529s – Filling up the Education Basket

Despite the wintry mix yesterday, Spring feels like it may be here (knock on wood!). My family is enjoying the beginnings of spring and Easter 2022 was a success. This was the first time both of our youngsters were able to experience the thrill of racing against a pack of other kids to see who could fill up their Easter baskets / bags the fastest. Even with some friendly competition thrown in there, both kids ended up with very very full baskets and I am drowning in mismatched plastic Easter eggs!

As gratifying as a full Easter basket can be for the kids, filling up the education savings basket in the form of a 529 can be even more rewarding in the form of current and future tax savings and investing to keep up with the exponential rising cost of college education (bonus— the goodies in these baskets don’t cause sugar crashes!).

If you are expecting to receive a refund from your 2021 tax filing or maybe looking to reduce your tax bill in 2022, saving for education in a 529 plan is a great way to fill up that education basket.

Some of the greatest benefits to saving in a 529 plan are:

- Tax savings — Some 529 plans provide you with a state tax deduction up to a certain amount per account. For our Virginia residents, the Virginia 529 plan allows up to a $4,000 state tax deduction per account (even if the beneficiary (aka the child) has more than one 529) no matter if you invest in the Invest plan or the Prepaid plan. The contribution has to be made before the end of the calendar year to qualify for that year’s state tax deduction.

- Here is a comprehensive list of all state plans and their corresponding state tax deduction eligibility – https://www.savingforcollege.com/compare-529-plans/state-tax-deductions

- Seven states that offer state income tax benefit for contributions to any 529 plan

