Keep Calm and Carry On

If I didn’t address the elephant in the room, I feel as though I’d be doing our weekly blog a disservice . And for anyone who has turned on the television, radio, or news recently, I am almost 100% certain you know what I’m referring to …. we are 15 trading days into the year and have already seen quite a bit of volatility in the stock market. Yesterday, for example was a roller coaster ride for most of the stock indices and today seems to be bringing more of the same.

Talk about whiplash…

It can be jarring as an investor to see these types of swings in your portfolio. As human beings we are wired with a fight or flight instinct whenever we sense any sort of threat to our homeostasis. That is in fact how early human species stayed alive right? However, this fight or flight instinct can actually do more harm than good as an investor. This is not meant to dismiss the large market moves we have experienced over the last two years and the performance we have seen in the market since the start of 2022. And these could feel particularly hard to process if you are new to investing or are currently drawing from your portfolio. However, as prudent investors, we feel it is important to take a step back, zoom out, and reflect on how the stock market has performed historically during periods of high volatility.

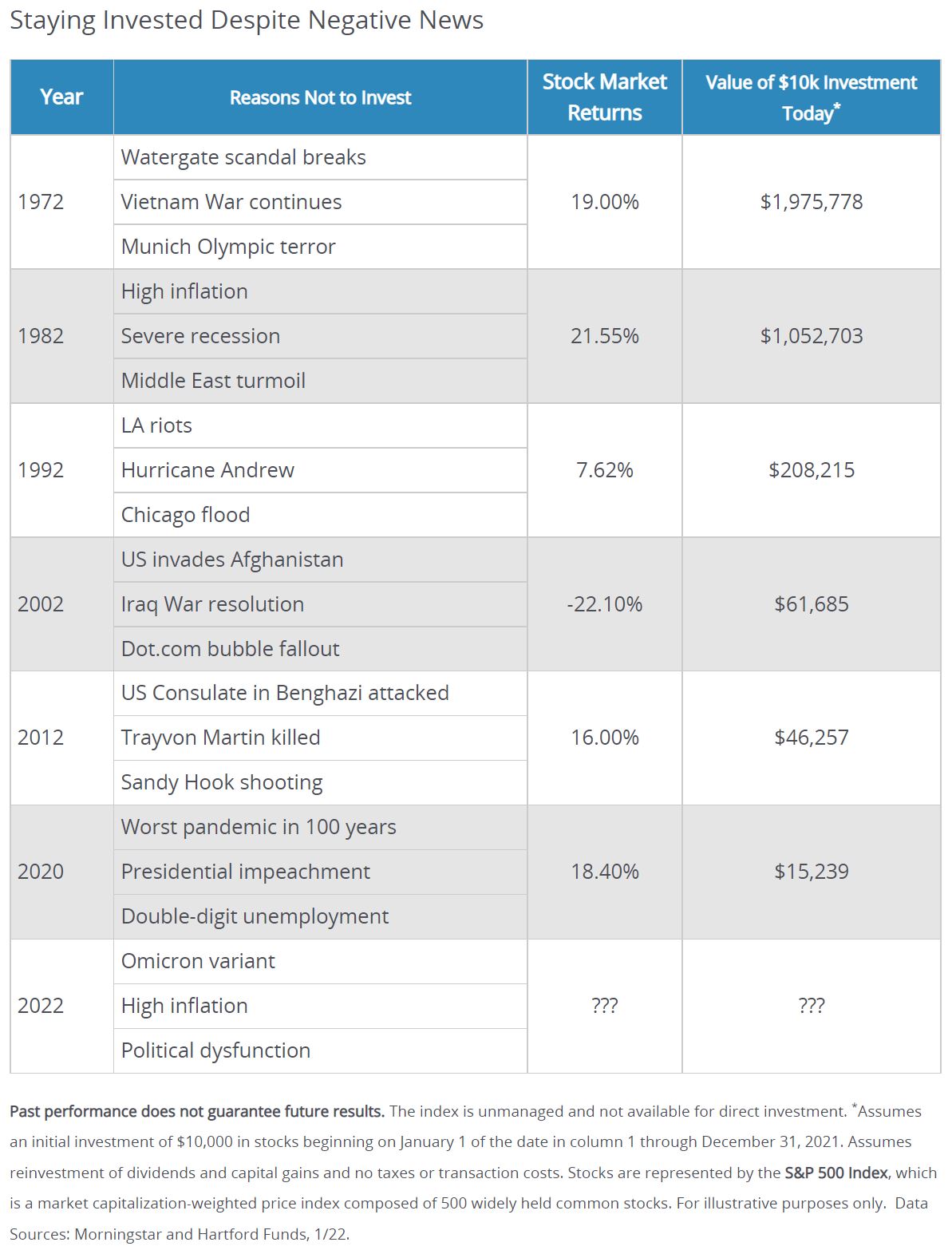

If you were to invest $10,000 on January 1st during the below years in which negative news was prominent, the returns are pretty significant.

