Teach Them Well

Four year olds are intrinsically curious which means they tend to ask a lot of questions…. About everything…. All the time. As tiresome as it can be, it is an incredible trait of children and a characteristic that most teenagers and adults grow out of. The favorite word in the Irving household right now is “why”, so as a parent I’ve decided to take advantage of this inquisitiveness and start teaching some basic financial concepts to our daughter. While she is not quite ready to be investing in “stonks” on her own like Sarah Yakel’s son Ben, I know we can still provide tools to cultivate a healthy relationship with finances and money that can be done at any stage of life.

Finances and money can understandably be a very personal and sensitive subject to talk about between parents and children but the research on early (or rather any!) financial education and the impact on future financial decisions is compelling. Even more impactful though is the ability for children both young and grown to understand their emotions around money.

Early on:

Personally, we are at the phase that our daughter is now realizing that food, toys, and clothes don’t just appear out of thin air — someone has to pay for them. Integrating the value of money into every day life and demonstrating what the value of a dollar can buy, where that money is coming from, how it’s deposited into a bank account, and how the money we spend gets taken out, particularly in a day and age where everything is put onto a card or bought online.

My kids always surprise me when I let them make their own choices and the same can be said about money they have earned. Providing guidance on how to make decisions about their money in the future can be accomplished through a strategy of having their child divide their allowance money between spend, save, and give jars. I’ve even heard of some parents taking it to the next step and taking some money for back for “taxes”! Guiding them through the process of deciding where money should go, what is important to them, and how to save up for things that are important to them helps with money decision making down the road.

Chae earning his “allowance” aka Cheerios.

As they continue to grow:

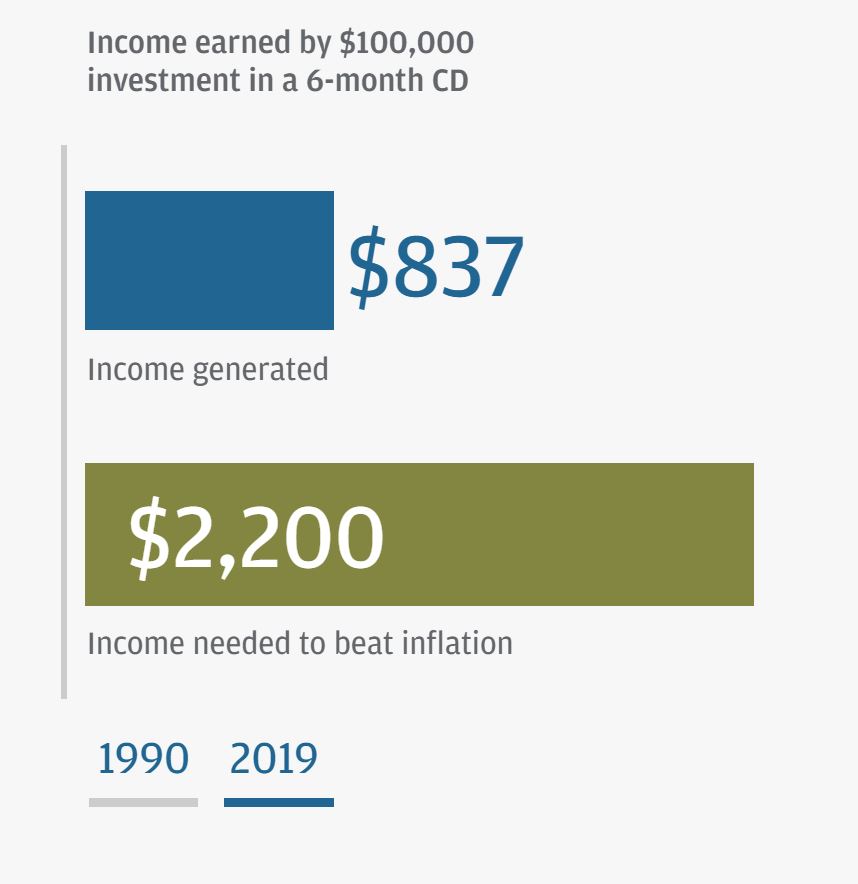

Teaching the basics of investing either through a custodial account or through an app can not only demonstrate the power of investing, but it can help children understand the management of emotions around investing and the power of “staying the course”. Also demonstrating what the long-term difference is in keeping money as cash versus investing it. While the concept of inflation can be a harder one for younger kids to wrap their head around, showing them that prices of goods and services increase over time may be a good start to demonstrating the power of investing extra cash to meet those increasing costs.

As an example, the below image demonstrates the power of investing to keep up with the costs of inflation.