- Arizona

- Arkansas

- Kansas

- Minnesota

- Missouri

- Montana

- Pennsylvania

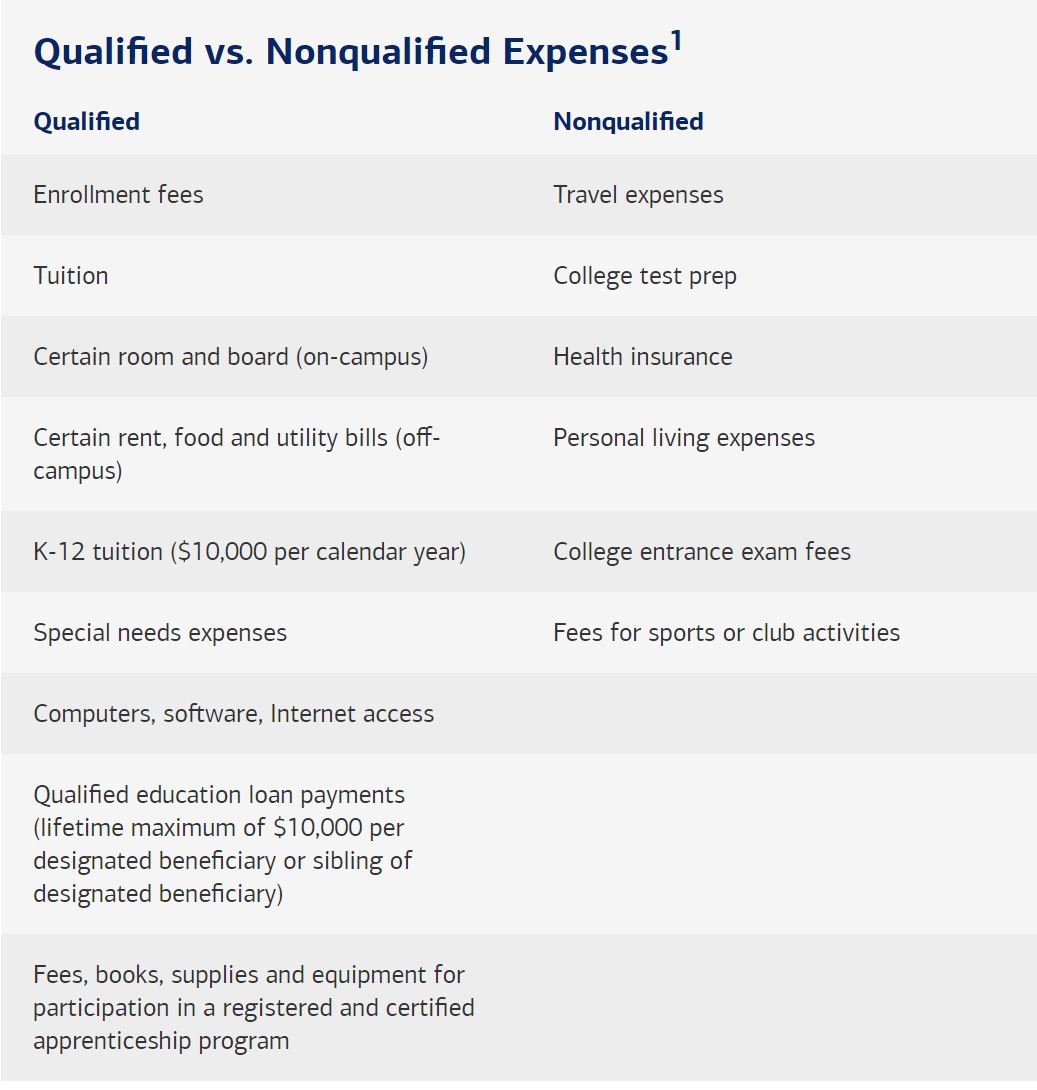

- Funds grow tax-deferred AND are withdrawn tax free if used for qualified education expenses. (That’s a triple tax benefit if your state plan offers deductions on contributions.) If used for K-12 expenses, this is limited to $10,000. Anything that is not a qualified education expense will incur federal and possibly state tax on the earnings, plus an additional 10% federal tax on those earnings… ouch!

- For those trying to reduce potential taxable estates, there is the option to make five years of tax-free gifts in a single year (up to $80,000 per individual per account).

If you or a family member has already started saving into a 529 plan, well done! You may now be at the point of utilizing the funds or perhaps planning for how you will use those funds for future expenses.

If you are getting close to withdrawing funds from a 529, understanding what is considered a qualified expense is critical. Below is a good summary of what is eligible for a tax-free withdrawal from a 529.

To pay for these qualified expenses, the account owner (usually the parents or grandparents) can withdraw the funds to reimburse themselves or have the payments sent directly to the educational institution. If you as the account owner are reimbursing yourself, it is important to do so within the same calendar year the expenses were incurred. And while 529 plans don’t ask for evidence that the funds are being utilized for eligible expenses, you will want to keep receipts, canceled checks, and any other relevant documentation in your tax records.

What if your child receives a scholarship? You are able to take a non-qualified withdrawal up to the amount of the tax-free scholarship without having to pay the 10% penalty; however income taxes will still be owed on the earnings. The same is true if you or a spouse are a veteran and are eligible to receive benefits through the Dependents’ Educational Assistance program.

If your student is employed and receiving tuition reimbursement or assistance, for the year 2022 anything under $5,250 is tax-free. However, it is not possible to double dip by using both the tuition reimbursement and 529 for the same expenses. This is particularly important and can come into play when a 529 has been utilized to cover all the upcoming expenses and then tuition reimbursement is received at a later date. This could retroactively make the 529 withdrawals non-qualified if the total amount exceeds tuition and qualified education expenses.

Another question I have been asked frequently is, “What if our child decides not to go to college or we have overfunded the 529? Aren’t we stuck with the 529 that we can’t use?”

