Back to School: Financial Literacy for Kids

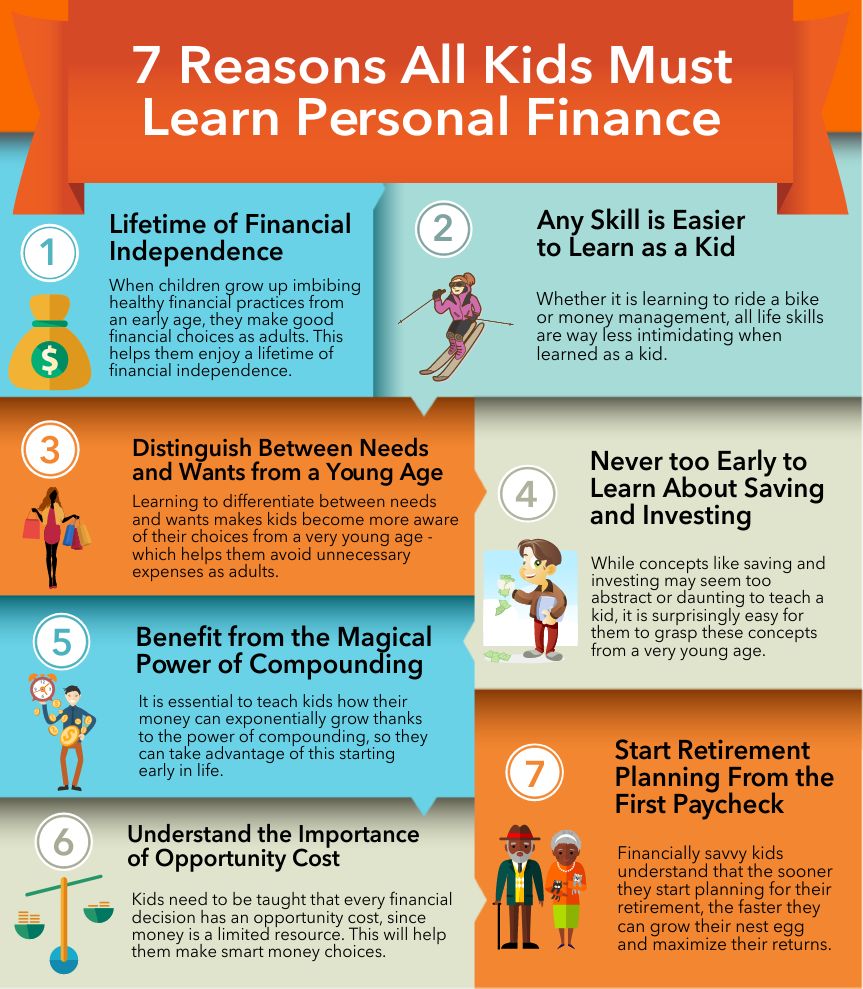

Many of us are in the back to school swing. With education on our minds, let’s talk about why teaching kids financial literacy is important, and how to do it effectively!

Speaking of good money habits, here are 6 impactful ways to teach financial literacy for kids. It will in turn help your young children become financially savvy adults:

- Teach your kids independence and responsibility through chores

Household tasks can play an important role in teaching kids independence and responsibility even if completing chores isn’t linked to their allowance.

Responsibilities can include for making their bed, keeping their bedroom clean, setting the dinner table, and putting their laundry away at the end of the night. Chores teach kids what it is to work hard and the value that comes from it. Doing household tasks helps your kids understand what it takes to make money.

While they might grumble about the work, know that you are giving them the skills necessary to live on their own in the future.

- Open a saving account for your child and take them through the process

What better way to help kids financial literacy than to have them manage their own money? Giving your kids an allowance is a great place to start.

By showing your children how you open their accounts, how to make deposits, and how to track their savings, you can impart valuable financial literacy for kids.

Parents can make a household rule that savings stay untouched until it affords its owner a valuable opportunity. Savings includes money from allowance and other income including gifts. In turn, your kids will one day be amazed at the doors that their savings will open for them.

- Educate your children about finance concepts

Simply put, knowledge is power, and it will give your children the opportunity to make choices and follow dreams. Show your kids that learning about money is an important part of them having a successful future.

Put education at the top of your parenting priorities by setting expectations and celebrating educational success. Children learn by example and observation.

Set up a college savings account as soon as possible, as this is part of financial literacy for children. And involve your children in the process, as it will allow them to build their financial confidence.

- Leverage fun resources to impart financial literacy for kids

As you’re teaching your children financial literacy, make the experience fun. Leverage fun activities, games, and money books for kids.

You can even have them pursue some great business ideas for kids such as a lemonade stand.

The whole idea is to make talking about and dealing with money a comfortable experience for your children.

Old-fashioned board games: Games that you grew up with like Monopoly and Life can teach some solid financial practices. While your kids might have fun playing a game with you, you can use it as an opportunity to explain the basic concepts of investing and choosing what to spend money on.

Money board games are great financial literacy activities for elementary students. And some simpler board games will even help with financial literacy for kindergarten-aged kids.

Let them help with the budget: This isn’t one of the financial literacy games for kids, but it is an important activity. While budgeting may not sound like a ton of fun upfront, your kids will likely appreciate the inclusion in something as important as the monthly budget.

They don’t need to make sure the bills are paid or make serious decisions about the money. But showing them how the budget works and involving them is a fun activity that can help them get real-world experience.

Saving up: Show your kids the power of saving up their money for something they really want. Help them decide on a toy or game that they want to buy, and then aid them in saving up their money, reminding them that they can eventually purchase the item.

When they are able to buy it, they’ll realize how much saving money can help them. They’ll have positive associations with saving money, encouraging this as a skill later.

- Teach your children the power of investing

When it comes to wealth building, investing is how you grow your money. And teaching your children how investing works at a young age can set them up for incredible success.

Starting early will help them reap the benefits of compounding, appreciation, dividends, and more on their investments.

- Leverage your village to raise financially savvy children

The last strategy is for you. Raising children is hard work and should not be done alone. Create a reliable support system to help you achieve the goals you have for teaching your children. A support system should include mentors and other successful people in your life that can impart wise life teachings and financial literacy for children. Economic self-sufficiency is one of the most important and perpetuating lessons you can teach your children. With education and know-how, broader perspectives, and the support of others, your children will be able to explore their dreams. They’ll get to know their world, and help to forge change that will empower and inspire others to do the same.

Your children’s confidence will empower them to make good choices because their personal savings served as a source of independence. Don’t underestimate the change that financial literacy for kids can have in the world.