Information Overload

Investing has been front and center this past month with the ongoing Reddit/GameStop/Robinhood saga all over the news:

In a Yahoo Finance poll, 28% of investors polled admitted to buying one of the stocks in the news—AMC was the most purchased stock, with 10% of polled investors buying shares in January:

You even have Shark Tank’s Mr. Wonderful himself, Kevin O’Leary, jumping into picking investments based on Reddit’s WallStreetBets.

While we are certainly happy to see Americans excited about investing, it makes us very sad to see a large majority of American investors acting on stock tips from “Roaring Kitty”.

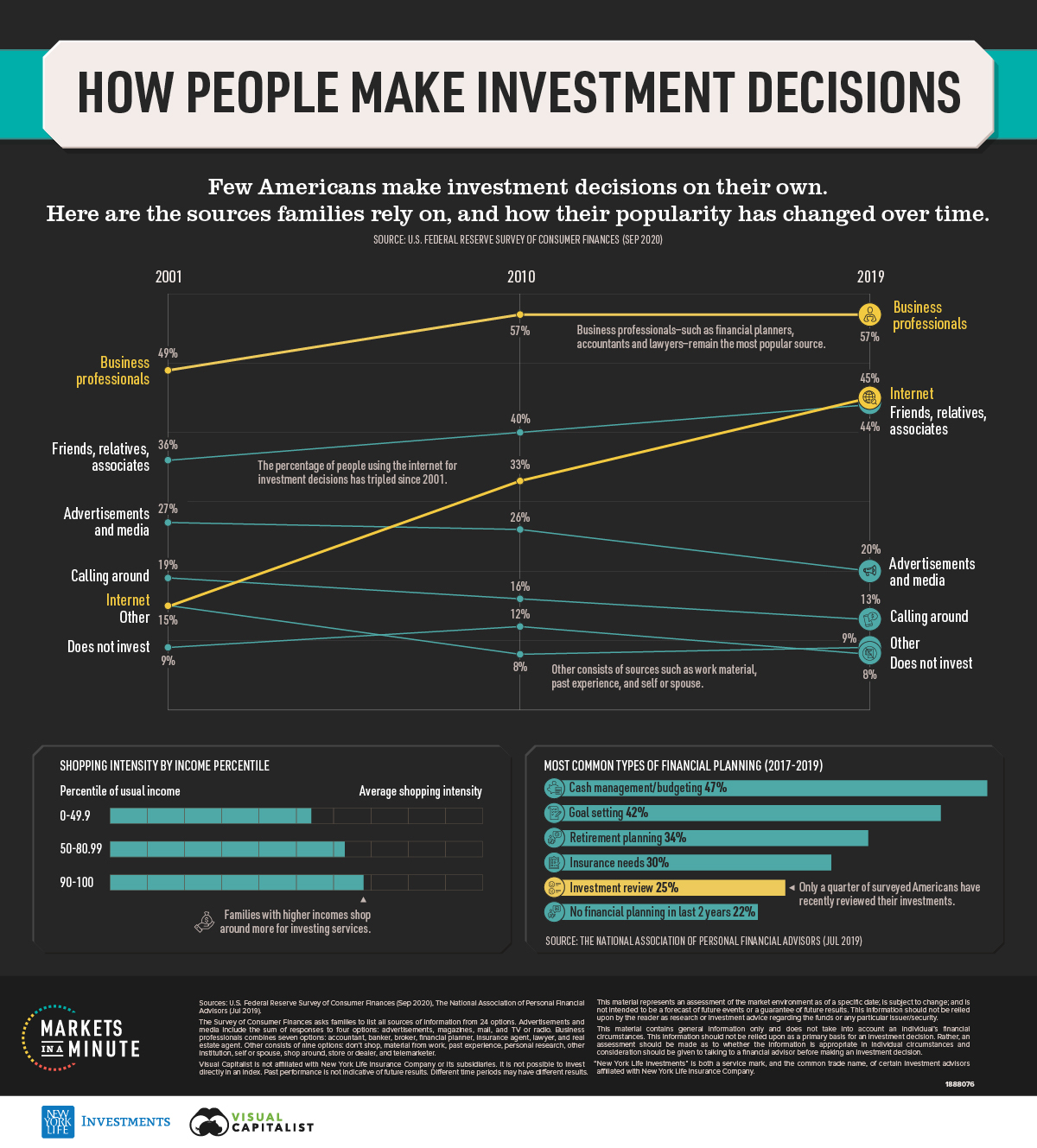

Visual Capitalist had an interesting infographic on how people make investment decisions:

Thankfully, investment advisors are hanging pretty steady at 57%, but the percentage of investors who use the internet to make investment decisions has tripled over the past 20 years.

