Cryptocurrency and Speculation: A Case of FOMO?

At Meridian, we’ve been trying to not wade into the cryptocurrency debate—as any skepticism can illicit firestorms of angry mail from crypto fans. But, with cryptocurrencies back in the headlines throughout 2020 and into 2021, it has attracted a lot of attention from investors.

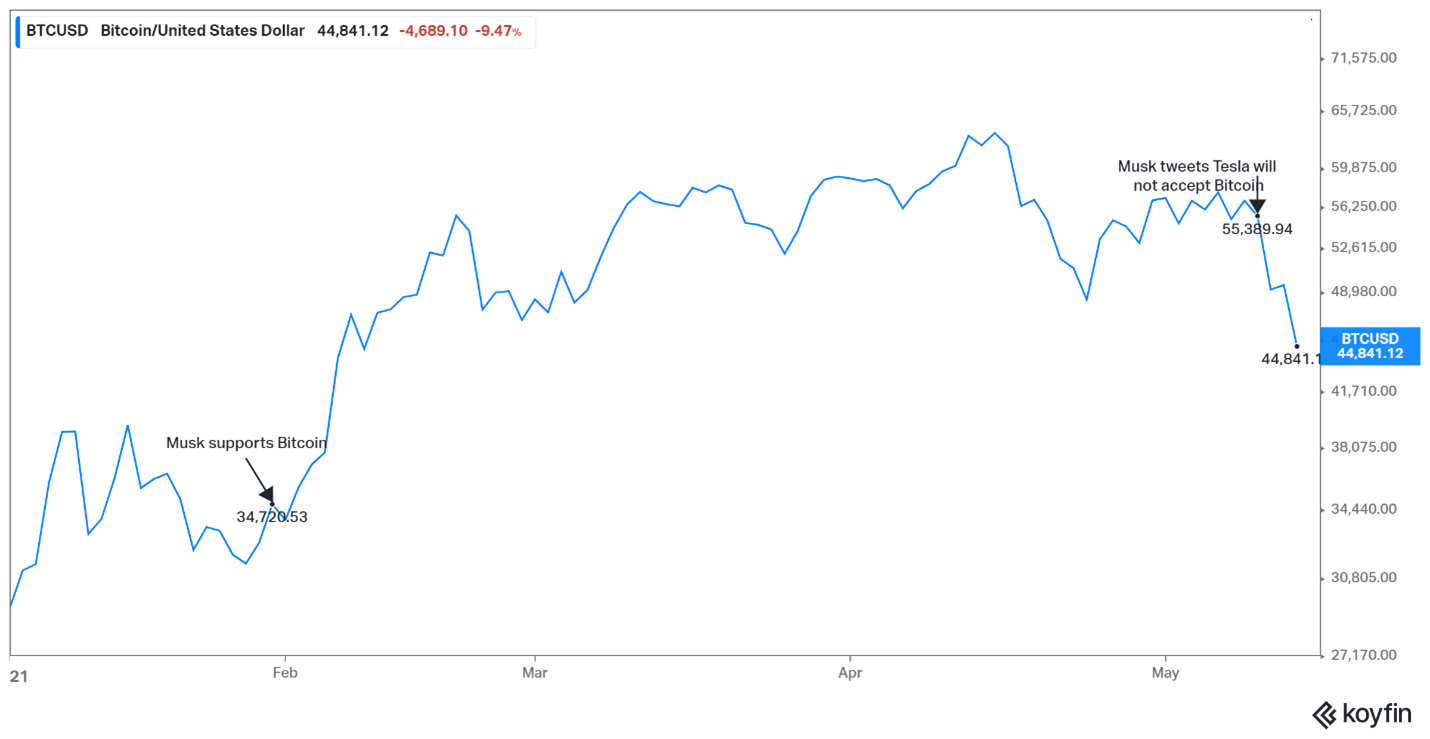

Recently, Tesla CEO Elon Musk tweeted support for Bitcoin–and then quickly withdrew it–causing a whipsaw in Bitcoin’s price:

