Fresh Start

With this week’s last gasp of winter temperatures, we are hopeful that Spring is finally here. Trees are flowering, daffodils are up, and at the Yakel house, we are just waiting for final frost danger before putting all of these healthy guys to bed:

And, we met new puppies!!

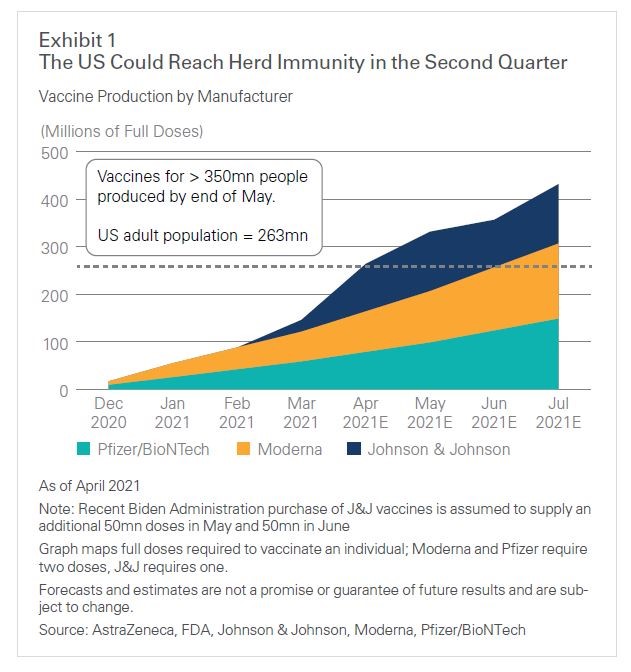

The US economy is starting fresh too—with encouraging news on the vaccine front, hope and optimism of returning to ‘normal’ is pervading the market.

