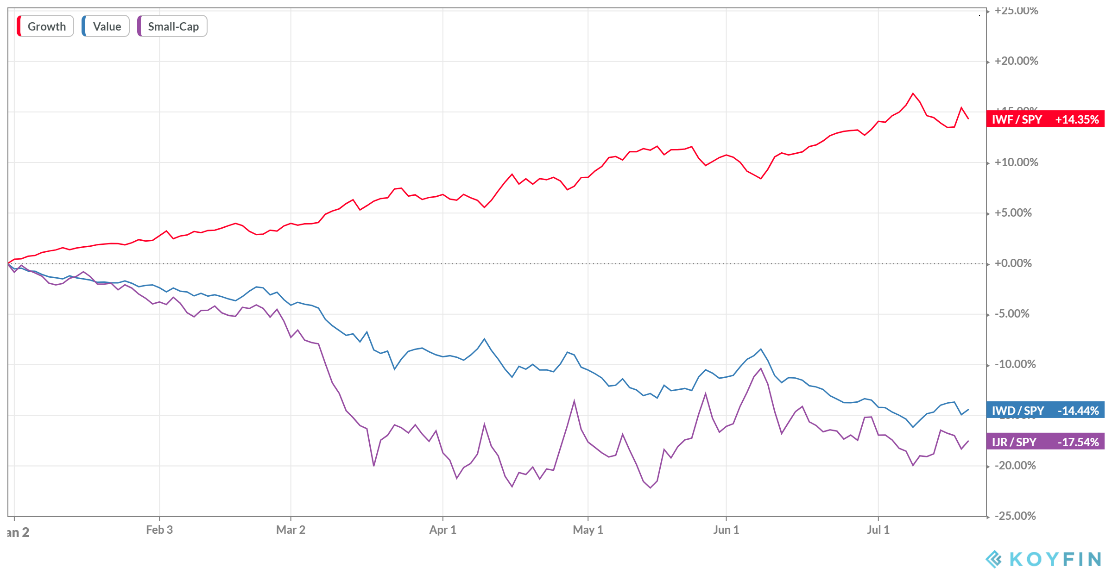

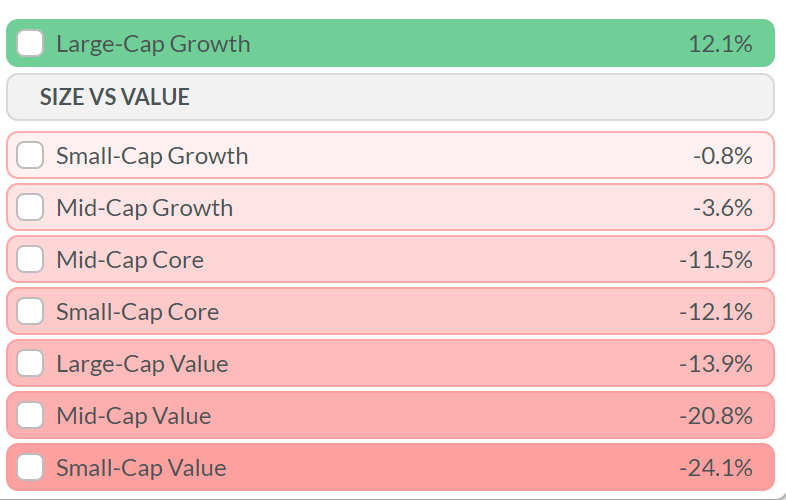

First of all, the gains have been concentrated in large growth stocks (the red line). Small companies and value companies are still significantly down for the year:

Year to date, through 7/21/2020, there is a 36.2% performance difference between large cap growth companies (at 12.1%) to small cap value companies (at -24.1%). That is one of the largest margins of underperformance in recent history.

