Risk On

Irrational investor behavior is nothing new, but as Sarah Yakel pointed out in her blog last week, the sheer volume of data (both good and bad) and wanna-be-stock analysts has increased dramatically in recent years. Some have made headlines touting huge short-term gains, but most “average” investors often get burned by getting caught up in investment fads.

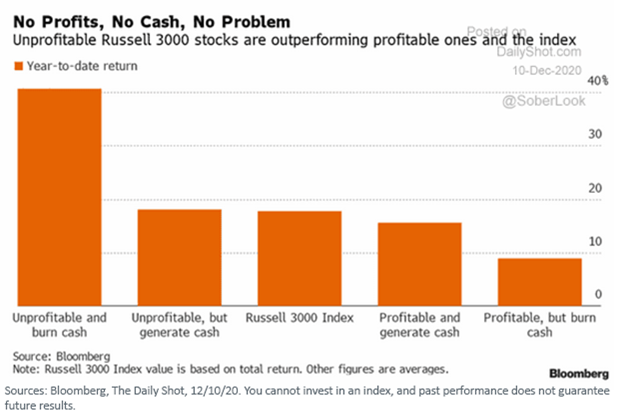

Through the end of 2020, the best performing stocks were actually unprofitable (aka did not make money) and burned through their cash reserves. Yes, one might argue that they are investing in the companies’ potential future profits, but it is hard to believe that this is sustainable trend over the long term.

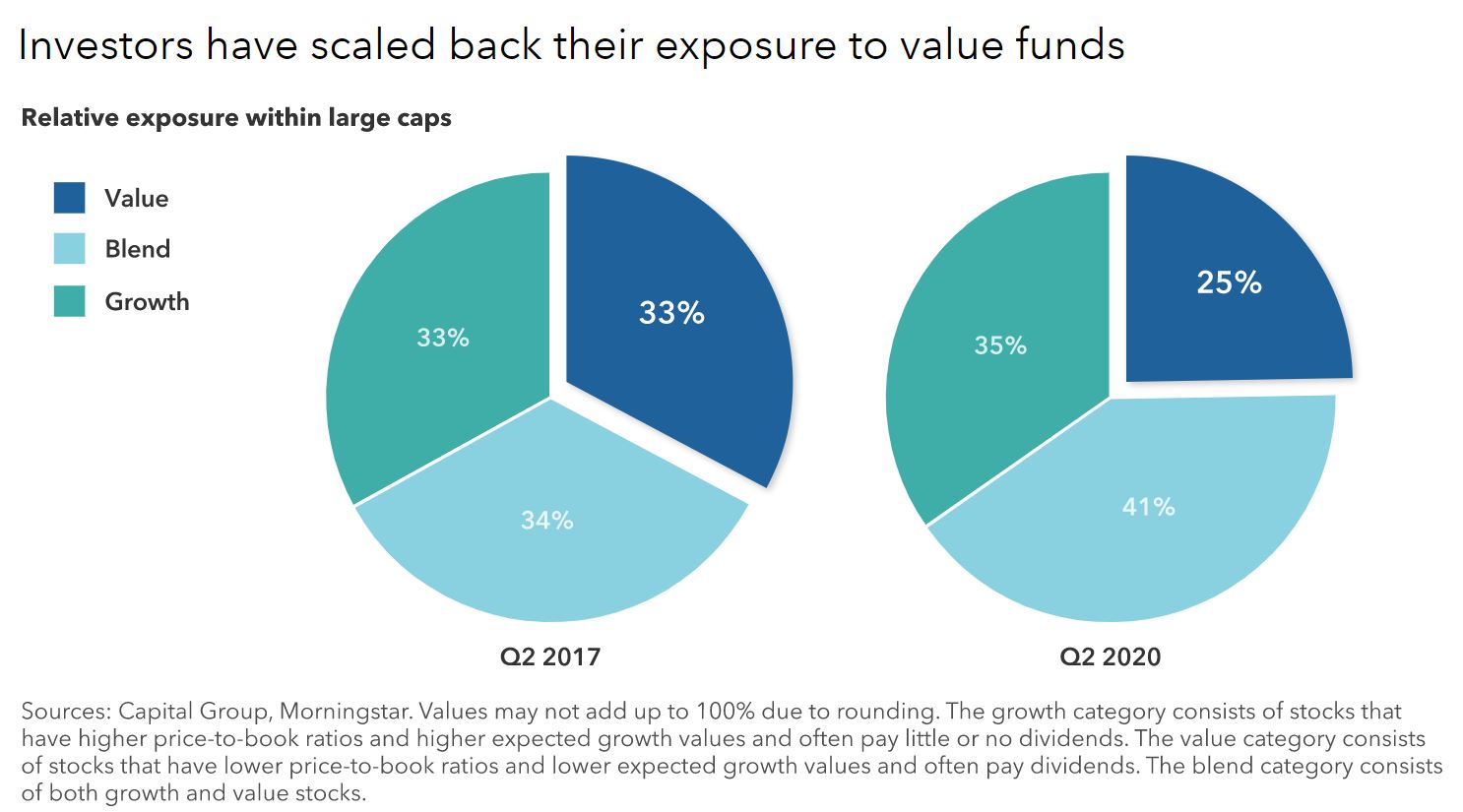

Unsurprisingly, investors as a whole have adjusted their portfolios (willingly or unwillingly) to be more growth focused. In my mind, this is a classic example of chasing returns; the idea that what performed best in 2020 will also perform best in 2021. This is almost never the case.