While the internet does have vast amounts of useful and productive investment information, it can also be a giant wasteland of random, bizarre, or incorrect information. In a survey by Brunswick, search engines provide the majority of investment information to investors, but some of the information sources are a bit shocking (WeChat? Wikipedia? Eek.)

At Meridian, we use internet research to form our investment decisions too…but we start from a base of Nobel prize winning research…starting with concepts like:

- Eugene Fama’s efficient market hypothesis

- Harry Markowitz and William Sharpe’s modern portfolio theory

- Robert Shiller’s forecasting models

- Richard Thaler’s behavioral economics

- Daniel Kahneman’s prospect theory

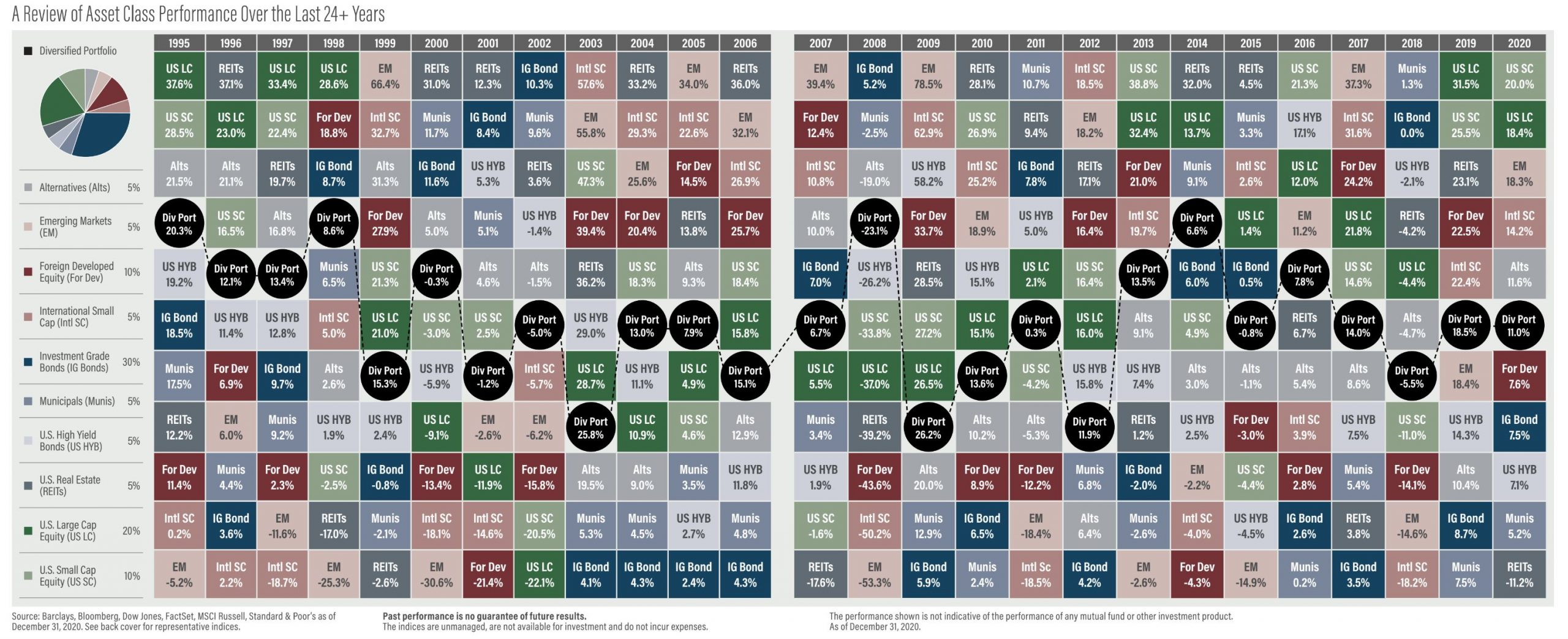

From there, we use industry research that stretches across many historical market periods, to help us develop portfolios that we think are rational, but that will also hold up well during irrational periods. We incorporate correlation research and long term risk/reward attributes to build diversified portfolios, similar to this one:

And while diversification means a portfolio will never be at the top of the performance list, it also guarantees that a portfolio will never be the biggest loser. Historically, taking on less risk of catastrophic loss has allowed diversified portfolios to lose less in down markets, recover sooner, and end up in a similar place as riskier investments:

So, while the internet is certainly a wonderful place to learn about investing, having a professional help you navigate the vast landscape of information can be valuable too!