Happy 30th Birthday to the First ETF

The very first ETF (Exchange Traded Fund) was created almost exactly 30 years ago on January 29, 1993, in the form of the SPDR S&P 500 ETF (symbol: SPY). It was originally listed on the American Stock Exchange (AMEX) which was acquired by the New York Stock Exchange (NYSE) in 2008. Our industry certainly loves their acronyms and symbols!

The need for an ETF sprung from the Black Monday market crash on October 19, 1987. From State Street Global Advisors, “the stock market didn’t have a single security to represent the broad market in the way the futures market did, with futures contracts on the S&P 500® Index. Believing that such a vehicle might have potentially minimized damage — or even avoided the crisis altogether — the SEC expressed interest in developing an entirely new kind of security.” That prompted State Street and AMEX to work together to create such a security, and it is not a stretch to say that it was a revolution within the investment industry. In a way, they democratized a way for smaller investors to own all of the securities in an index without having to buy stock in each company.

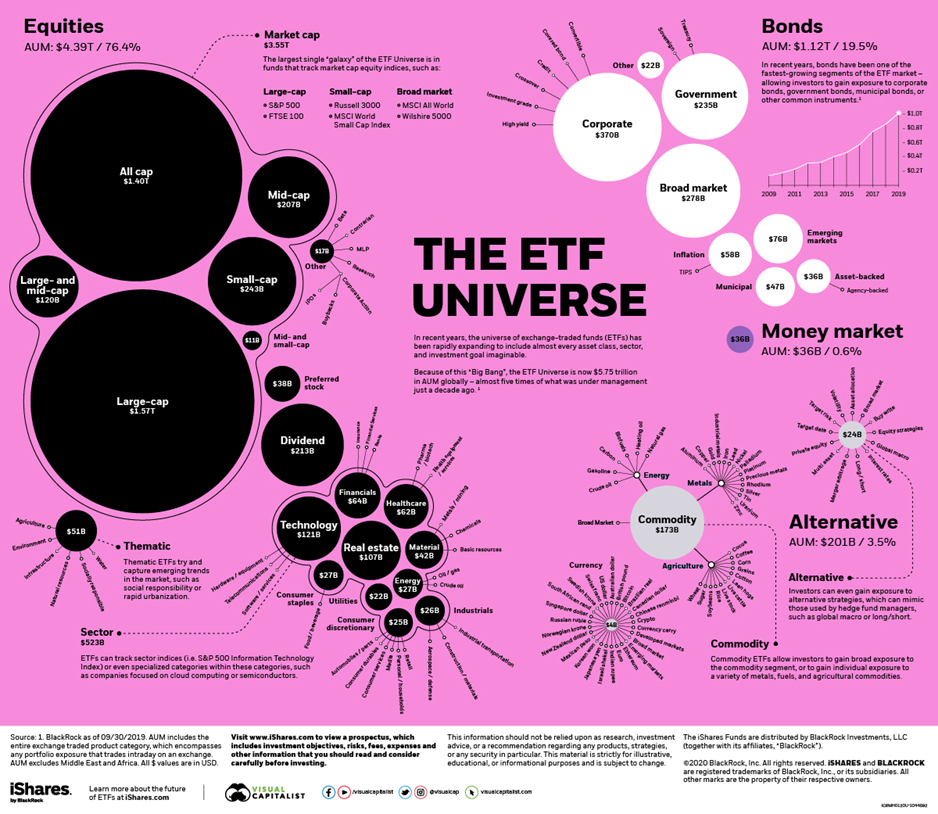

- Because ETFs trade like stocks, they are accessible to anyone with a brokerage account, and they are a basket of securities that track a particular index, sector, or other types of assets and strategies.

- This means less trading expense and lower expense ratios than a mutual fund.

- ETFs also have built in tax and liquidity benefits when compared to their traditional mutual fund counterparts. Since they trade like stocks, an investor can maintain control of taxable gains and losses, and the shares trade throughout the day (like a stock) vs. a mutual fund which only trades once per day after market close.

Today, there are over 8,000 ETFs with billions of dollars invested. And, you would be hard pressed to find an index or sector that doesn’t have an ETF tracking it. From The Morning Brew (morningbrew.com), “The first US ETF is now the world’s biggest, with $375 billion in assets, and the ETF sector in total had amassed $6.5 trillion in assets by the end of 2022. While mutual funds still have 3x the amount of assets that ETFs have, the tide is turning: Investors poured $600 billion into US ETFs on a net basis last year, but pulled out almost $1 trillion from mutual funds.

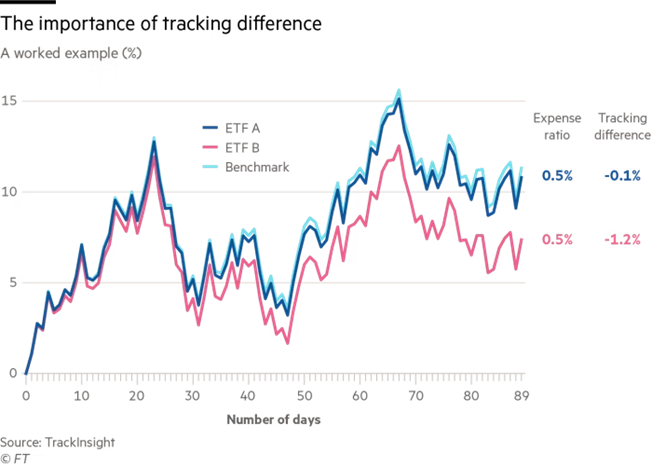

As with any investment, there are some things to consider when choosing an appropriate option. One important thing to pay attention to is which index, sector, or strategy the fund purporting to track. For example, not all ETFs that track the S&P 500 are built exactly the same and will perform differently. Additionally, there has been a recent rise in active ETFs, where a manager will overweight (put more money in) certain areas of a particular index based on predicted outperformance.

*KID PICTURE TIE IN ALERT*

Much like SPY has grown exponentially since it’s birth 30 years ago, so too has my son since his birth over 13 years (!) ago. In addition to growing physically, he has also grown significantly in his ability to navigate the ski slopes. I would never admit this to him (and I am assuming he is not an avid blog reader), but he may have officially surpassed me in skiing ability during our most recent trip. Because I have some ego remaining, I would say I am still more technically skilled, but what his body (Gumby-like) is able to do vs. mine (Nature Valley granola bar-like) has become vastly different!

Yes, this is the same person under all of that ski gear!

Here’s to continued growth and innovation for all.

Nathan