Non-Coronavirus Commentary

If only to avoid further commentary on “that virus” and its effect on the markets, we wanted to address another common question that has been coming up lately; “What happens to the stock market in election years?” Since it is Super Tuesday here in Virginia and many other states, it seems appropriate. We certainly don’t know exactly what will happen in this election year, especially with the litany of other factors out there. However, it is helpful to look back over past election cycles and market reaction.

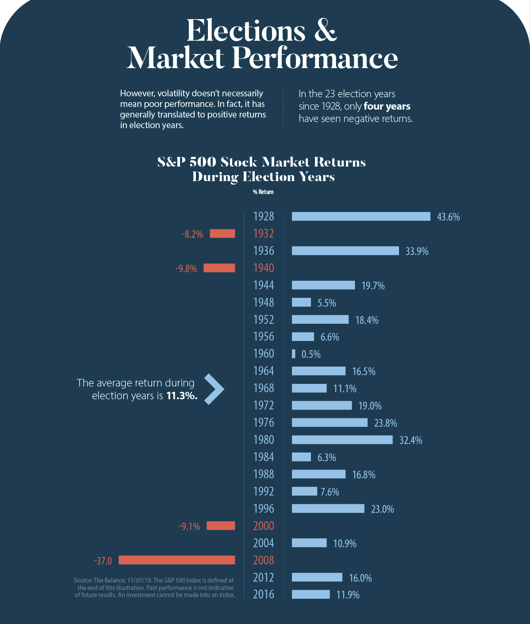

Believe it or not, “in the 23 election years since 1928, only four years have seen negative returns.” (source: visualcapitalist.com) In general, markets are volatile in the first part of the election year (read: right now), and then turn positive once some level of certainty is attained around the outcome. As always, markets do not like uncertainty, and there’s usually a lot of uncertainty at the beginning of an election year. Add in a pandemic and fed rate cuts (breaking news: the Fed just cut rates by 50 basis points) and you get the kind of wild market swings that we are currently experiencing.

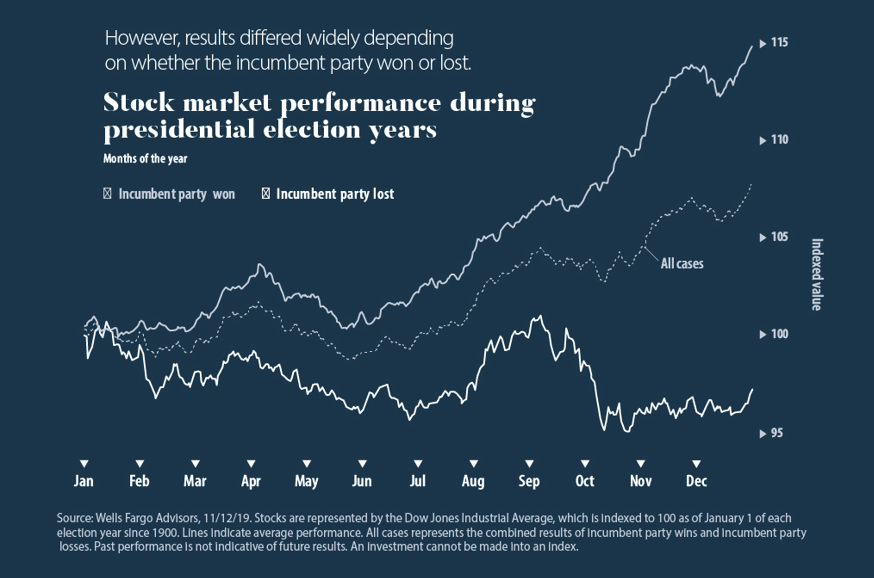

As you can see, markets perform better when the incumbent party wins and not nearly as well when the incumbent party loses. Again, this represents the markets’ aversion to uncertainty and the known stances of the incumbent party are generally preferable (purely from a stock performance perspective) to the unknown of a newcomer.

It’s important to note that stock performance in election years may not have anything to do with elections at all. Obviously, there is no one factor that determines market direction. In 2008 for example, it would be hard to argue that the financial crisis was purely a result of an election outcome. Furthermore, any economic policy that an administration is able to put into place often takes years to actually prove effective (or ineffective).

On the Gilbert homefront, there has been some uncertainty as well. Mainly, when will the children actually listen to their dad and go to bed on time? Mom has been on some work travel of late, so dad has been left to be taken advantage of (mostly by his daughters!). Just last night, Lyla discovered a creative and comfortable way to use her iPad and research potential election outcomes.

Much like it’s important for dad to remain calm in the face of bedtime uncertainty, we as investors must remain calm in the face of market uncertainty. The ‘get out and get back in’ strategy has proved to hurt most investors more than help, so keeping your investment allocation aligned with your goals remains imperative.