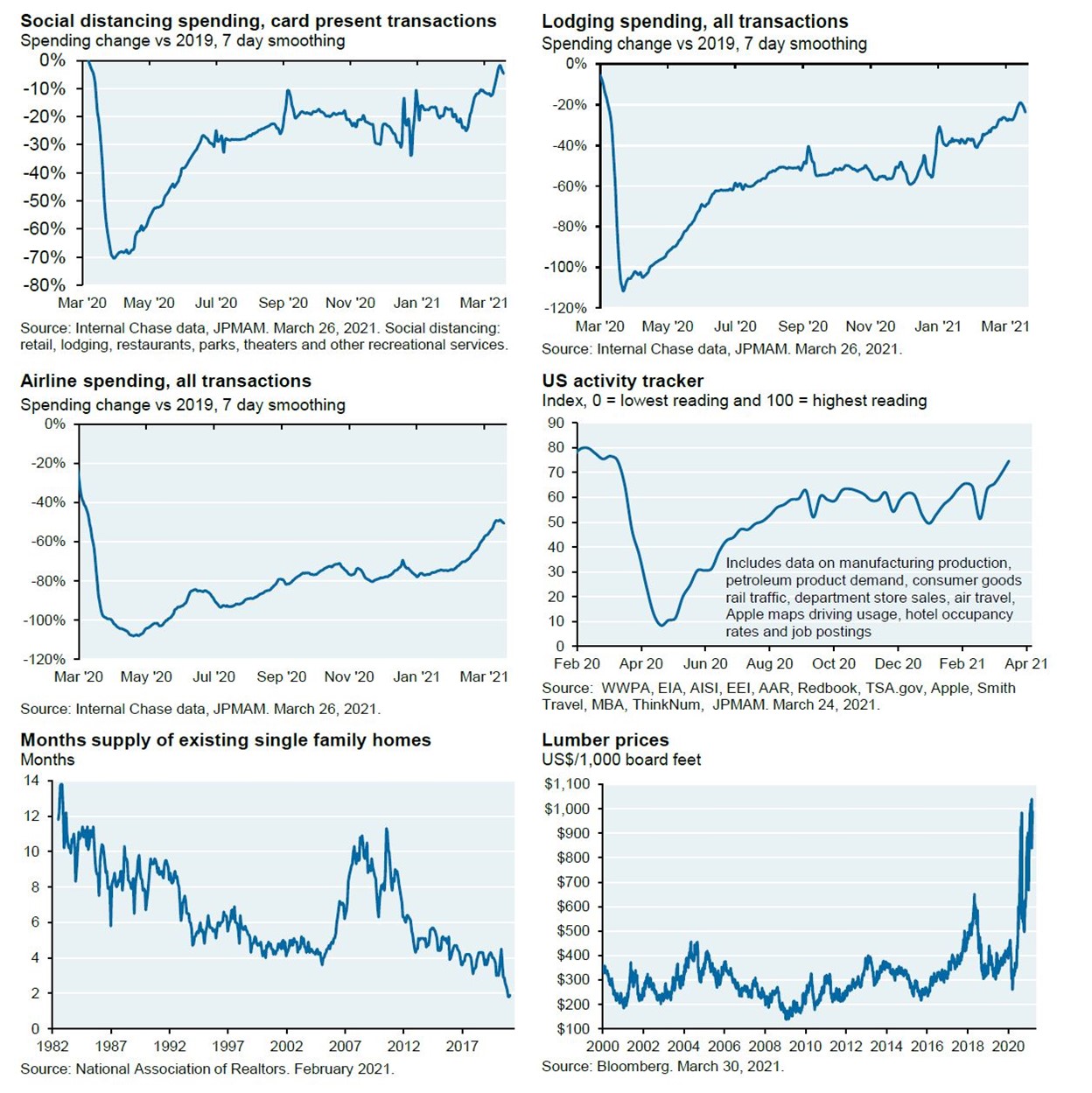

Signs of activity and movement are picking up:

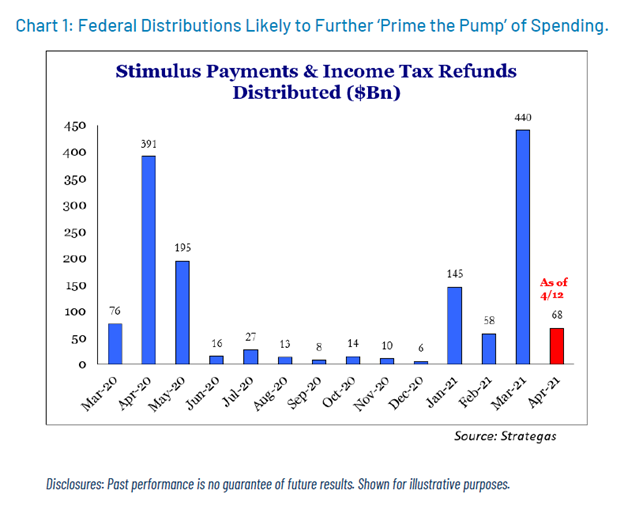

And tax refunds and stimulus payments are hitting people’s checking accounts:

