Everything, Everywhere Not All At Once

Other than the Oscars, the failure of Silicon Valley Bank has been dominating the headlines. However, the U.S. Treasury and the Federal Reserve have moved swiftly to address potential risks to the financial system. We also believe the turmoil will relieve some pressure on the Federal Reserve, possibly leading to a pause or slowing in its current rate-hike cycle.

How did this happen?

With the previous environment of 0% interest rates and negative real interest rates outside the US it was a perfect storm for more risky, start-up companies. These “minnow companies” are the ones being left out to dry during the liquidity tide. SVB’s “unique characteristics made it more susceptible to an old-school bank run, the event highlights the fallout of rapid rate increase, particularly on rate-sensitive bank assets. Significant developments over the weekend, including a generous liquidity facility and a preemptive (cryptocurrency) bank seizure in New York, may stem any further contagion, but the situation is still highly fluid.” – Horizon Investments

Some of these unique characteristics are:

- High Industry Concentration

- Rapid Growth in Deposits

- Rapid Growth in Lower Yielding Securities

- Price Below Tangible Book Value

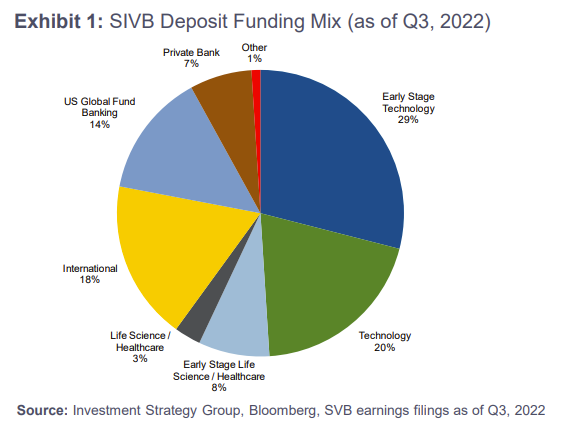

1. High Industry Concentration. SVB’s customer base was highly concentrated with the technology start-ups and the venture capital firms that fund them. “As the operating environment became more difficult for these firms over the last year, they began to drawdown their deposits more quickly than expected. The broader banking industry has a more diversified deposit base with an average account size that falls within the existing FDIC guarantee.” – Goldman Sachs

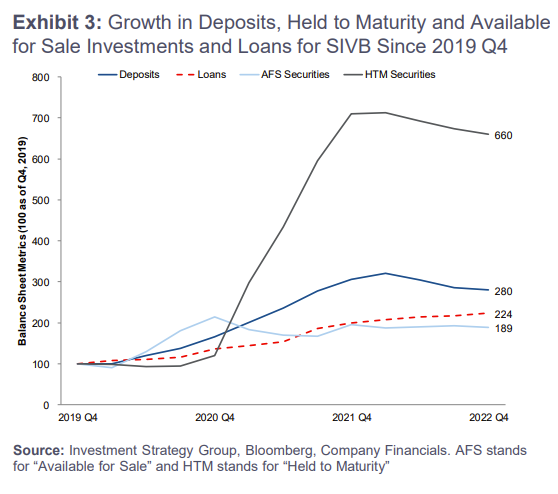

2. Rapid Growth in Deposits. The boom in technology fundraising and IPOs in the wake of the pandemic led to a surge in deposits for SVB. As seen in Exhibit 3, SVB’s deposits nearly tripled since the end of 2019. In contrast, the banking industry’s deposits grew a more modest 34% over the same period.

3. Rapid Growth in Lower Yielding Securities. Because SVB’s deposits grew faster than its loan book, the bank deployed the excess liquidity into securities, namely low yielding Treasury and agency bonds during 2020 and 2021. But the rapid accumulation of these securities at lower yields left the bank vulnerable to mark-to-market losses as interest rates rose over the last year. SVB had a much higher concentration of securities—and lower share of cash and loans—relative to deposits—than the typical US bank. In fact, the unrealized losses on SVB’s securities—combining both those it planned to hold to maturity (HTM) and make available for sale (AFS)—essentially exceeded its entire tangible book equity. Yet such losses represent a much smaller portion of capital at other banks.

4. Price Below Tangible Book Value. At the time SVB attempted to increase its liquidity by issuing equity last week, it was trading below its tangible book value. Issuing equity when a stock is trading below its book value is dilutive to existing shareholders and typically reinforces downward pressure on the issuing stock. In contrast to SVB, less than 3% of other regional banks—and even few larger banks—currently trade below their tangible book value. Compared to the financial crisis, banks today hold more cash, fewer risky real estate loans and have a much lower loan to deposit ratio. – Goldman Sachs

So, what’s next?

