Saving Isn’t So Scary

2020 has proven to be the year almost everyone will be happy to see go as the clock nears midnight on Dec 31st. Although the issues we have been battling globally and as a country have been particularly severe this year, I feel as though that is a recurring theme — at the end of every year most people have the sentiment that they are ready to start fresh in the new year and end almost every year with “good riddance, cheers to new beginnings”.

I will say, with Halloween around the corner, people are having a good sense of humor with how “scary” 2020 has been so far.

Jokes aside, I think we can all agree, this has been a pretty scary year.

However, as we have been working on end of year planning and preliminary planning for 2021 with our clients, I can’t help but notice great planning opportunities available despite the major life changes we have all gone through over the last few months.

For those who have remained fully employed throughout the pandemic, there may have been the opportunity to temporarily increase savings rates due to the reduction of spending on discretionary activities / going out to eat, vacations. Also, the influx of refinancing has skyrocketed over the past few months which in turn has dropped mortgage rates to record lows and has provided additional monthly cash to those who have refinanced to a substantially lower rate. The scenario I have found particularly interesting are those individuals who found themselves unemployed due to Covid or made the decision not to return to work and have in turn started their own business or side “gig”. This can be a relieving and exciting step for some and a scary step for others. From a savings perspective, being self-employed does not mean giving up saving for retirement and even investing a little bit every month can make a huge difference.

