Calling All Super Savers

Is there such a thing as overdoing it when it comes to contributing to your 401k / employer sponsored plan? If you are in the position to be questioning this, then congratulations, that is an excellent place to be financially! Obviously yes, there are limitations as to how much you can put into your 401k or other employer sponsored plans:

2021 contribution limits for employer sponsored plans

- 401k / 403b / 457- $19,500 for for those less than 50 years old plus an additional $6,500 for those 50 yrs and older. Note- 403bs and 457s have additional special catch up contributions that can be offered as well.

- SIMPLE IRA – $13,500 for those < 50 years old plus an additional $3,000 for those 50 years and older.

Per Nathan’s blog a few weeks ago there are huge benefits to contributing your employer sponsored plan first, if you are offered one.

However, if you find yourself to be a “super saver” (yes, they do exist and fall within all age ranges!) and are wondering what to do next outside of an employer sponsored plan, there are several options for savings vehicles that can provide tax diversification and tax benefits. Or perhaps you aren’t offered an employer sponsored plan or are self employed and are looking for ways to boost your savings.

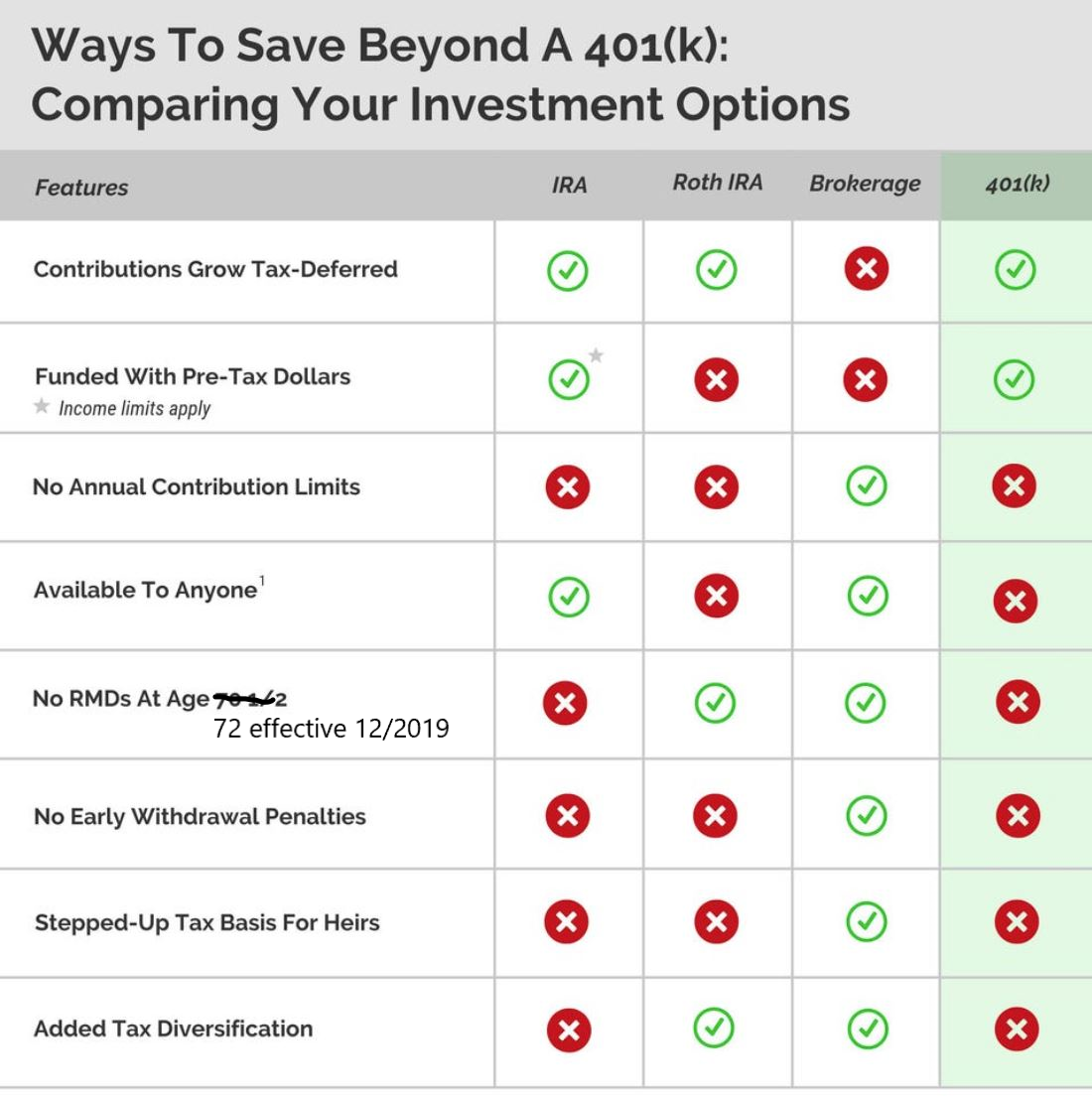

The below chart provides a very basic outline of investment vehicle options and their features which are important to consider when deciding where to put an extra stash of cash.