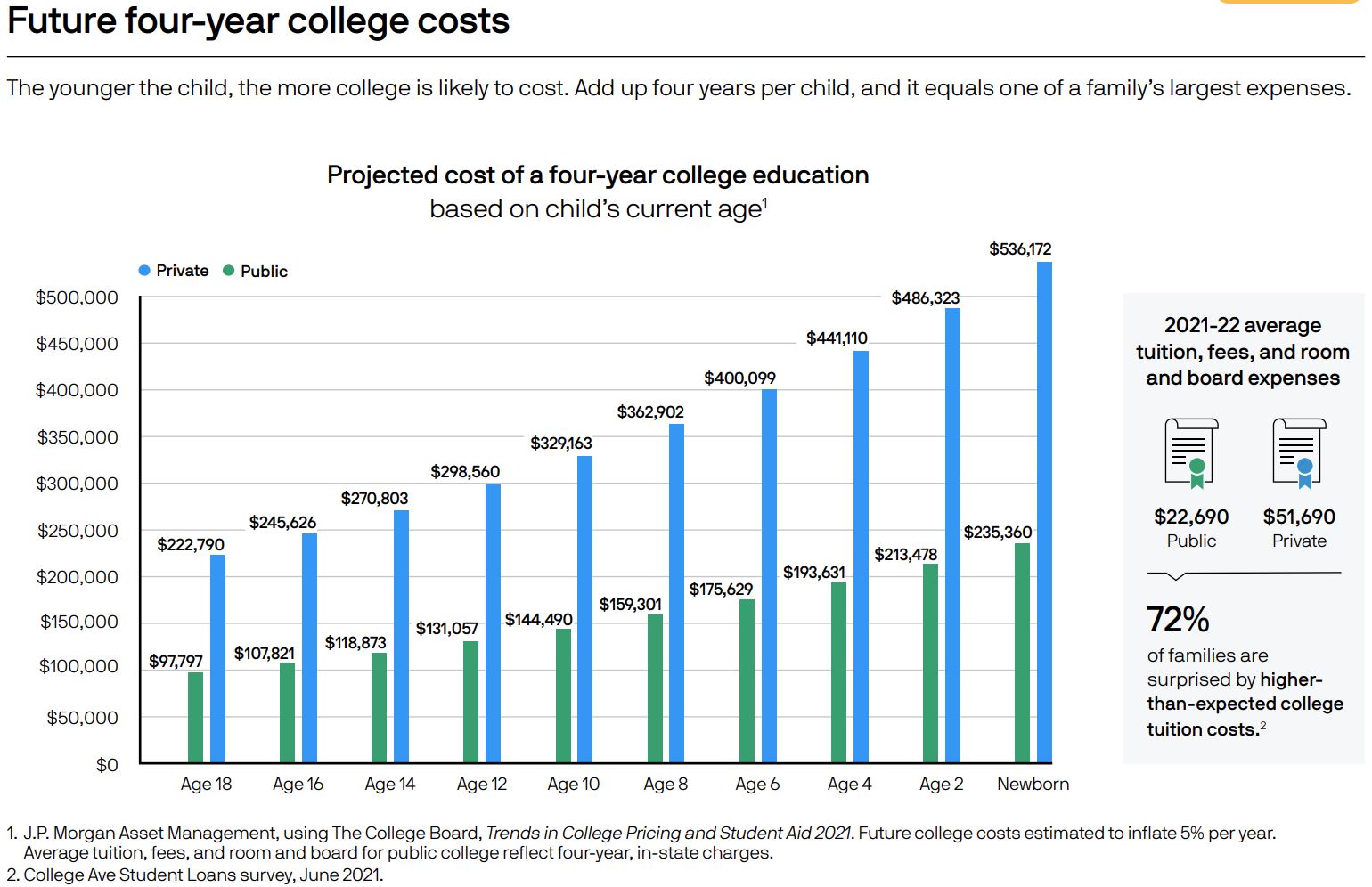

When it comes to overfunding a 529, while that is an incredible problem to have, it is a very seldom one. The unfortunate reality is that college costs are one the fastest rising costs parents will face.

However, if you have been a super saver, have a student who receives a full ride, or have a child who decides not to go to college here are options. Whomever is the account owner can change the beneficiary to another child, qualified family member, or to themselves. You can also keep the beneficiary the same and allow the funds to continue to grow tax deferred until the child has a need for them in the future.

Either way, the importance of putting money for education in a basket of invested funds that hold preferential tax treatment is a pretty sweet treat today and in the future. Happy Spring to everyone and their families!