Free Lunch

This past week, the fact that I pay in advance for the kids to be able to order lunch at school was discussed in our car one morning. Ben, my youngest son, said “You pay for those lunches? I thought they were free.” To which my sassy ten year old daughter replied, “Seriously? Nobody gives away lunches…of course she pays for them, (insert rude name for your younger brother here).”

Even at age ten, my daughter understands the basic saying “There’s no such thing as a free lunch.” This phrase has its origins back in the mid 1800’s…saloon owners would often advertise free lunch, but it was only available for those patrons that also bought drinks. So, those partaking of the “free lunch” paid via the overpriced drinks they were forced to buy. Economists and politicians jumped on the idea, promoting that everything has a cost, seen or unseen.

In the investment world, the concept of no free lunches is very true as well. There is a cost to everything. “No load” mutual funds have underlying fund expenses buried in the fund prospectus. Cash in bank accounts earning .1% has the missed opportunity cost of being out of the market. Outsized investment returns come with higher risks. Everything has a cost, seen or unseen.

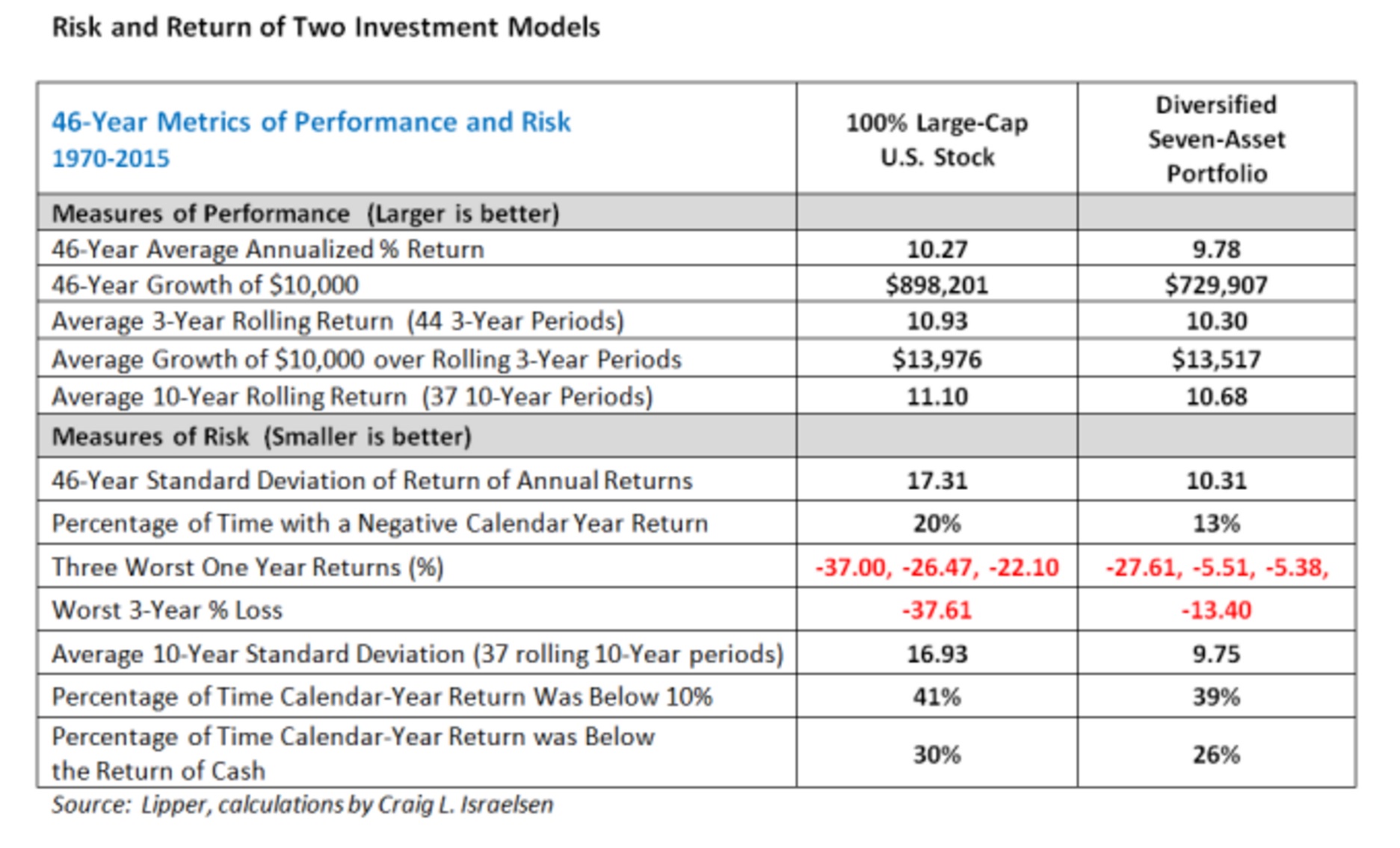

The closest thing to a free lunch in investing is diversification. The benefits of diversification have been studied and proven over and over, most recently in an article in Financial Planning magazine. The author runs risk and return metrics of two portfolios—one consisting only of US Large company stocks, and the other diversified among seven major asset classes (like large companies, small companies, non-US companies, real estate, etc.). The results are shown below:

Interestingly, over a long time period, the returns were very similar, with the large cap only portfolio returning 10.27% to the diversified portfolio’s 9.78%. So, there was a small cost to being diversified in absolute terms. However, what is astounding is the amount of risk that was removed by being diversified. The large cap only portfolio had a standard deviation of 17—this means that 95% of returns for this portfolio fell within -17% and 51% (2 standard deviations). But, the diversified portfolio had a standard deviation of 10, meaning 95% of returns fell between -10% and 30%. The range of outcomes is narrower, which make the overall portfolio performance more even and less subject to the wild whipsaw of a volatile market.

This is the “free lunch” of investing—the cost of diversification after accounting for the reduction of risk is almost nothing. If done properly, diversification means there will always be something in your portfolio that you hate as it is underperforming the others…but that is the point. There will always be something that is the best performing asset as well, and it is the evening of these highs and lows out that makes the ultimate performance steady. With economic uncertainty rising, diversification is the key to prudent portfolio management!