Santa’s Last Stop

Every year, after Santa delivers presents to the good little boys and girls around the world, he swings by Wall Street and gives one last gift to investors. Typically, the stock market strongly rallies between December 25th and January 1st every year.

PNC Financial Services’ chief investment strategist William Stone mentioned the trend in a note circulated to investors:

“According to the 2016 Stock Trader’s Almanac, since 1969 the Santa Claus rally has yielded positive returns in 34 of the past 45 holiday seasons — the last five trading days of the year and the first two trading days after New Year’s. The average cumulative return over these days is 1.4%, and returns are positive in each of the seven days of the rally, on average. Nevertheless, each year there is at least one day of declines.”

While 1.4% seems like small amount, the fact that it is achieved over a 7 day period means that it translates to an annual return near 50%!

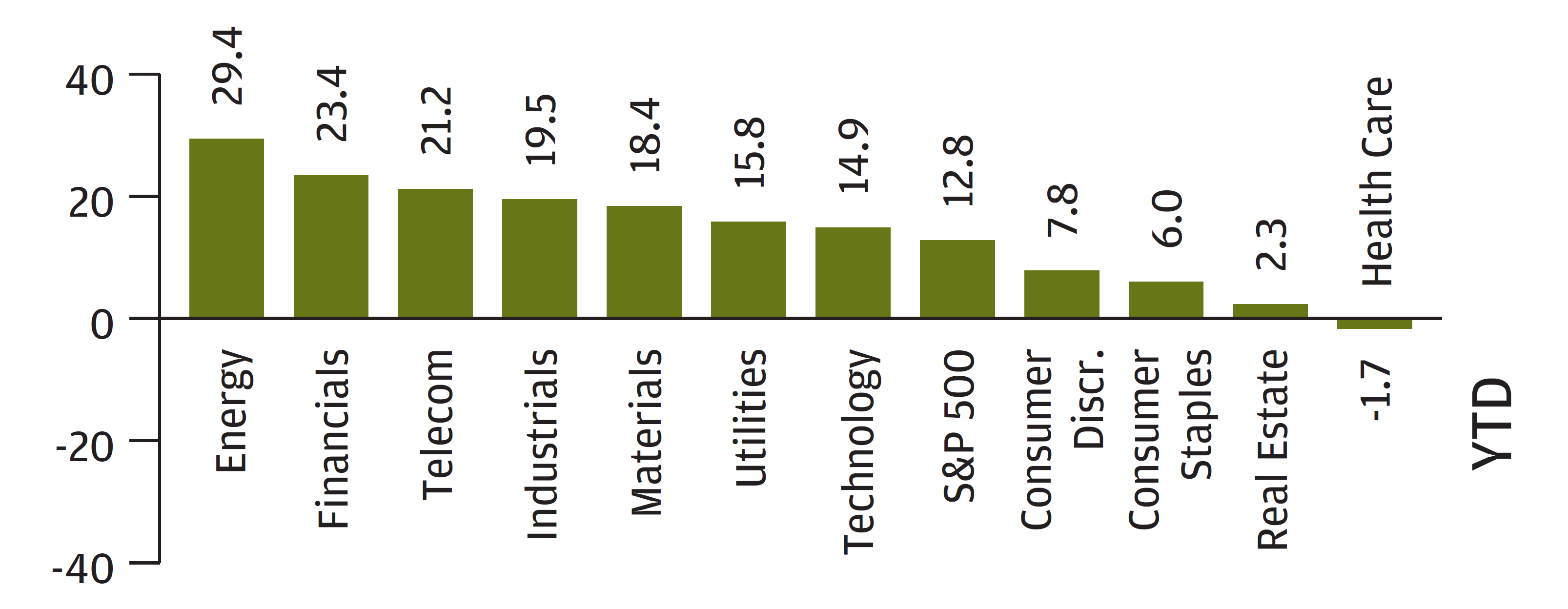

However, it is interesting to note that Santa definitely has his favorites. As this chart from JP Morgan shows—in the rally that began earlier this year)–the energy, financials, telecom, industrials, and materials sectors have been the strongest performers, leaving traditionally defensive stocks like consumer staples, real estate, and health care behind:

Also getting lumps of coal in their stockings, so far, are other asset classes like International Stocks at .5% return year to date and Fixed Income (bonds) at 1.52% return for the year…

Enjoy the rest of your holiday celebrations, and we wish you a bright start for 2017!