Inflation hits Santa in 2021

A big headline in 2021 has been the unusually high annual inflation figures, as compared to 2020. As of November 30, 2021, the Consumer Price Index increase from November 2020 was 6.8% according to the Bureau of Labor Statistics. Much debate has occurred over the causes (supply chain? Used cars?) and whether it is permanent or transitory. And the high increase has had some unusual consequences—like the 5.9% increase to social security payments in 2022 (the average annual increase over the past decade has been 1.4%!). Other beneficiary of the high inflation figures are I Bonds, which are directly issued Treasury bonds with an inflation competent. They are currently being issued with an annualized yield of 7.12%. We’ve already covered I Bonds here …and here is a great article by Lead Financial Planning Nerd at Kitces.com, Jeffrey Levine on how exactly I Bonds work…

On the negative side of inflation, its effects are being seen at the grocery store, gas pump, and beyond—as this chart from Visual Capitalist shows:

Another victim of inflation…Santa.

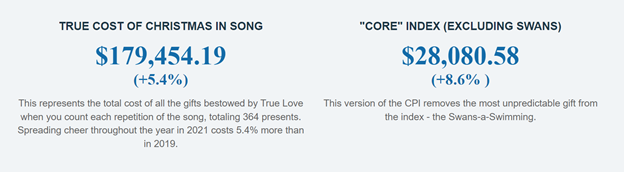

According to PNC Bank, the cost of Christmas is up 5.7% versus 2019 costs (2020 was too hard to value because of COVID impacts). Every year PNC values the cost of the items in the 12 days of Christmas song…and due to the high costs of six geese a-laying (up 57%!), the total cost to buy the gifts across the 12 days of Christmas is over $41,000.

The index is also calculated without the seven swans a-swimming, which as the highest costing item in the index, often unduly influences the index:

Excluding the swans, the Christmas price index jumped by 8.6% from 2019:

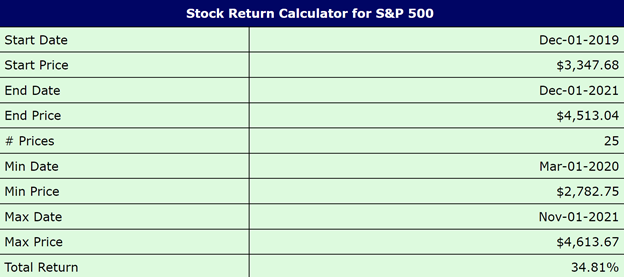

Hope that the True Love invested their money from Christmas 2019 until now…they would have made 34% return…enough to cover inflation. 😊