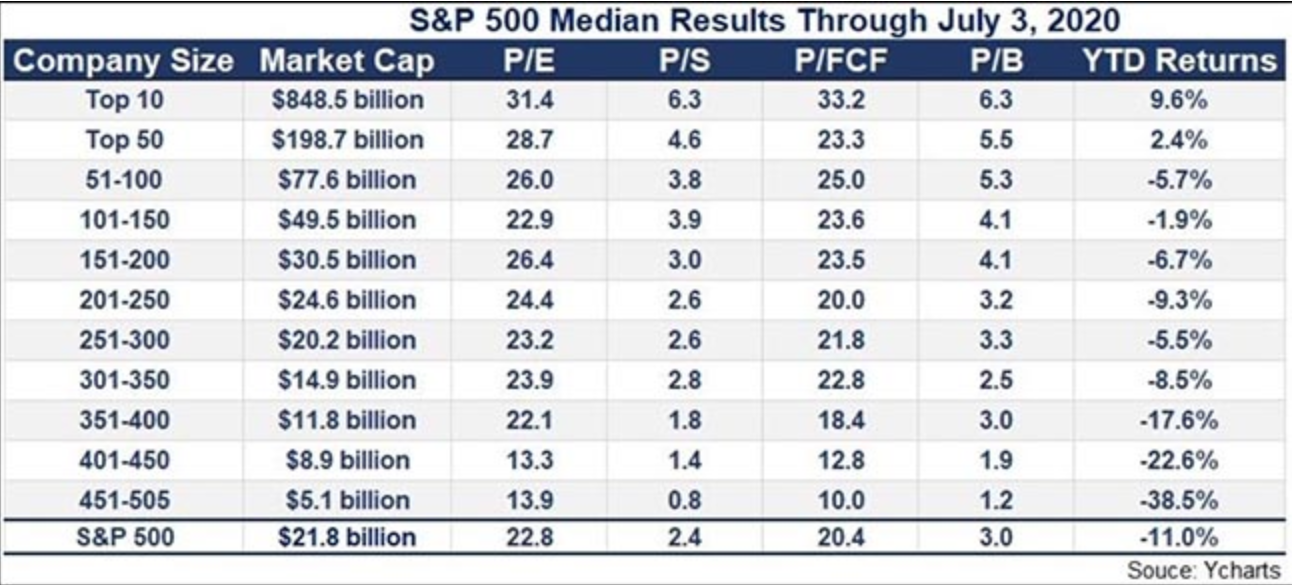

Within the S&P 500 index itself, there is a huge disparity in returns from the top 10 companies (returning 9.6%) and the bottom 50 (returning -38.5%).