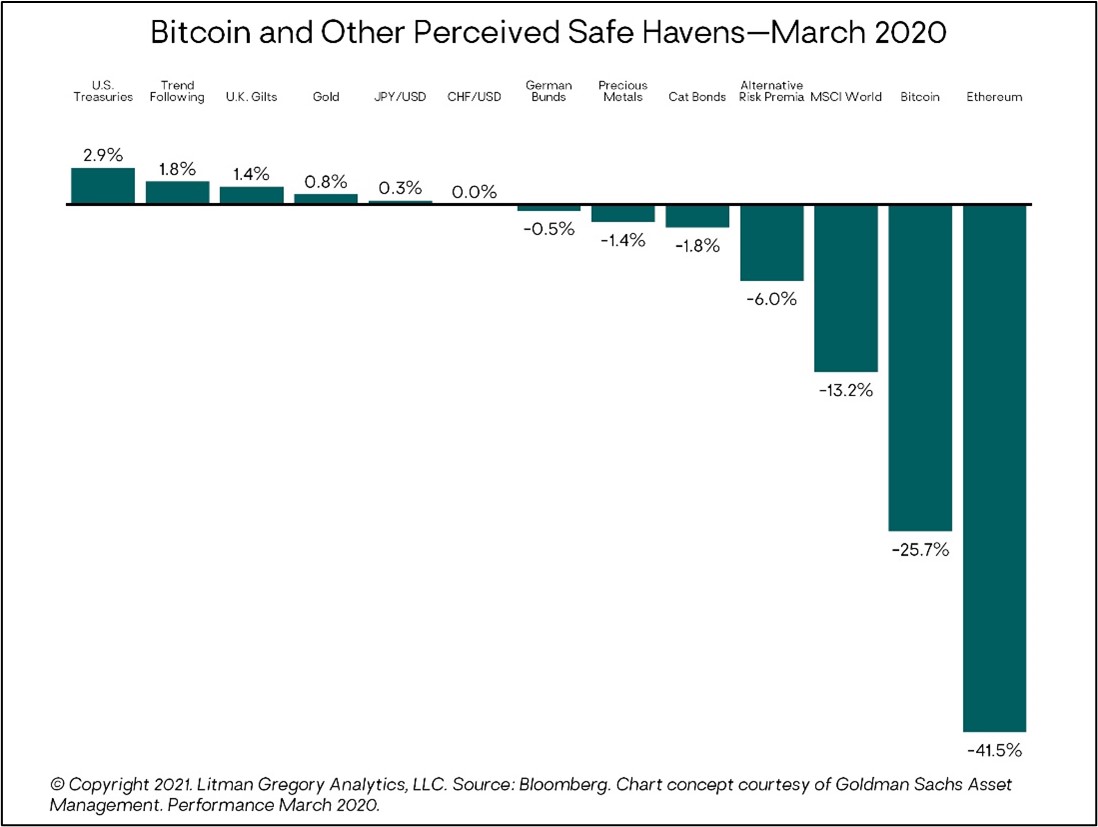

In times like these, with growing concerns about potential U.S. dollar devaluation and increasing inflation, investors often turn their eye to alternative options for hedging these risks. Given that cryptocurrencies are gaining broader acceptance, it is not surprising to see some investors considering whether they deserve a place in long term investment portfolios. So, where do cryptocurrencies fit in?

For clients concerned about a falling U.S. dollar or inflation, we believe our current approach to protecting against those risks (diversification, scenario planning) is both more effective and reliable. For context, our investment framework revolves around a fundamental approach to building globally diversified portfolios across asset classes, each serving a distinct role in the portfolio (some targeting the aforementioned risks):

- Global stocks provide a source of long-term growth (and some inflation protection) and U.S. dollar devaluation protection (from exposure to non-U.S. stocks).

- High-quality fixed-income can provide protection during periods of equity market stress and deflation.

- Hybrid investments like flexible bond strategies and floating-rate loans exhibit qualities of the first two: some capital appreciation potential (and some potential inflation protection) but with less short-term downside than stocks.

- Alternative strategies and assets can provide diversified sources of return and protection to reduce a portfolio’s overall volatility (there are also tactical options available to us in this category if we feel the need for greater protection against unexpected inflation).

As fundamental investors, we invest in assets that we can reasonably value; that offer transparency and defined liquidity; and finally, that we can be confident are subject to a reasonable amount of regulatory oversight and legal protection to minimize the risk of price manipulation. We have a very difficult time applying any of these criteria to cryptocurrencies. Based on our current understanding, there are reasonable scenarios where the price of Bitcoin, at some point, could go to zero. As a rule, we don’t tend to favor investments that have zero as their downside! Even as currencies, cryptocurrencies fail to meet the requirements to be a reliable “store of value” or “unit of account.”

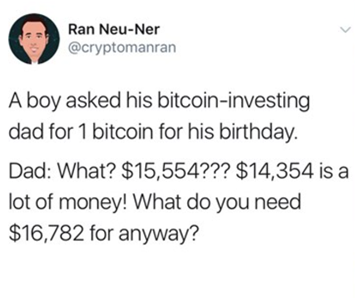

With Bitcoin prices swinging wildly up and down—and the volatility in daily returns surpassing the volatility of the S&P 500, it makes is remarkable difficult to use Bitcoin as a currency:

Hence the memes…

So, at the risk of angering the Bitcoin bulls, at this point in their trajectory, cryptocurrencies appear as speculation:

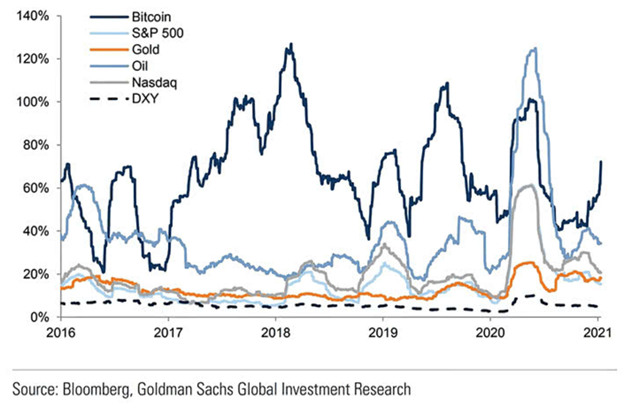

- Bitcoin has acted more like a speculative “risk-on” asset than a safe haven (see the chart on the next page).

- Bitcoin is extremely volatile and has suffered multiple massive drawdowns during its short-lived existence.

- And given its volatility, Bitcoin will likely be an extremely difficult investment for most people to stick with.

- Additionally, despite claims of Bitcoin being an inflation hedge, when headline inflation numbers were reported on May 12th, showing year over year inflation spiked 4.2% for April 2021, Bitcoin prices dropped 7%.

To be clear, speculating can be a fun game for some people with some small portion of their money. And, we certainly do not want to kill all the fun.

But we aren’t hired to speculate with the assets our clients have entrusted to us. And we don’t need to own Bitcoin or play the cryptocurrency game to achieve our clients’ investment goals.

As the capital markets continue to rally and valuations get increasingly stretched across nearly all asset classes, thus muting future returns, investors have inevitably cast a wider net. More speculative investments have lured investors after delivering spectacular short-term returns, including cryptocurrencies, special purpose acquisition companies (SPACs for short), and “meme” stocks. At times, these have been driven higher by an army of retail investors, fueled by zero-cost trading and information that is quickly shared via social media.

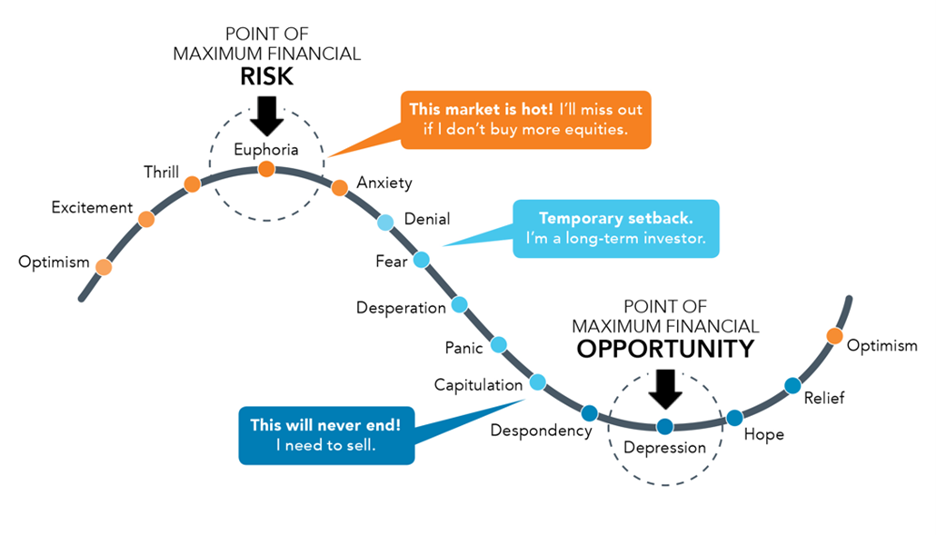

These spectacular returns have reintroduced the age-old, dangerous behavioral risk: FOMO, or the Fear of Missing Out. FOMO can tempt investors to take risks beyond what they would normally consider acceptable in search of incremental return. This behavior is often reinforced by reports that “smart money” endowments are making these same investments (likely in small size, limiting downside).

This chart by Omnistar Financial demonstrates, FOMO can make investors jump into investments when euphoria is running high…

While we certainly do not discount Bitcoin and other cryptocurrencies as stores of value and mediums of exchange in the future, we would be interested in them as an asset class as they begin to behave more as an investable asset (with reduced volatility and ability to act as currency—both of which are not unattainable in the future). In the meantime, our guidance to clients and investors broadly is to regularly revisit your risk tolerance and return objectives and ensure that your portfolio remains well aligned with these objectives.

On other cryptocurrencies…while not quite Dogecoin, here are two cute doggies…

Certain material in this work is proprietary to and copyrighted by Litman Gregory Analytics and is used by Meridian Financial Partners with permission. Reproduction or distribution of this material is prohibited and all rights are reserved.