Outside of the above abbreviated list, would be to consider contributing to a Health Savings Account (HSA), which are available to those covered under a qualified high deductible health insurance plan. While the maximum annual contribution to an HSA is $3,600 for self-only and $7,200 for family coverage, these contributions are pre-taxable, grow tax-deferred, and withdrawals are tax free if utilized for qualified medical expenses or for any expense for those ages 65 or older. An additional added benefit is that HSA balances roll over year to year and the funds are yours for life.

Usually once emergency savings levels have been met (see Lucy’s blog) and retirement / HSA contributions have been maximized, a taxable investment account is a good route for additional cash which provides tax diversification without the restriction of having to withdraw the funds at a certain age. While taxes are paid on any dividends / interest income received during the year as well as capital gains taxes, tax efficient portfolios and strategies can be implemented to reduce these costs and these types of accounts provide lots of flexibility for meeting financial goals.

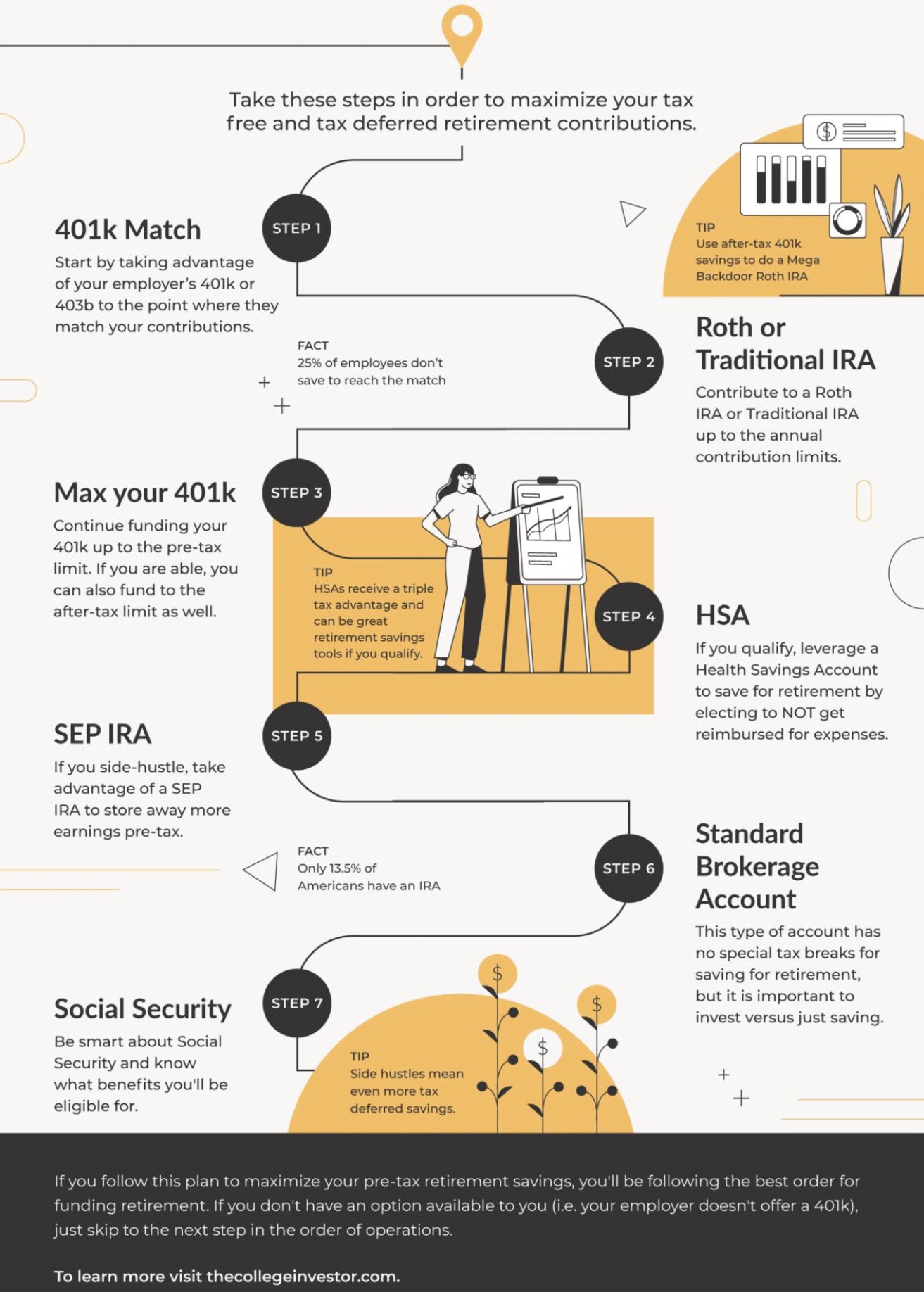

While everyone’s paths and end goals will be different, the below is good retirement savings order flow for those “super savers”.

Even though he may not be a super saver yet, our son Chae is maxing out his coolness in my opinion.