@hkuppy

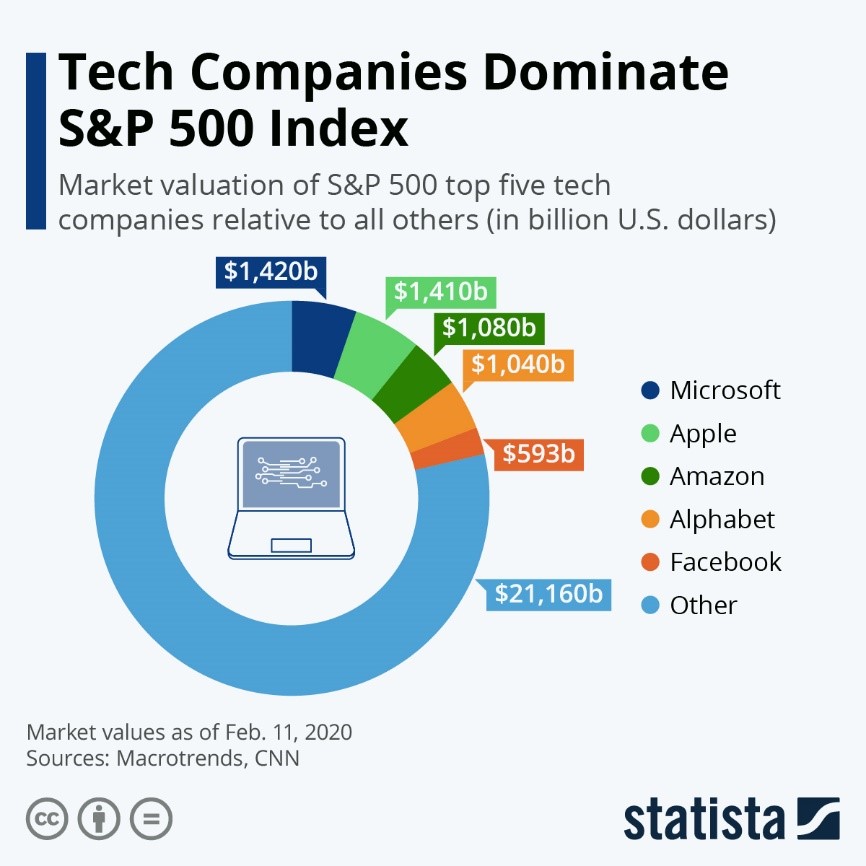

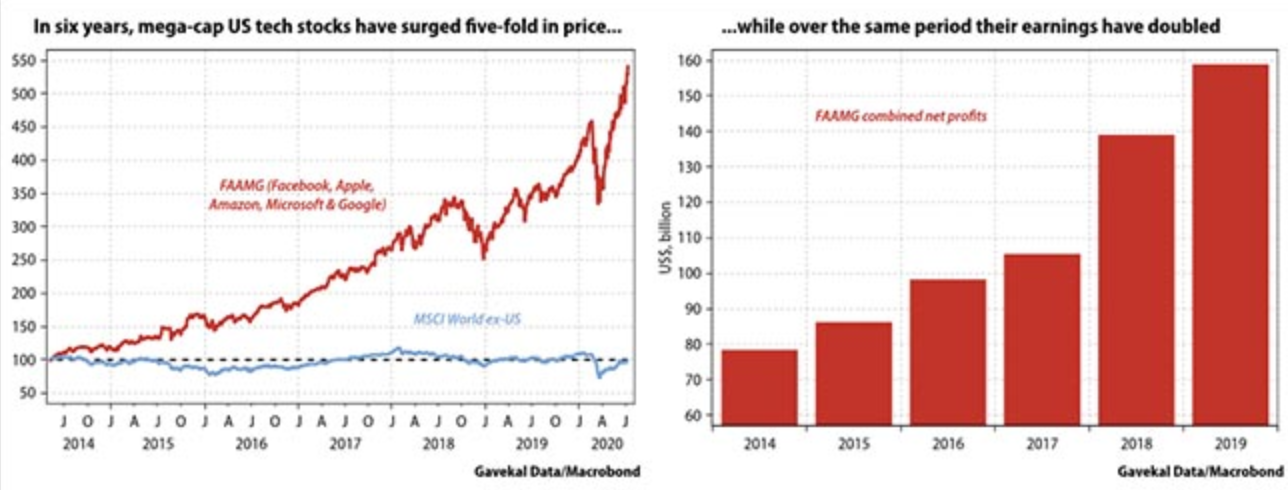

Investors are piling into these big names, predominately the tech companies of Facebook, Apple, Amazon, Google (Alphabet), and Microsoft:

Driving their prices up five-fold, while their earnings have doubled in the same time frame:

@Gavekal

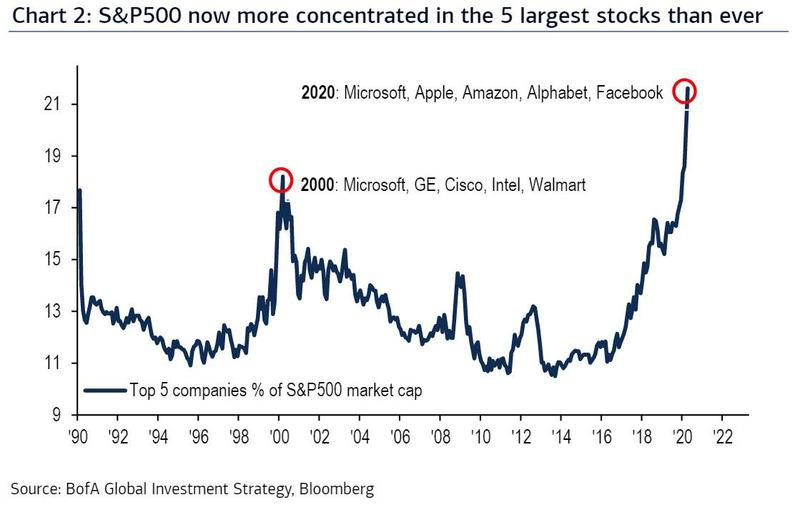

The top five stocks in the S&P 500 are now over 22% of the entire index—so price movements of these stocks dramatically impact the S&P 500 total level.

So, while we are thankful for the market rally, we are also concerned that the rally is very narrow and concentrated in a handful of tech companies. A healthier economy should bring a healthier and broader rally—and we will have to have a healthier world to see that happen too…we are hopefully vaccine trials across the world will be successful at some point soon.

But for now, you know…the rest of the story.