The Birthday Season

All three of our kids have birthdays within one month of each other, so we are all busy figuring out which family member is getting what for which kid***. Not to mention the annual discussion with each child of who they are going to invite, and where will the party be? It can all be a little ridiculous (and overly expensive!), but it is a lot of fun most of the time. And, it’s a good excuse for family and friends to get together.

This past weekend, we had family in from out of town, and they helped to celebrate all three kids’ birthdays in one fell swoop. Of course, this is in addition to the traditional parties with friends that have happened (in the two girls’ case) and will happen (in our sons’ case). In a way, for us as parents, it is kind of nice to get them all out of the way at one time. The big gift for all of the kids was a karaoke machine, which has been a very big hit. Fortunately, most of the “performances” have been in the basement and almost out of earshot. However, I have to admit that I now know the lyrics to an inordinate number of Taylor Swift songs!

Thumbs up for too many birthday presents!

Obviously, birthdays for adults are usually somewhat less exciting. But, you can give yourself the riveting (that’s sarcasm) gift of reviewing your retirement account investments! Especially in the case of work retirement plans; we hear clients say, “I had no idea what to pick, so I just put a little bit in each investment.” As investment managers and financial planners, this makes us cringe! While it is a good idea to diversify, randomly selecting investments that have a direct effect on your retirement success or failure is never a good idea.

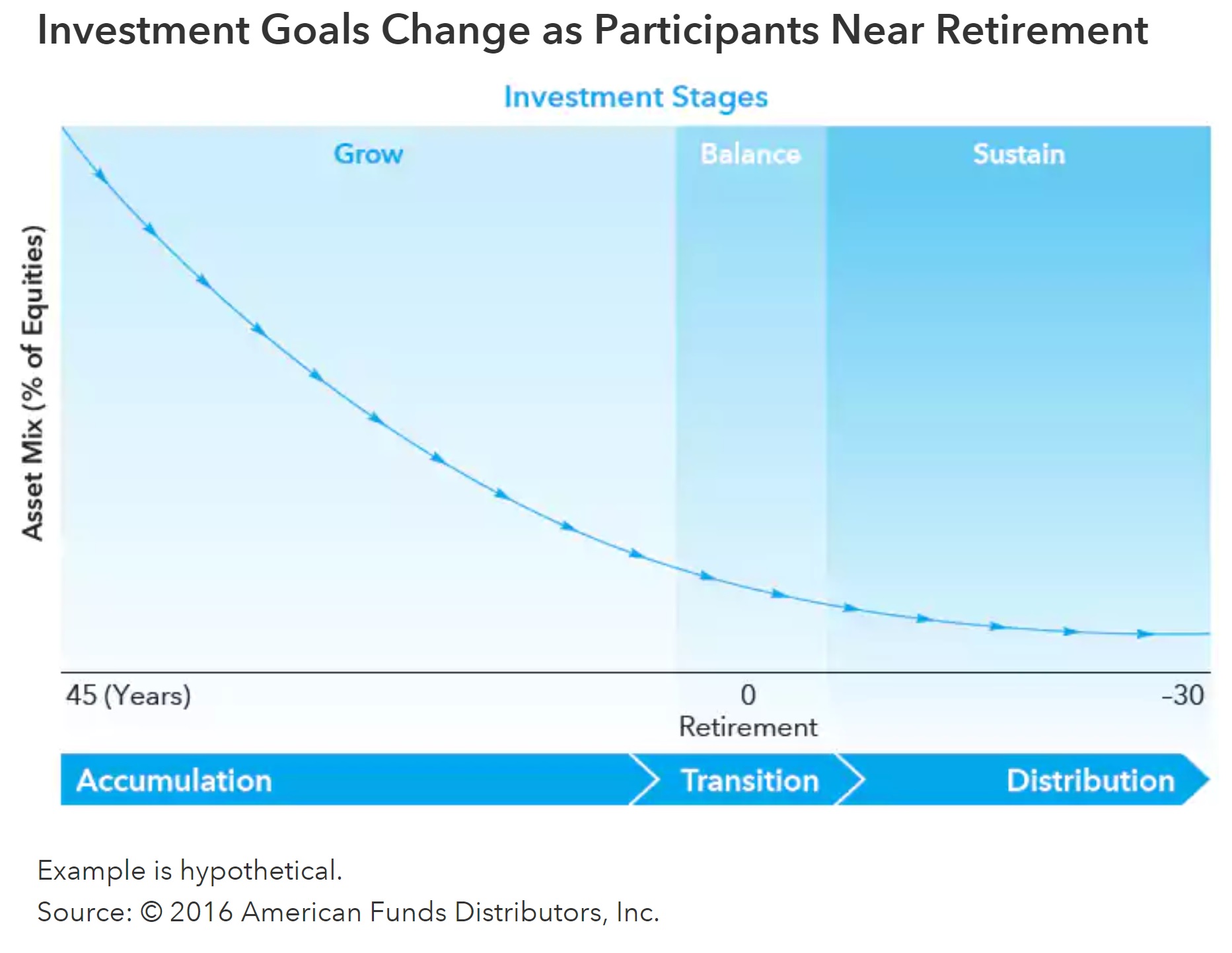

If you don’t have the desire or time to consult with an advisor or planner, then all you need to know is your birthday in order to pick an appropriate investment. These days, almost all plans have what are called ‘target date funds’ or ‘lifecycle funds’ or something similar. Each fund option will have a number in its name that represents a year out in the future. You should select the year of your approximate retirement date.

These types of funds will automatically adjust (get more conservative) as you get closer to that date. It is a great way to stick to an investment strategy, and can help avoid the pitfalls of trying to time the market or make short-term adjustments. As a brief example, if you were born in 1967 and you plan to retire at age 65, you would want to choose a fund with a target year of 2032 (2017 plus 15 years). Usually the funds are in 5 and sometimes 10-year increments, so you will either need to round up or down depending on your options.

Note that you will be putting 100% of your money into one fund. This may seem scary on the surface, but keep in mind that each target date fund is made up of many other funds. This means that you actually have investment exposure to hundreds of different stocks and/or bonds.

So, say happy birthday to yourself next year, and make sure your retirement plan investments are on track.

***I have tried, with limited success, to encourage family members to gift to the kids’ college savings plans rather than get them yet another toy! Just a thought for those of you who might have this option.