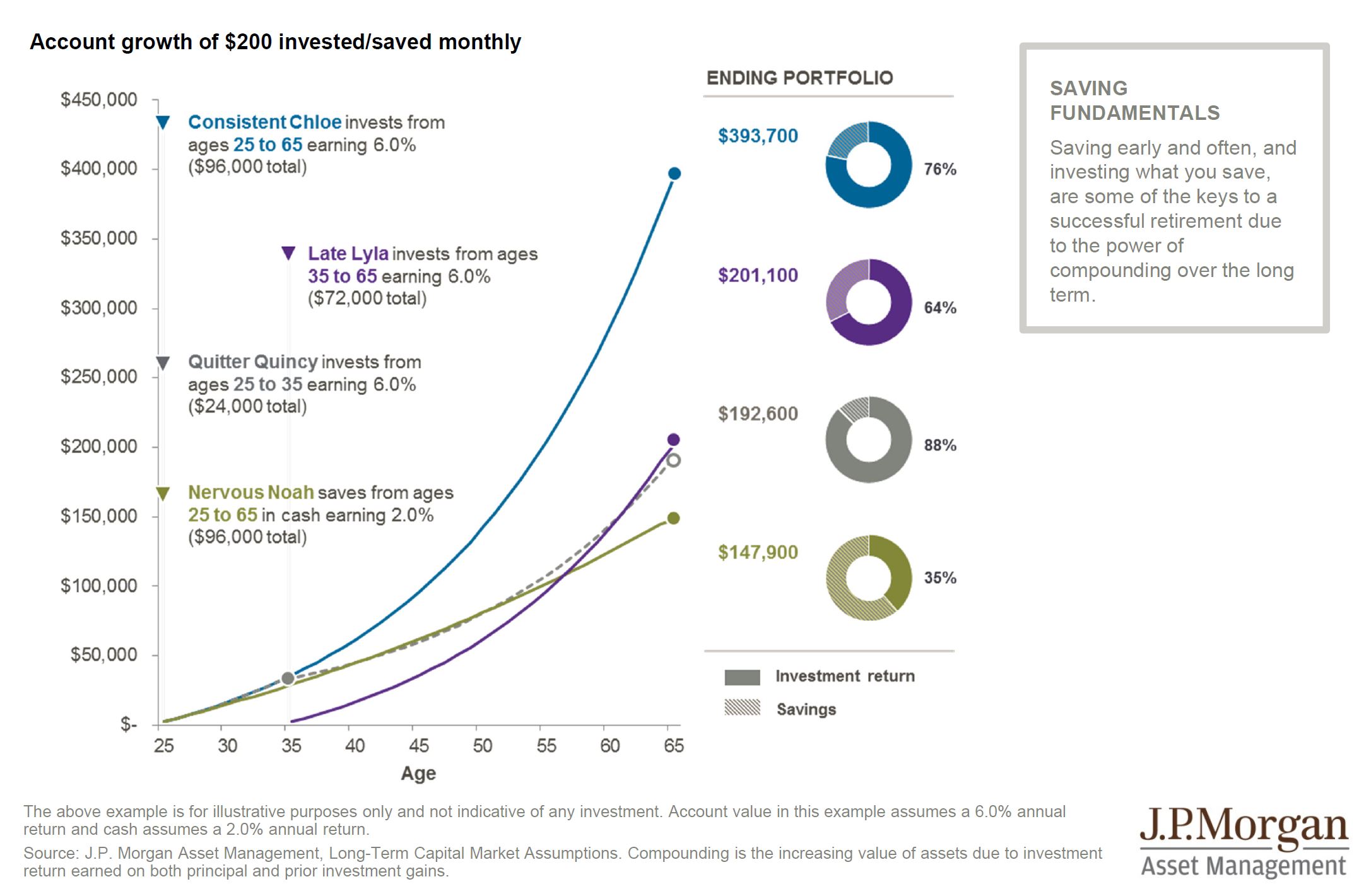

The below chart outlines the benefits of frequent and early investing, proving that every lit bit helps.

To further incentivize small business owners to save for retirement the SECURE act of 2019 provides tax credits up to $5,000 to small business owners to establish a qualified retirement plan, SEP, or SIMPLE.