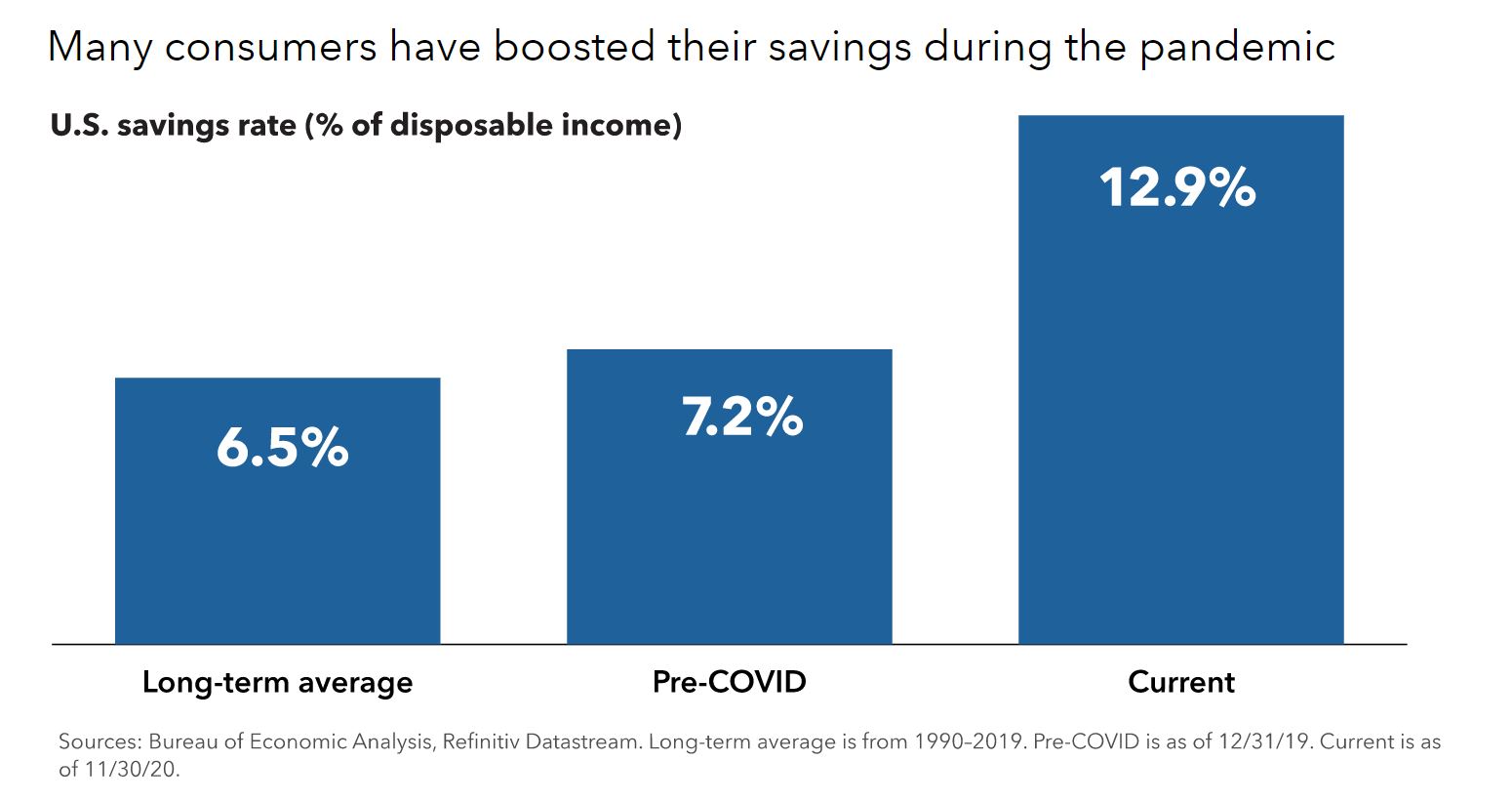

There is increasing evidence that the trend of growth stocks outperforming value stocks is getting ready to reverse. Many industries (outside of the tech sector) have a long way to go to get back to pre-COVID levels. Additionally, the US savings rate has increased substantially during the pandemic, and that may point to increased spending on things that had been placed on hold.

From Lisa Thompson, Equity Portfolio Manager at Capital Group: “Once there’s an all-clear, I expect the desire to travel plus the ability for many consumers to spend means we could see a powerful recovery, even if it takes a few years. This crisis is much different than the global financial crisis in 2008 or any of the other crises I’ve seen in my career. Today, looser fiscal policy, looser monetary policy, a very strong banking system and high person savings rates could help drive a very sharp pickup in demand.”

In short, some investment professionals think there might be a return to “safety” when it comes to the next best performing asset class. Generally, that means stocks that pay dividends and higher quality bonds. How do you put this into action? The easiest way may be to just rebalance your portfolio. Undoubtedly, if you haven’t done that in a while, you are overexposed to growth stocks just because of the recent outperformance of those types of companies. Sell some of what has gone up and buy some of what has gone down. And, for my broken record comment, make sure your investment mix fits with your overall financial plan.

Safety and prudence are also important when it comes to raising your children. Our son is into hockey (maybe not the safest sport!) and recently convinced one of his sisters to get the goalie pads on for some basement practice. Based on her stance and form in the below pic, I don’t think it was too tough for him to score!