Glass Half Empty

Last Friday, I went to Yahoo Finance to check how the markets had done for the day and the main headline caught my eye—it read “JP Morgan: Recession risk has never been higher”. This seemed odd to me since I had just returned from a JP Morgan analyst conference last week, and they said nothing of the sort. In fact, they had expressed that while recession may be on the horizon, the economy should manage to muster its way through 2016 with sluggish positive growth. So, “Recession risk never higher?”…I had to click on the link…

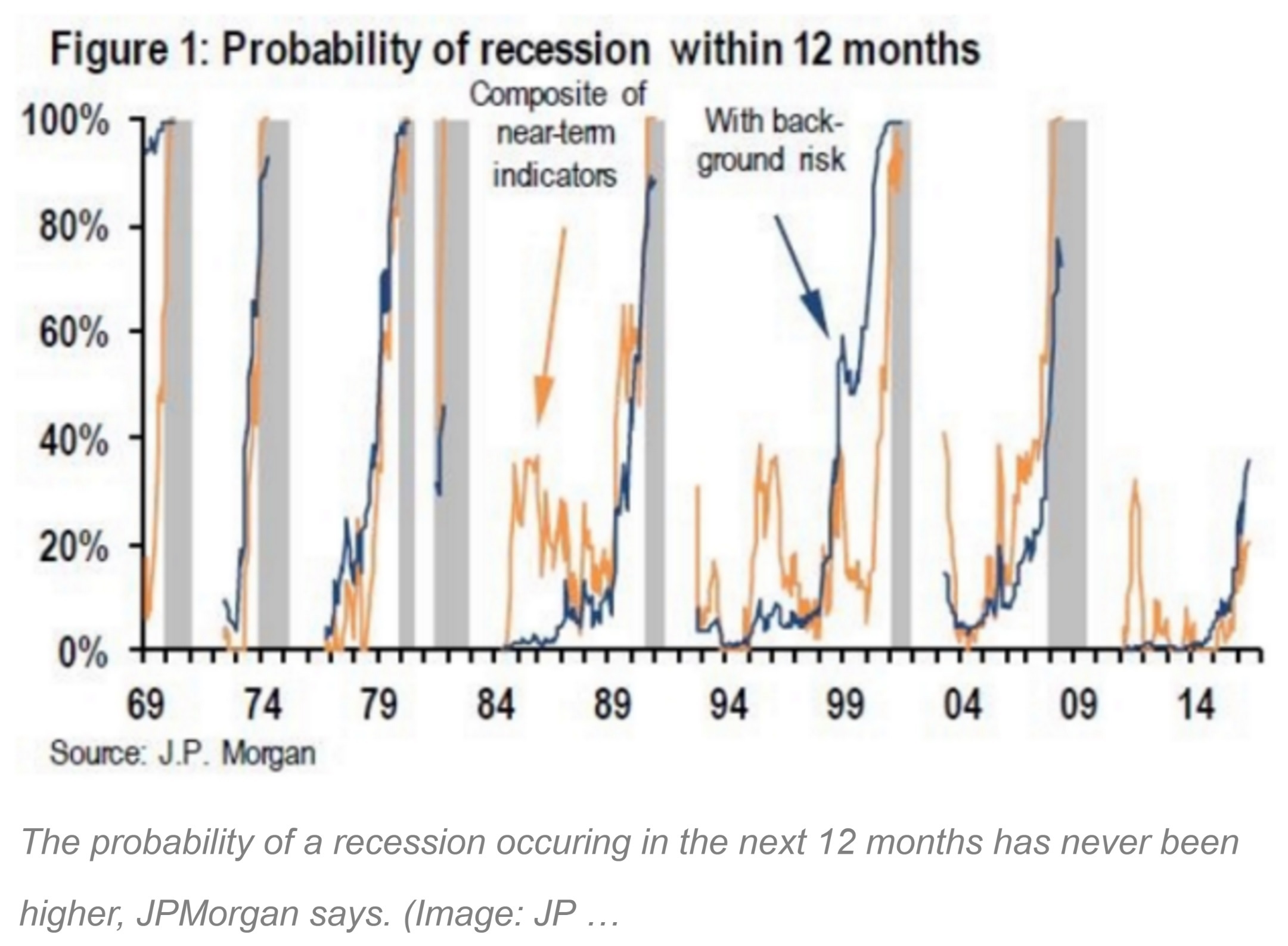

Click the image to enlarge.

In the article, the actual analyst quote was: “Our preferred macroeconomic indicator of the probability that a recession begins within 12 months has moved up from 30% on May 5 to 34% last week to 36% today,” JPMorgan’s Jesse Edgerton wrote. “This marks the second consecutive week that the tracker has reached a new high for the expansion.”

So, according to JP Morgan, the recession risk has never been higher in this current expansion! In fact, look at their chart—and Yahoo’s caption:

It seems to me that recession risks have been higher in the past—by JP Morgan’s own indicators, the probability of recession risk (the blue and yellow lines) has reached 70% or higher before each recession (which are the gray bars on the chart)…a far distance from our current 36%!!

Yahoo’s aggressive, negative, misleading clickbait headline worked—which according to a recent study published in 2015 is becoming more common. In a recent paper called “Breaking the News: First Impressions Matter On Online News,” researchers studied headlines from 2014. After analyzing whether the headlines were negative, positive, or neutral, they concluded that extremely negative or extremely positive headlines receive more clicks—and therefore induce content providers to exaggerate.

More disturbingly, the study highlights the importance that headlines have on how we perceive the rest of the article. The authors write, “Headlines give the first impression of news articles and they can drive how users perceive their content. By drawing attention to certain details or facts, a headline can affect which existing knowledge is activated in one’s brain. By its choice of phrasing, a headline can influence one’s mindset so that readers later recall details that coincide with what they were expecting…”

In other words, the headlines frame the context of the data. So, when we read the headline that recession risk has never been higher, when we see the recession risk climbing from 30% to 36%, that seems ominous. However, if the headline would have been “Recession risk remains relatively low”, we would have been anchored to 36% risk being moderate compared to the extremes shown on the chart of 70-80%.

So, while we certainly don’t dismiss the odds of recession rising when managing portfolios, the headlines are certainly not great ways to get a sense of the economy, the markets, or the world in general. The underlying data matters, and being aware of the media’s need to drive clicks by exaggerating content is always important!