Is now the time to take my gains “off the table?”

In a market environment like the one we are in right now, most investors have experienced some very nice gains in the US stock portion (and other areas) of their portfolios. For many, human nature causes us to ask the somewhat obvious question of “should I sell now?”

It’s an easy question to ask, but it’s a complicated one to answer. I think the two biggest issues with the question are, where do you go with the proceeds of your stock sales? And, when is the right time to get back into said stocks?

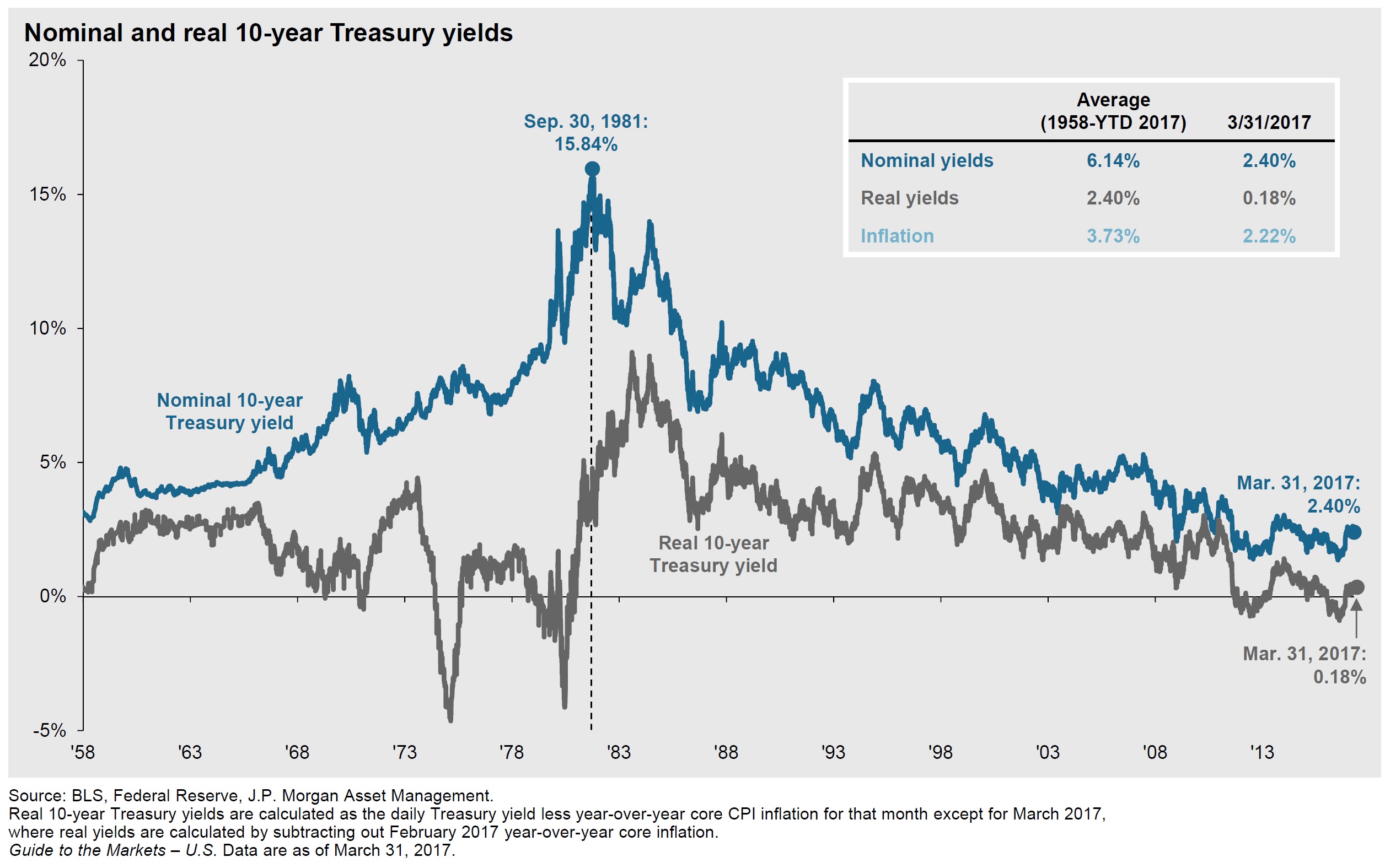

While there are many alternatives to investing in stocks, almost none of them have the proven history of long-term returns and liquidity that stocks do. For most people looking to move out of the market, they are looking to move into ‘something’ that is more conservative. Unfortunately, the conservative options are tied to current interest rates, which still remain historically low.

As you can see from the chart above, the conservative options net investors almost zero interest (0.18%) after you account for inflation. And, that’s if you invest in a 10-year US treasury. In case you haven’t shopped for a bank CD lately, the national average rate for a 5-year certificate of deposit is 1.86% (source: bankrate.com). So, when you subtract inflation from that number, you are actually losing money and committing to a 5-year term (-0.36%).