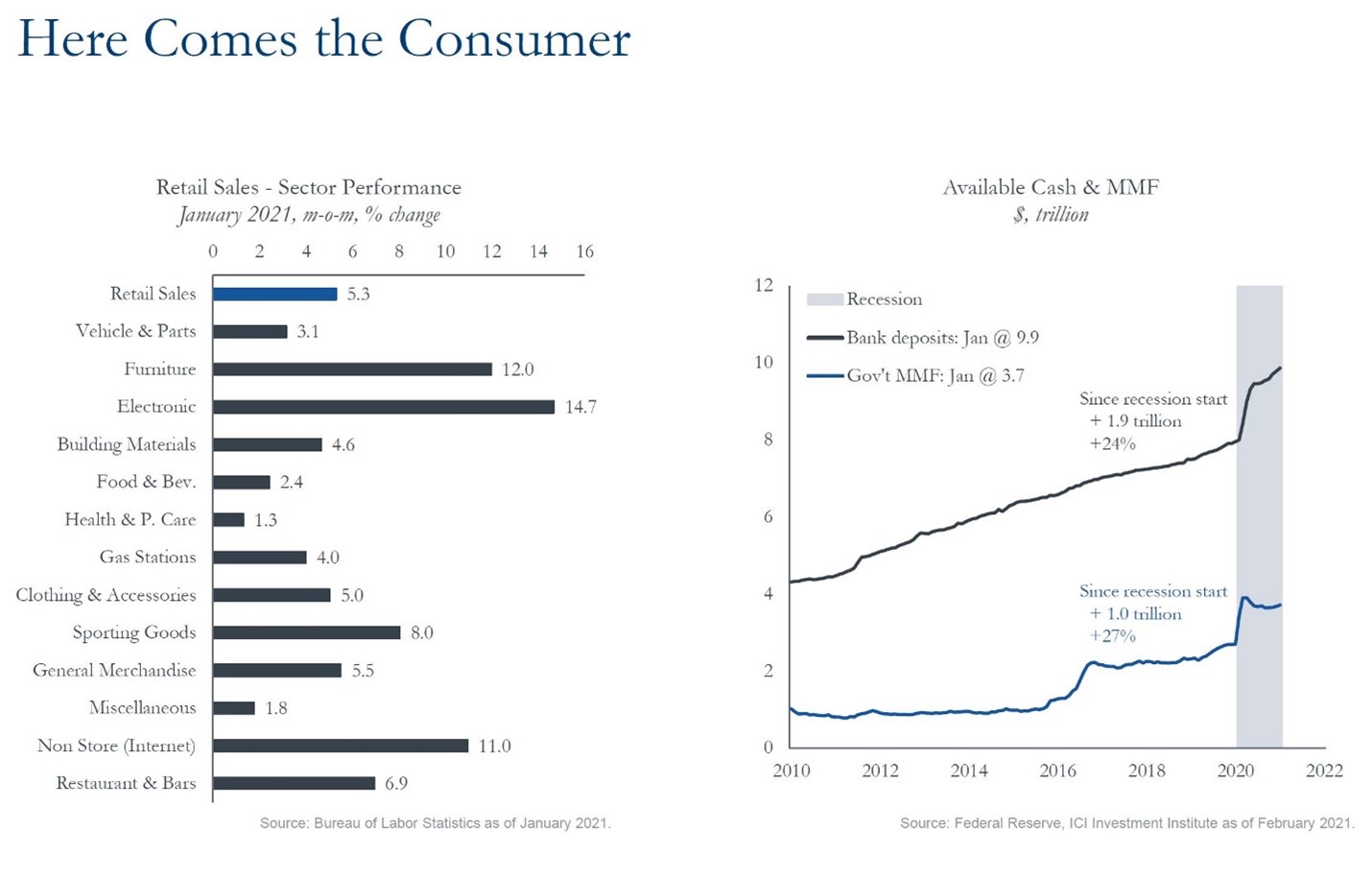

People are starting to unleash lockdown savings on all sorts of things:

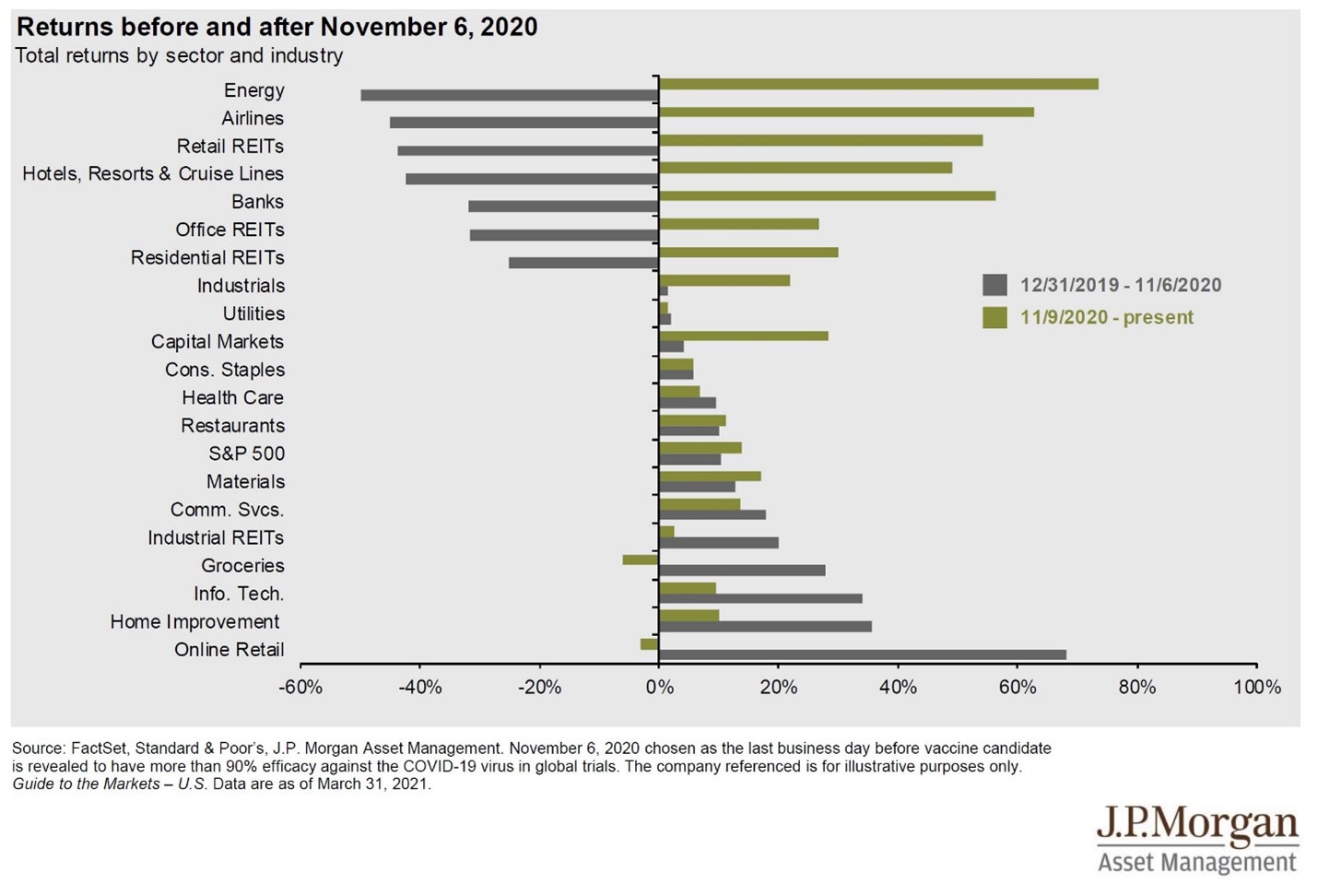

And the stock market darlings of the past five months are the ones that have the most to gain with a reopening economy:

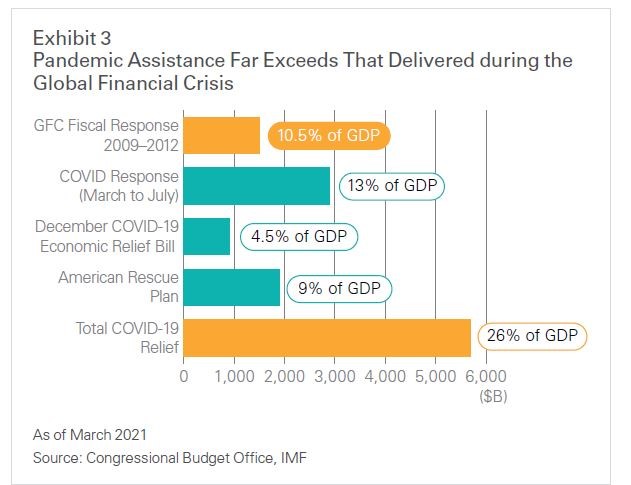

This optimism paired with unprecedented government stimulus (proposals total 25% of our total Gross Domestic Product!) has been a powerful market force.