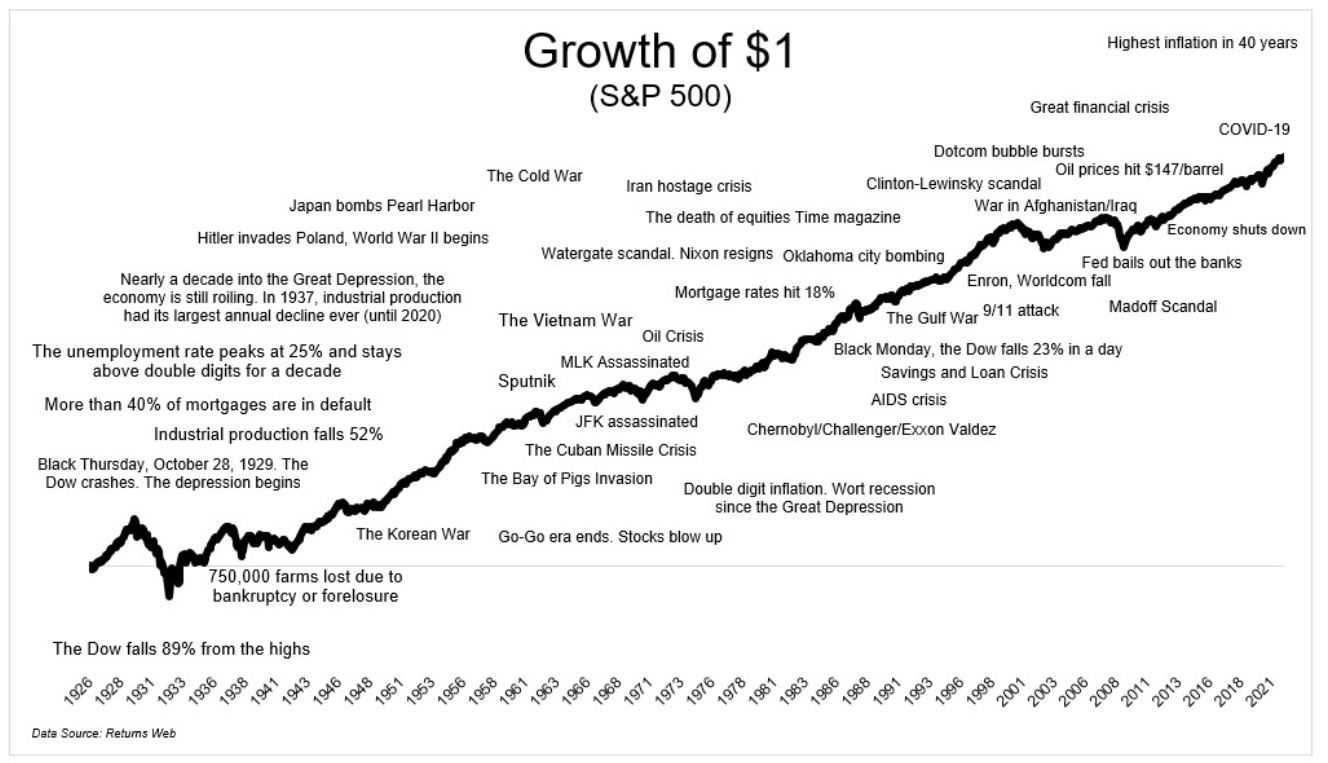

Another visual demonstrating the power of staying the path through the negative news.

It is worth noting too that these charts are only reflecting the returns and volatility in the S&P 500. In a properly diversified portfolio these “troughs” are much less severe as a prudently invested portfolio would contain exposure to more than just the largest 500 companies and are built taking into consideration timelines, cashflow needs, financial goals, and tolerance for risk. We at Meridian strongly believe a thoughtful plan informs how portfolios should be invested / allocated and yes while plans change, short term market movements and negative headlines should not necessarily change your plan.