Even more difficult to answer is, when do you get back in the markets once you get out? Earning zero interest is not a sound long-term strategy for most, so there must be a point of re-investment. Many have tried and failed to time the market. Some have gotten it right over stretches of time, but very few (if any) investors have gotten it right over the long term (10+ years). It’s a dangerous game to try to play, and you will almost certainly hurt your own returns by trying.

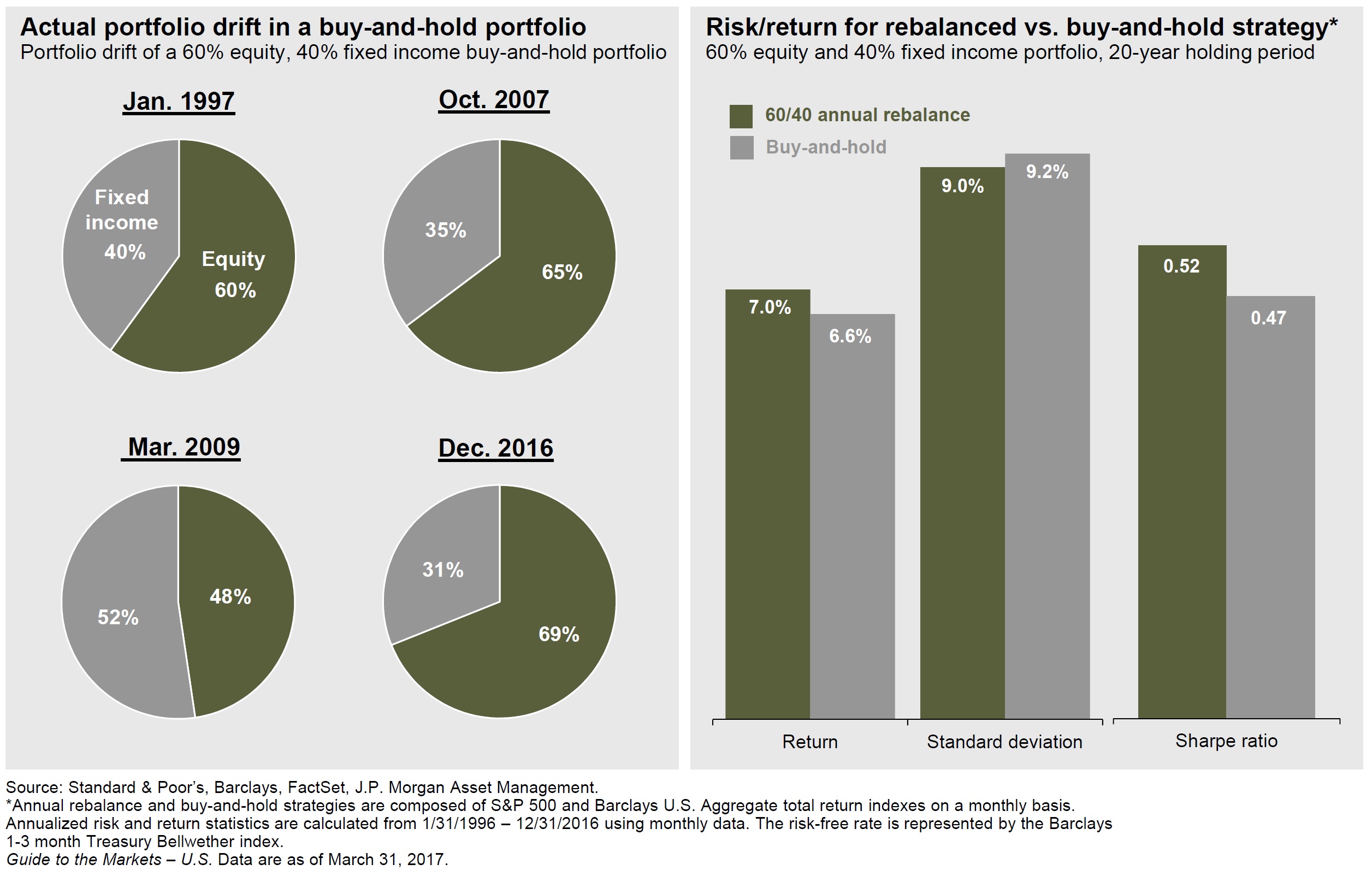

The not-all-that-exciting but correct answer is to rebalance on a regular basis (see above). There is no perfect frequency, but annually should be about right. If I had to guess, if you look at your 401k or other work retirement account, more money is in the stock portion than you intended there to be when you signed up. That’s because recently, stocks have done a lot better than the conservative “stuff” (technical term!). There should be a fairly easy way to reset (or rebalance) your investment mix via your company plan website.

I don’t have a clever way to tie in a recent personal experience to the post this week. So, here’s a picture of my kids sitting next to Theodore Roosevelt at the Natural History Museum in New York. For what it’s worth, inflation and interest rates were low during his presidency as well!