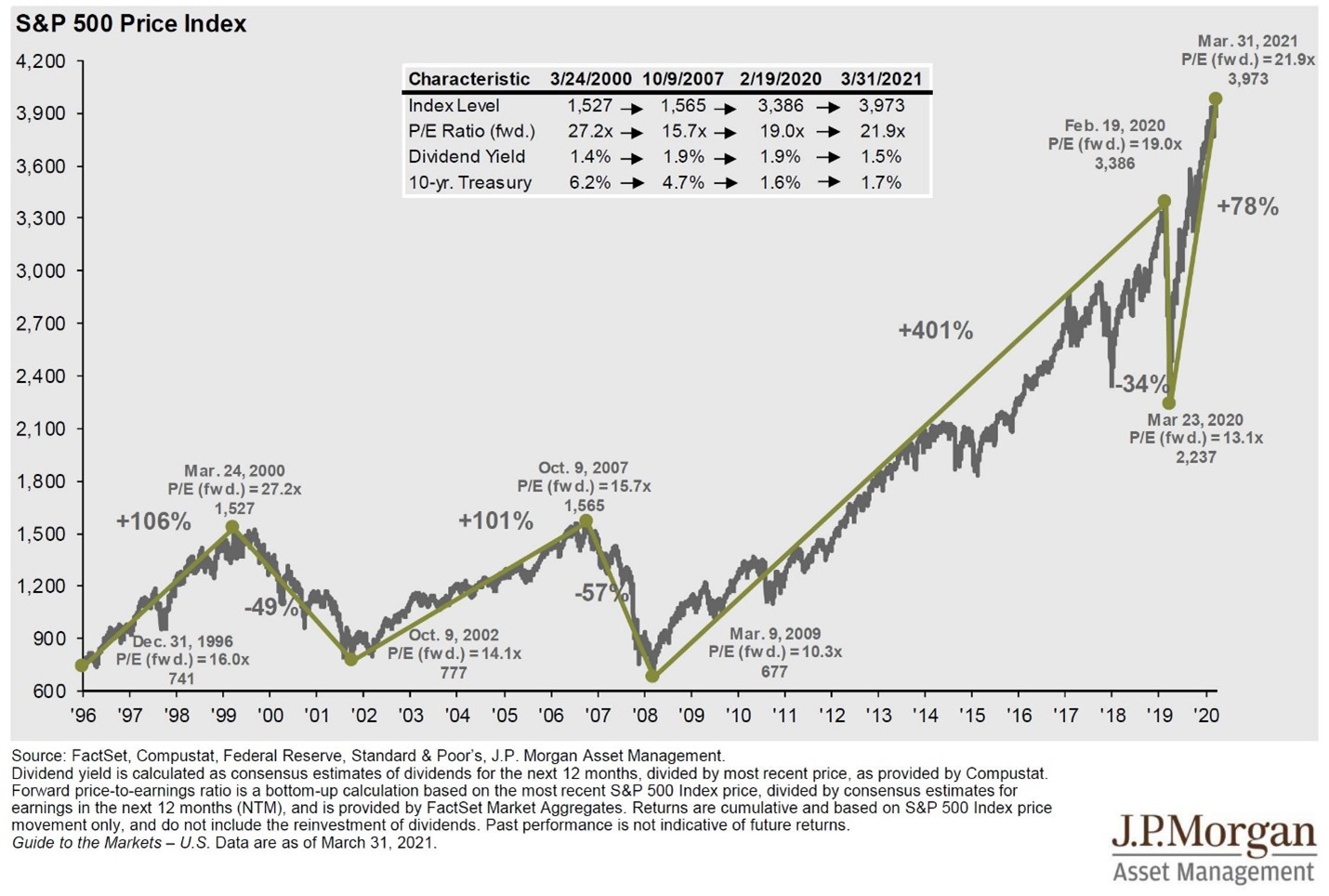

Since this time last year, the S&P 500 is up 78% and has soared past 4,000 in recent days.