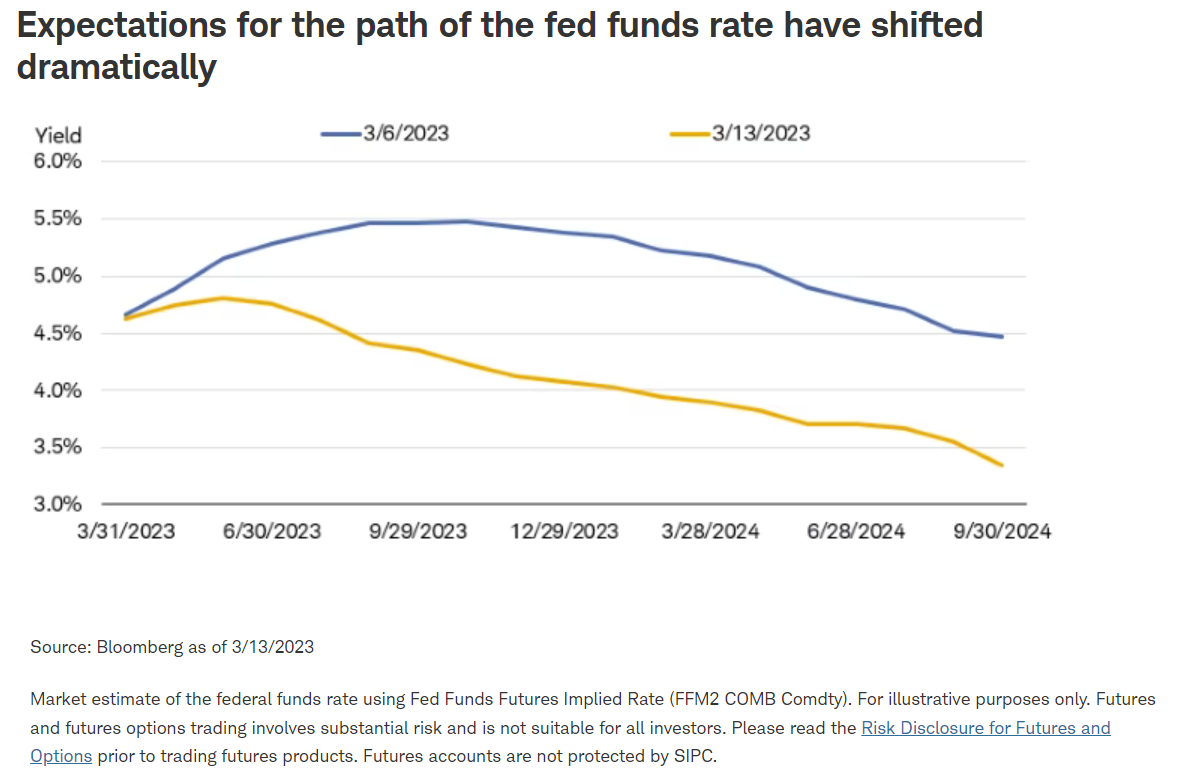

The situation with SVB adds a layer of complexity to the Federal Reserve’s rate-setting decision. “Despite the stronger than expected Nonfarm Payrolls print, we think that the risks to financial stability emanating from small- and mid-sizes banks will weigh heavily on the Fed’s thinking for rates. From a coin flip between 25 and 50 basis points, markets are now assessing the likelihood of a pause in rate hikes as soon as next week. Such a pause would indicate a shift to a more reactive, forward-looking framework for Fed policy, at least in the near term until the banking situation plays out.” – Horizon Investments.

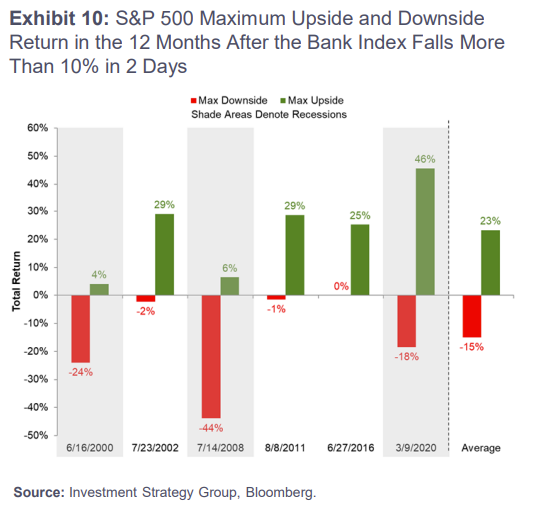

The market volatility is likely to continue for the year. In turn, we continue to recommend that clients do not position for either a recession or bull market exclusively, but instead stay fully invested at your risk tolerance. We know it’s hard to ignore volatility when headlines and TV news are focused on the market drop. However, markets historically have fluctuated and recovered. It’s important to stay focused on your plan and track progress toward your goal, not short-term performance.

As always, Meridian continues to work hard for our clients. I recently returned from almost two straight weeks at conferences enhancing knowledge on our trading software, current market events, financial behavior, investment trends, and more!

P.S. a quick note from Charles Schwab, our custodian:

- Investments at Schwab are held in investors’ names at the Broker Dealer. Those are separate and not comingled with assets at Schwab’s Bank.

- Schwab does not have any direct business relationship with Silicon Valley Bank or Signature Bank, so we do not have exposure to any direct credit risk from either.

Schwab’s long-standing reputation as a safe port in a storm remains intact, driven by record-setting business performance, a conservative balance sheet, a strong liquidity position, and a diversified base of 34 million+ accountholders who invest with Schwab every day. As such, we remain confident in our approach and in our ability to help clients through all kinds of economic environments. We stand ready to support our clients with award-winning service and time-tested expertise. – Charles Schwab, Founder and Co-chairman