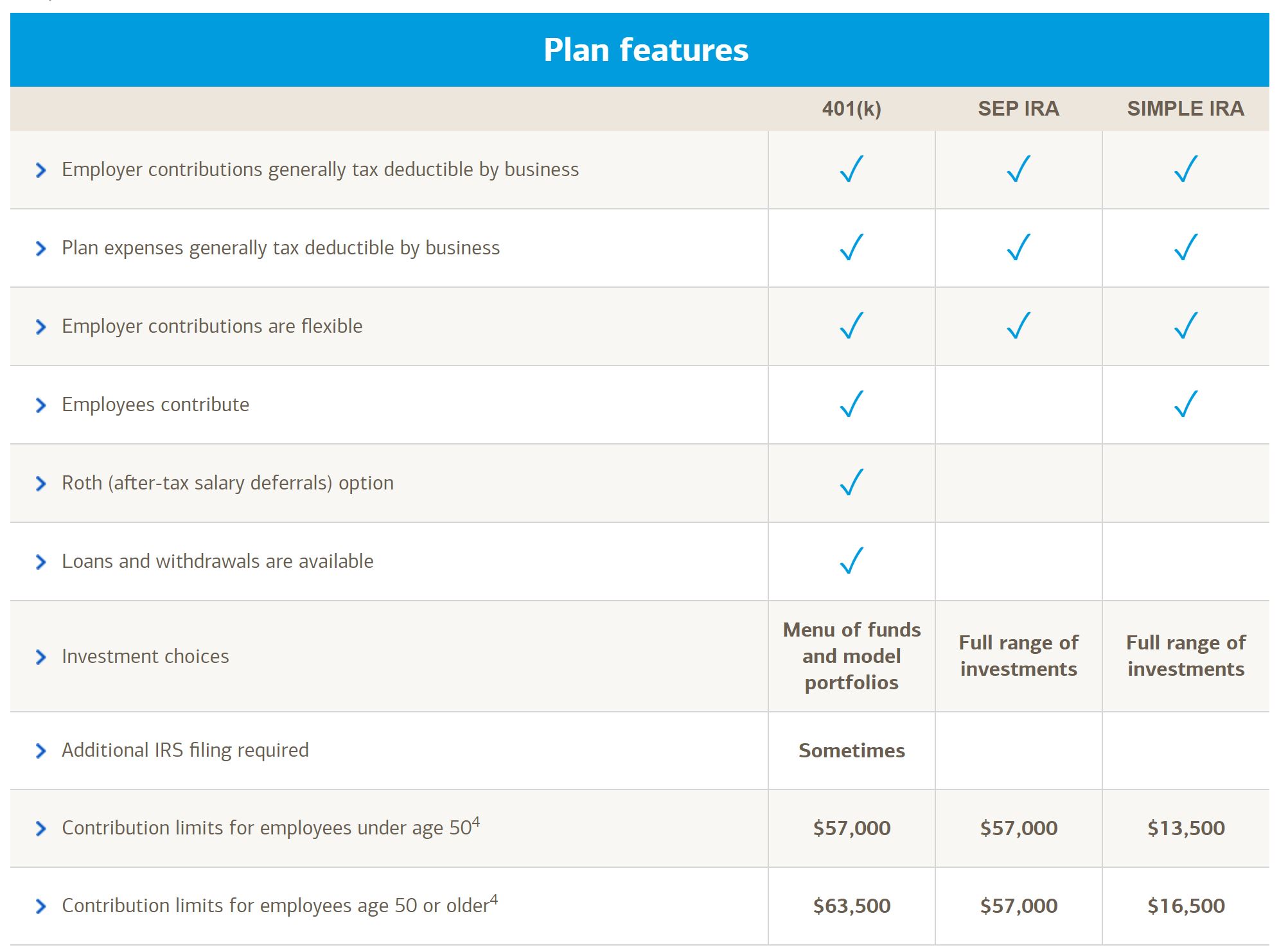

There are several options for self-employed individuals / small business owners to contribute to retirement with each having its own requirements and benefits based on what the employer is looking to accomplish. The below chart is a cliff notes version 😊.

Outside of a 401k, which most employees and employers are familiar with the most common small business plans are SEPs and SIMPLE IRAs due to the ease of setting them up, low maintenance costs, and no requirement for IRS reporting. While solo 401ks are certainly an option for small business owners, the cost of administration and maintenance, as well as less flexibility usually makes them a less popular choice than the SEPs and SIMPLE IRAs.

When choosing a retirement plan for your small business there are a few things to keep in mind.

Savings Incentive Match PLan for Employees (SIMPLE) IRA

- Less than 100 employees

- Allows for employee contributions

- Employer contributions match up to 3% or provide a 2% non-elective contribution to all employees. ** Contributions are required as long as employees are eligible. Employer contributions are deductible.

- Maximum employee deferral of up to 100% of compensation or maximum of $13,500 plus a $3,000 additional deferral for 50 and older. Employee contributions effectively reduce their taxable income.

- Might be ideal for sole business owners who are under a certain compensation limit as they might be able to contribute a higher % of compensation compared to other small business plans

Simplified Employee Pension (SEP) IRA

- Typically used by sole business owners.

- Only discretionary employer contributions that can change based on cash flows.

- Employer contributions up to 25% of compensation of a maximum of $57,000. ** Business owners are allowed a maximum contribution of 20% of their compensation (calculated as income minus ½ self employment tax multiplied by 20%)

- Might be ideal for a small business that is expecting to have uneven and / or increasing cash flow over the years.

A new small business owner may consider the benefits of each of the above which provide for deductibility, use of the SECURE Act credit, and retirement funding vehicle that provides for higher contribution limits than a traditional IRA / Roth IRA. Of course there is not a one fits all solution and each business and business owner will have their own desires, requirements, and factors that affect which investment strategy works best for them / their employees.

2020 might leave us all feeling a little bit like my son after his big sister helped during bath time (see below), but hopefully Meridian can help our clients find the opportunities to help make lemonade out of lemons and make saving for the future less scary.