The Transfer Process (Not always easy, but usually worth it)

Transferring your investment account(s) to a new firm can be intimidating and sometimes a reason to not make any change and leave things as they are. The two most popular reasons for transfer are 1) switching to a new advisor or firm and 2) changing jobs/retiring. While both types of moves do require some work on the client’s side, the processes can be accomplished relatively easily and with little to no tax, penalty, or cost.

Switching to a new advisor and/or firm is a little bit easier than moving money from an old work plan, because the new firm can help facilitate account opening and requesting the transfer from the previous firm. Steps include:

- Opening new (empty – they do not have to be funded with new money) accounts with the new firm that are titled exactly as they are at the old firm. It is important to note that the titling must match exactly, or the resigning firm may reject the transfer.

- For example, if you have a joint investment account with your spouse at the old firm, it needs to move into the same type of joint investment account with the new firm.

- This is most important for IRA-to-IRA transfers and ROTH-to-ROTH transfers, because there could be taxes and penalties if this is done incorrectly.

- Signing transfer forms with the most recent statements (all pages!) from the old firm attached. The new firm needs the statements to track what accounts and holdings should transfer.

- Transferring “in kind” is almost always the best option. This means that no investments are sold but are instead lifted out of the old firm and dropped into the appropriate account at the new firm. Not only can the new firm help to assess what should be sold and when, but it can also help avoid taxable gains on low cost-basis holdings in taxable (non-retirement) accounts.

- As you can imagine, these days the transfer process is almost completely electronic. The old firm’s back office moves the assets out to the new firm’s back office via the ACATS (Automated Customer Account Transfer System). So, once everything is set up and requested, the funds usually move within a few business days. Note that some types of holdings have to move via non-ACATS and can take longer (like annuities).

- Reviewing all the transfers for accuracy. If you are working with an advisor/firm, they can help make sure that everything has moved appropriately. In many cases, there will be residual smaller transfers that will occur from dividends, interest, and/or capital gains that pay out into the old account and transfer over to the new one. The instructions to transfer remain in effect for six months, so if there are residual amounts, they should automatically move

- If you notice that you are still receiving statements from the old firm showing a balance of any kind, you should check with the new firm to see if they need to reinitiate a transfer (again in most cases this will happen automatically)

- NOTE: You will receive 1099 and other tax forms from each firm for the year in which you transferred. So, just keep that in mind when filing.

Transferring an old work plan to a new work plan or an IRA can require a bit more legwork on the client’s part. This is because every plan is set up a little differently and has different requirements for moving the money. Some plans will allow you to request funds online, while others will require a phone call and/or forms. If you aren’t sure where to even start, we suggest speaking with your HR/payroll area to get some guidance. Steps may include:

- Open your new work plan or IRA. You will need to have this ready to go to receive the money from the old plan.

- Make sure the new IRA or plan is titled appropriately. If your old plan has ROTH money in it, that will need to transfer into a ROTH account. You want to avoid comingling money that has already been taxed with pre-tax dollars (a traditional IRA or 401k)

- Log in to your old plan site to see what withdrawal options are available to you. Some plans will allow you to initiate a rollover/transfer to an IRA or your new plan online.

- You will need to have the information regarding your IRA or new plan handy in order to inform the old plan how to transfer the money. You will likely need an account number, the name of the firm to make the check payable, and an address.

- Believe it or not, most plans are liquidating the assets and mailing a physical check to the new plan or IRA. So, you want to be sure you give your new plan holder a heads up that money is coming.

- You should be notified by the new plan or IRA holder that your funds have been received and deposited. If everything is done correctly, there will be no taxes or penalties.

- Note that some plans allow you to leave the money in the plan even though you aren’t working there anymore. This is usually not the best idea, as you can lose track of the money and how it’s invested. We often see a “bread crumb trail” of retirement plans for folks who have changed jobs frequently and not moved their plans along with them. It can take a lot of time and effort to move these older plans many years after leaving the job.

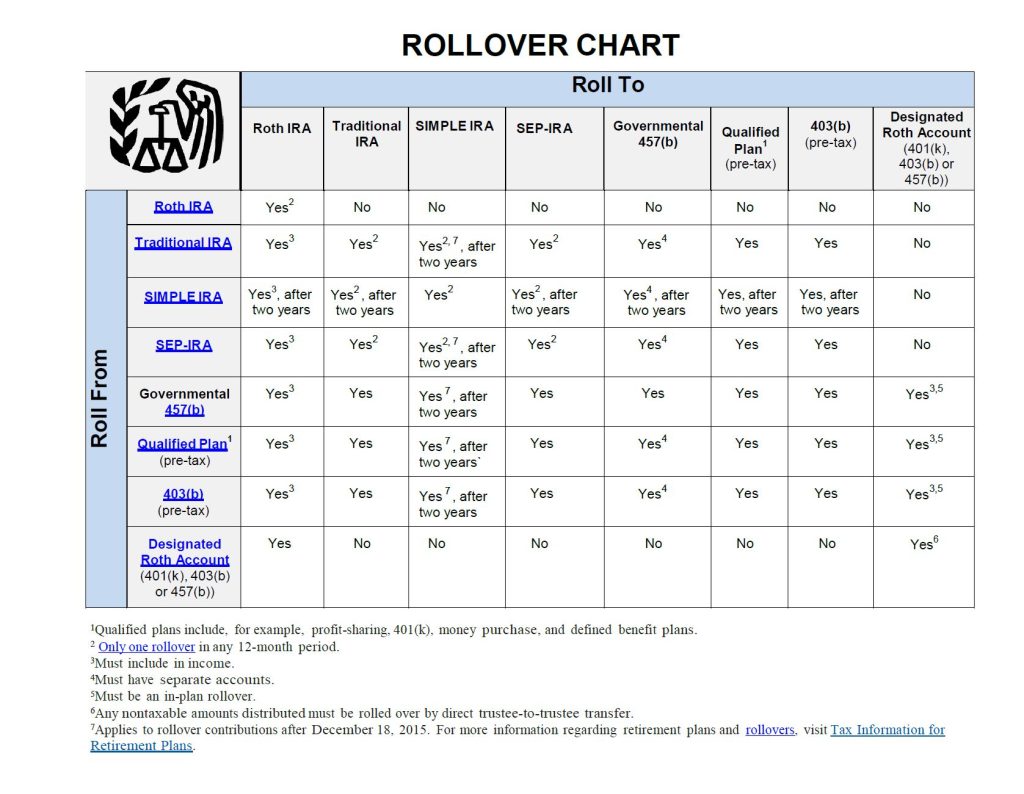

Below is a handy summary chart from the IRS that shows rollover options and what you can/can’t do. Qualified Plan = 401(k) in most cases.

As an avid Washington Reds…Football Te…Commanders Fan, I have been following the impending departure of the current owner, Dan Snyder. It’s not a totally done deal just yet, but an ownership change does seem very likely. So, the employees of the team may be facing some of these rollover decisions in the near future.

I could not resist purchasing some “Bye Dan” beer from Old Ox Brewery in Ashburn, VA (near where the team practices) to celebrate the joyous occasion. If you aren’t already aware, he was not a very well-liked owner!

Cheers to better money movement decisions (and team owners!) going forward!