Do Something

September is a bustling month in the Irving household, filled with birthdays, parties, back to school activities, and charity outings. Always keeping things interesting!

Speaking of events, thank you to all who joined us at our annual Client Appreciation Event last week!

These past two weeks have been just as busy in terms of key economic events – last week the August CPI number was released, and tomorrow is Fed fund rates day. Tomorrow investors will be listening scrupulously to Jerome Powell on the Federal Reserve’s decision on whether increase interest rates further or pause based off the economic data and recent inflation prints. The overall consensus is the Fed will pause in September but they will more than likely indicate there is still the possibly of another increase before end of year.

Arguably much of the volatility that has been seen in the bond and stock market over the last year can be tied to the rapid interest rate hikes (ie – “You can’t fight the Fed”), so it’s no wonder investors are sitting on the edge of their seats these next few months. The roughly 5% interest rates have made investments such as short-term Treasuries, CDs, and money market funds particularly appealing. However, those CDs and Treasuries will mature, and investors are left to figure out where and when to get that cash back to work.

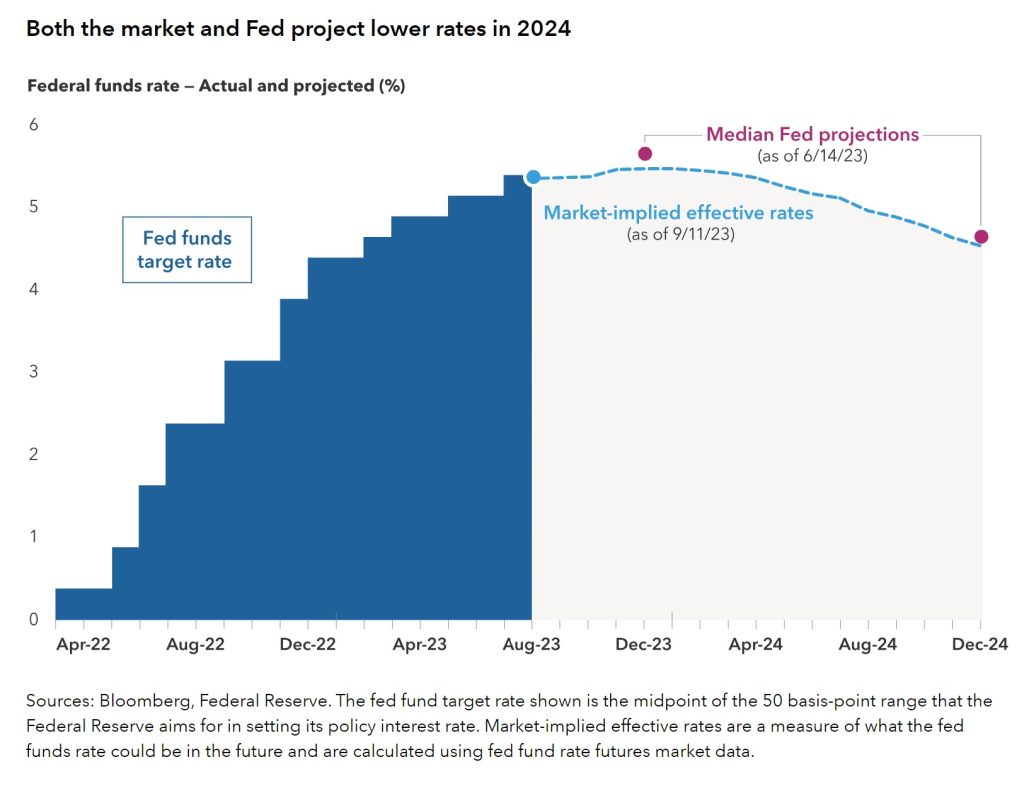

While we at Meridian are listening, reading, and watching the global economic indicators and important events, even the smartest investors out there cannot consistently predict when (and by how much) interest rates and markets will move. However, markets and Federal Reserve projections indicate a decline in rates throughout 2024 of approximately 1%.

When rates do begin to decline, history shows that the 18 months after the Fed ended hikes, yields on cash like investments such as money markets, CDs, and Tbills, rapidly declined. Investors who stayed in cash during these periods of time not only lost purchasing power quickly, but historically missed out on the return potential of other investments.

If the Federal Reserve does indeed end rate hikes in the near future, where should investors put their money to work? Nathan addressed this in his blog from a couple weeks ago – but it’s worth revisiting the historical short and intermediate term performance following the end of a Fed hike.

Investors who have cash on the sidelines may still be unsure of when to get their cash / cash-like holdings back into the markets. If you are reading this and are waiting for me to give the exact day and time of when that best time is – well, you will unfortunately be disappointed.

However, the short answer is, it is better to get it invested at any time than never. Charles Schwab performed research on 5 hypothetical long-term investors who were following very different investing styles.

Each received $2,000 at the beginning of every year for the 20 years ending in 2022 and left the money in the stock market, as represented by the S&P 500® Index. (While it is recommended to diversify your portfolio with a mix of assets appropriate for your goals and risk tolerance, we’re focusing on stocks to illustrate the impact of market timing.) For sake of consistency, they analyze all 78 rolling 20-year periods dating back to 1926 (e.g., 1926-1945, 1927-1946, etc.)

The Five investing styles were:

- Peter Perfect was a perfect market timer. He had incredible skill (or luck) and was able to place his $2,000 into the market every year at the lowest closing point. He continued to time his investments perfectly every year through 2022.

- Ashley Action took a simple, consistent approach: Each year, once she received her cash, she invested her $2,000 in the market on the first trading day of the year.

- Matthew Monthly divided his annual $2,000 allotment into 12 equal portions, which he invested at the beginning of each month. This strategy is known as dollar-cost averaging. You may already be doing this through regular investments in your 401k or employer sponsored plan.

- Rosie Rotten had incredibly poor timing—or perhaps terribly bad luck: She invested her $2,000 each year at the market’s peak.

- Larry Linger left his money in cash investments (using Treasury bills as a proxy) every year and never got around to investing in stocks at all. He was always convinced that lower stock prices—and, therefore, better opportunities to invest his money—were just around the corner.

Here are the results:

No surprise that Peter Perfect ended up with the largest investment over time; however, it’s nearly impossible to accurately identify market bottoms on a regular basis. The best course of action for most of us is to create an appropriate plan and be ready to take action as soon as possible.

So while we would all love to be Peter Perfect, the reality is we don’t know exactly when the Federal Reserve will exactly start cutting rates and long-term prospects for investments both on the bond and stock side is very encouraging – a reminder that doing something is better than doing nothing!

Bringing it back to our jam-packed month, this also rings true when I reflect on how crazy, yet joy-filled our schedules can get… better than doing nothing!