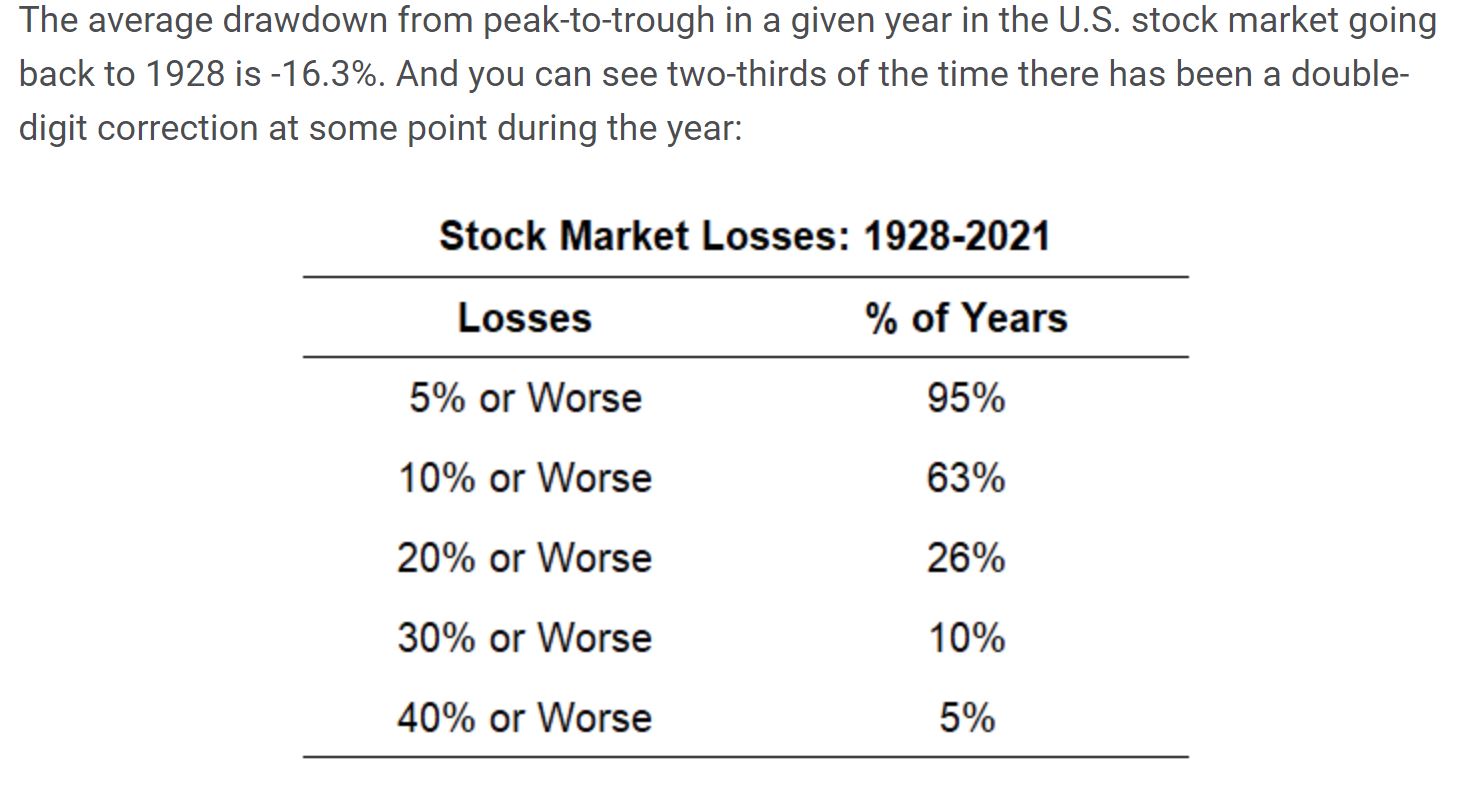

Market dips are unfortunately a part being a long term investor.

This shouldn’t deter investors from taking risk as the first chart I referenced clearly shows the rewards of taking risk and riding out any market corrections. This is just a reminder that Meridian is here to help our clients keep an eye on the longer term goals and to weather the shorter term volatility. We are here if you have questions and in the meantime, “Keep Calm and Carry On.”