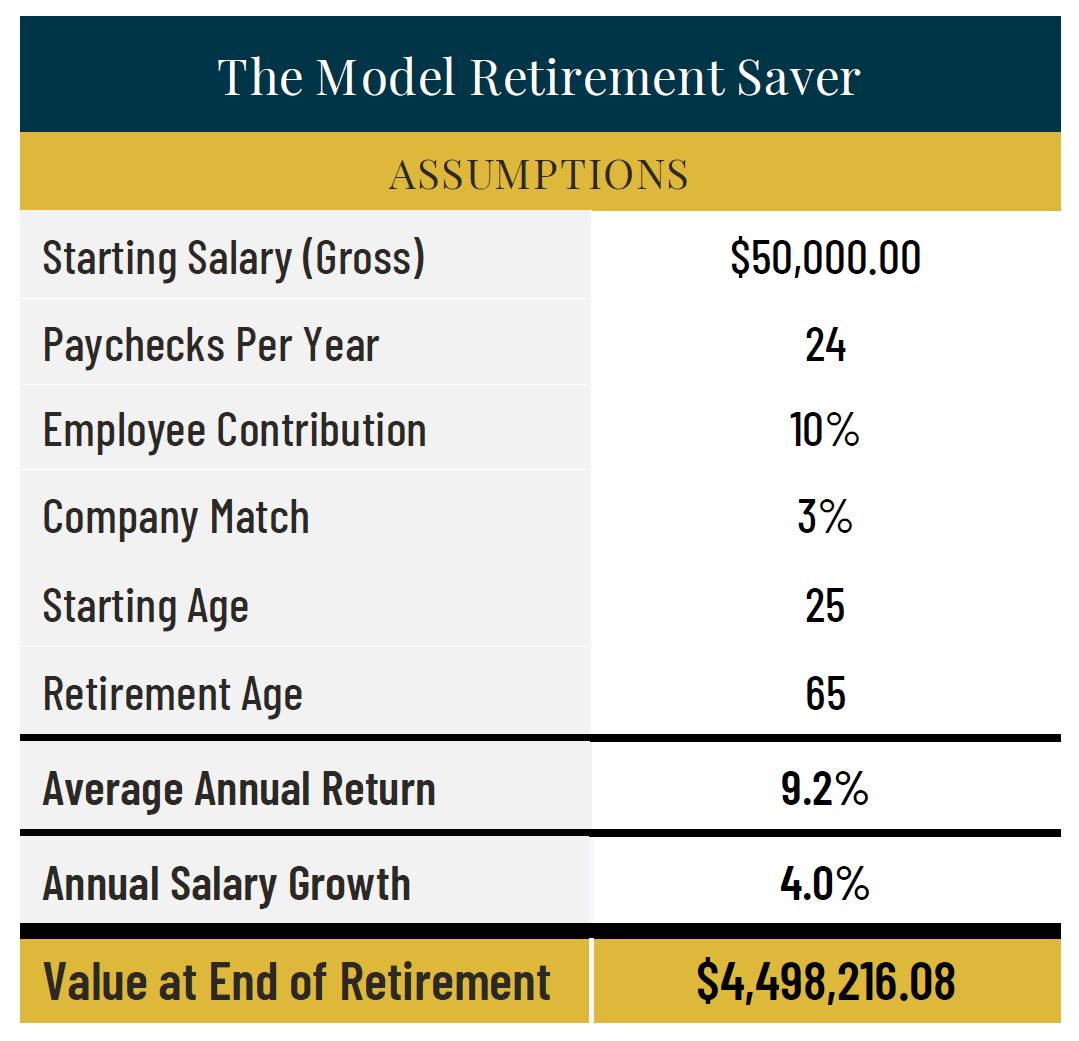

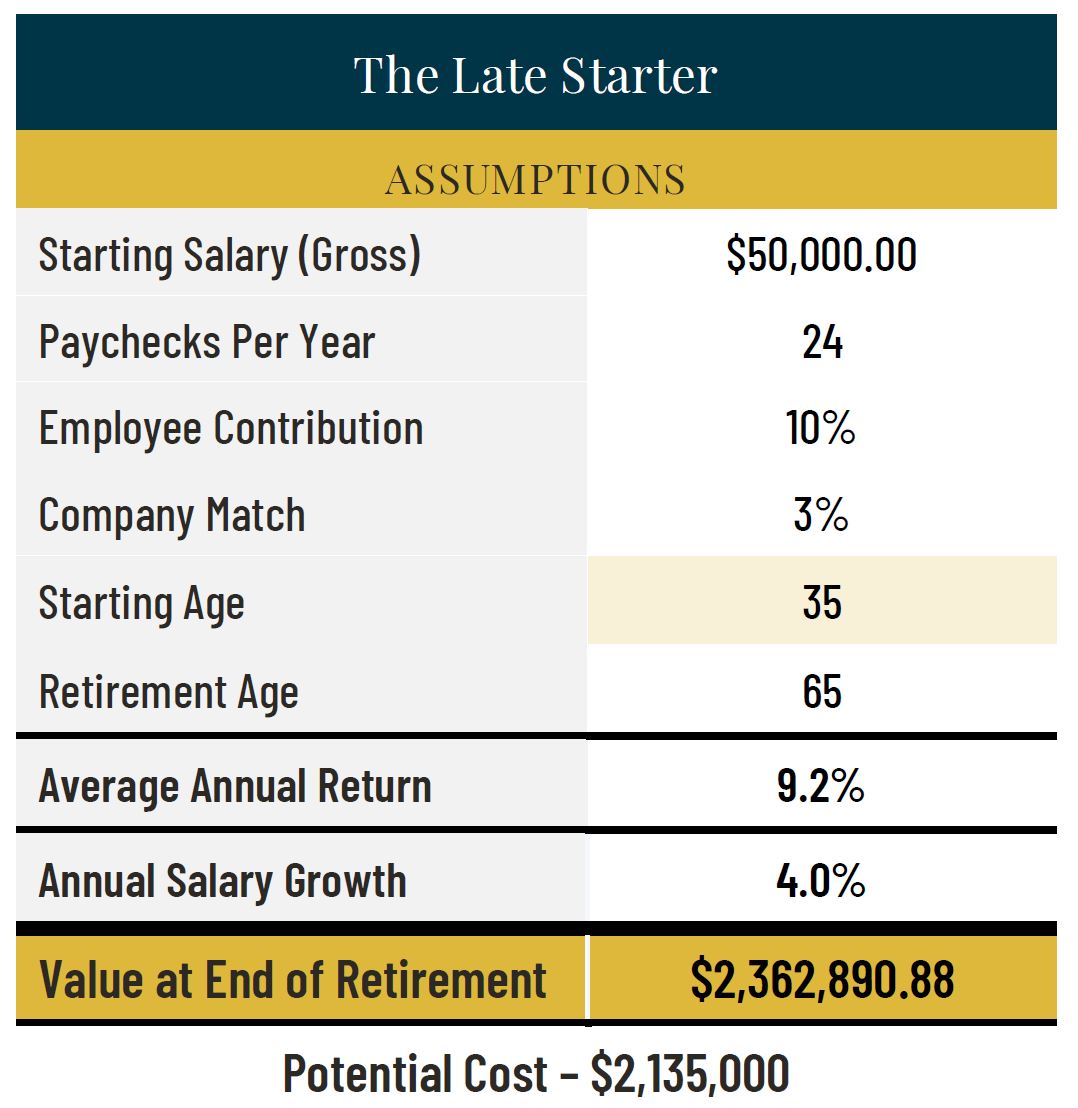

Once kids have a summer or after school job, helping kids develop a budget and utilize their paychecks to help fund these future and current needs, wants, and goals. As soon as a child has earned income, they are eligible to contribute to a Roth IRA if 18 or older or a Custodial Roth IRA if they under the age of 18. Demonstrating to children the power of early saving and the enormous difference it makes the earlier you do it hopefully encourages younger generations to take advantage of employer sponsored benefits.

When they are “grown”:

Many big financial life events tend to occur in the accumulation phase of life such as buying a first home, starting a family, changing jobs, etc. From our experience, this is when there tends to be a lot of questions and opportunities for good decisions to be made. This might be the time to guide them in the direction of a trusted advisor and / or financial planner who can help them create some guideposts to meet these big-ticket goals and help make good lasting financial decisions.

Continue the encouragement of saving and investing even when things get rocky in the markets and throughout life. This is the time for them to become familiar with the basic investment concepts of diversification, risk tolerance, time horizon, and how those play into their overall financial plans.

To borrow a quote from an article from Barron’s “Here’s the thing: regardless of whether your child is 3 years old and buying something with her own money for the first time, or 23 and paying her own rent, there’s tremendous value in financial independence.”

Whether you are a parent or a grandparent, providing little nuggets of encouragement, guidance, and advice as children go through life does make a difference and something that will last with them forever.

Speaking of things that will last forever, I can say without a doubt, I am keeping this note I got from my daughter’s teachers forever — if she thinks I am embarrassing now, she is in for a big surprise in about 10 years!