LIVE from Inside ETFs 2019

This week, Nathan and I are in Hollywood, Florida attending my favorite conference ever…Inside ETFs

Once a niche conference designed to help advisors use newfangled ETFs (Exchange Traded Funds….as opposed to the mutual funds of yore), this conference has grown to over 2,300 attendees coming to hear some of the sharpest minds on the subject of the US and global economy, the stock market, the Fed and interest rates, and overall portfolio positioning. Every one who is anyone in the money management world shows up with tons of ideas and sales literature in tow:

Even CBNC is broadcasting live from the conference floor, wanting to be the first to break the news from each session:

And to be completely honest, Florida in February is awesome too…sorry (not sorry) to our spouses with kids at home from school due to the sleet…

(my view while writing this…definitely very inspirational…we should write more blogs from the beach).

So, you get the gist…we are getting a lot of information from some smart folks…and we just wanted to share some of the more interesting things we’ve heard and learned this week:

Ric Edelman—always bold with his predictions, Ric took the stage and talked about disruption—what the investing ideas of tomorrow look like…his thoughts? Entire industries erased by advances in health care and subsequent longevity of life spans (life insurance, annuity companies, disability insurers, long term care insurers), the emergence self driving cars (auto insurance, auto industry, valets, truck drivers, chiropractors), and changes to our lifestyles (free college erasing the university system, green energy erasing the fossil fuels, etc). Interesting, thought provoking, inflammatory of course.

I also learned Whistler’s mother was 67 when he completed this painting…amazing how different age 67 looks today!!

Donna Brazille and Michael Steele—a rare treat—a civil conversation between a Democrat and a Republican. Both are former heads of the national parties, and both had intelligent approaches to our current political situation. They were friendly and respectful of each other, even with different approaches to issues. Both agreed that the each party has to give their constituents something to vote FOR, rather than just voting AGAINST the other…and that we all need to get involved and speak up to our regional and local politicians in order to hold them accountable to “We the People”…

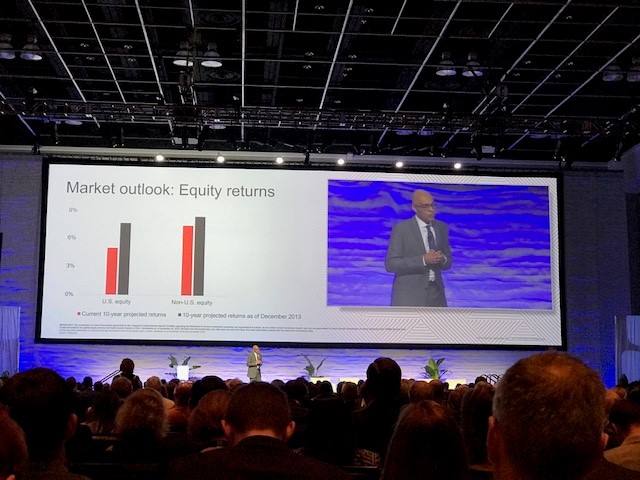

Greg Davis, CEO of Vanguard – With a tribute to Jack Bogle, Greg laid out the case why fees still matter—and how lost cost investment are the key to surviving a low return world. We were glad to hear the reinforcement of what Meridian has always believed…controlling tax impact and costs are the two things investors have total control over…and therefore should be managed well.

Michael Lewis, author of The Big Short, Moneyball, Flash Boys, and The Blind Side – Driving home the point that Greg Davis made, Michael Lewis entertained with stories of his days on Wall Street as a bond broker and the absolutely silly amount of money ripped off of unsuspecting investors.

His book Flash Boys was about how the stock exchange was rigged in favor of certain investors—in this case, high frequency traders—who paid for better and quicker trade execution…which shaved pennies off of investor trades every single trade. While pennies off each trade does not seem like enough to be outraged over, the cumulative effect of taking a couple of pennies off every trade routed through an exchange amounts to somewhere between $1 billion to $7 billion every year. Thankfully, government intervention and the creation of a new trading exchange has been curbing some of this high frequency trading!

Robert Shiller, Nobel Prize winner and Yale Economist and Jeffrey Sherman from Doubleine – Dr. Shiller famously called the 2001 and 2008 market crashes, and Jeffrey Sherman is know as one of the smartest minds in fixed income investing. Seeing the two of them together on stage, discussing things they are looking at, worried about, and seeing opportunity in was so much fun (I know that makes me nerdy…I can own that)

They discussed the tone at the World Economic Forum—how populist movements and income inequality are critical concerns, the current political landscape, the stock market, and major indicators they were watching to mark the next recession. For the most part, we’ve already been positioning portfolios at Meridian to withstand the risks they outlined…we are always happy to hear validation of our strategic outlook on such a big stage.

Even more fun, Nathan and I were able to have lunch with Dr. Shiller, and it was fascinating to hear how he is applying his academic research to predictive asset management. For an example, one of Dr. Shiller’s important contributions to academia was his CAPE ratio—a method of determining whether the stock market is over or under valued. At the moment, the CAPE is signalling slightly overvalued. He is now applying the CAPE at the sector level (consumer staples, communication services, and industrial socks all appear to be undervalued), as well as at the national level (Japan is deeply undervalued from a historical aspect).

We wanted to get a picture with Dr. Shiller to prove it actually happened, but we both chickened out…so as I head back to the final closing sessions of the conference, I’ll leave one last picture of the beautiful Florida ocean…see you back in Virginia soon!