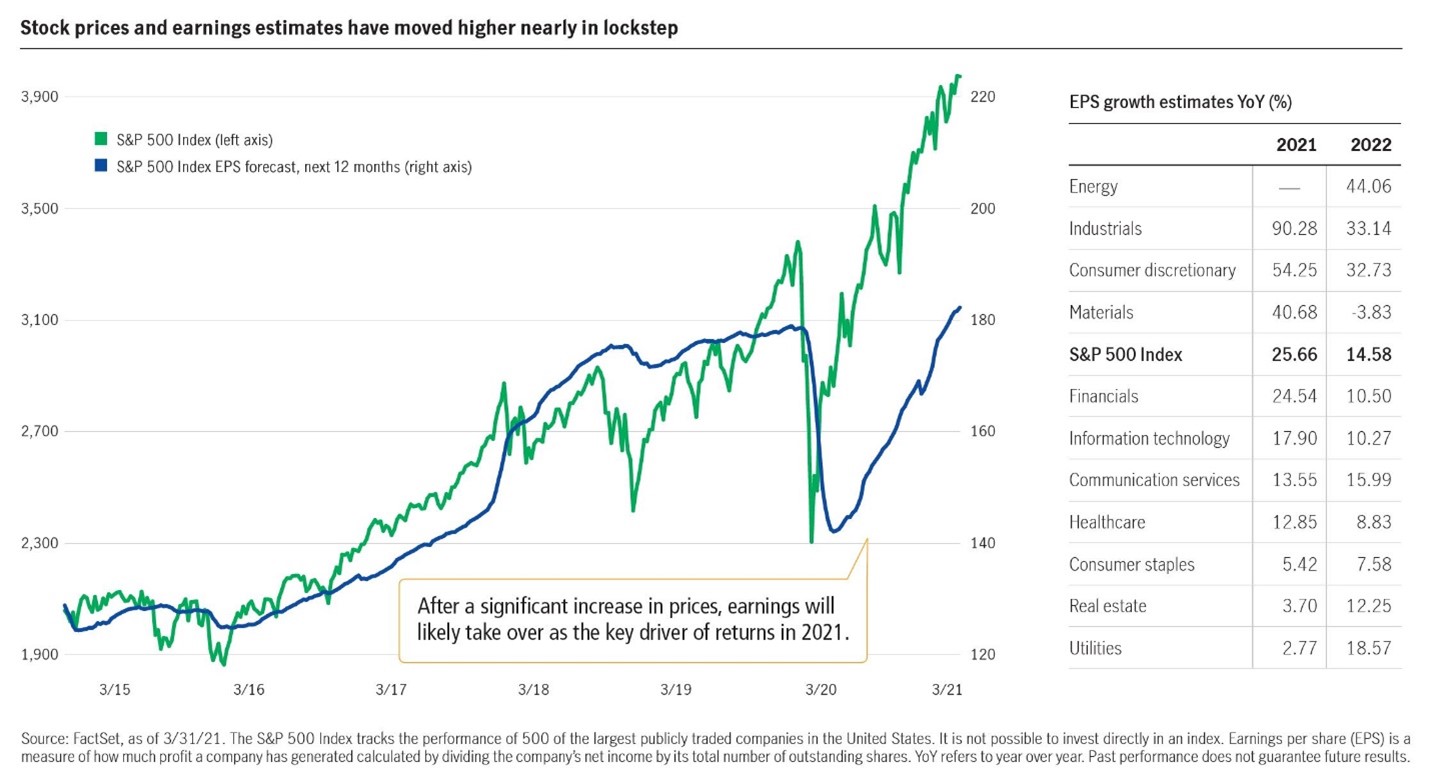

We are glad to see a broader recovery across the market (as opposed to the tech giants propping up the entire market as they did last year). But it remains to be seen how this massive government stimulus and waves of consumer demand. Inflation fears have begun to surface (case in point being lumber prices soaring 180% since last April), but as supply chains are ironed out, the general consensus is that inflation may be short lived and not systemic.

This Spring is a great time to be an investor, yet it is shaping up to be a difficult season with many cross currents to navigate. We hope to see unemployment continue to fall as Americans can safely get back to work, and we look for earnings to catch up with the big price expectations set by market participants.

Happy Spring!