The Give and Take of Risk and Return

With everything going on in the world and the markets right now, the word “risk” has seemed to take center stage. But it got me thinking, isn’t some level of risk always there? So I thought it timely to get back to the basics and revisit what risk means as an investor, how it correlates to investment returns, and why we even take risk in the first place.

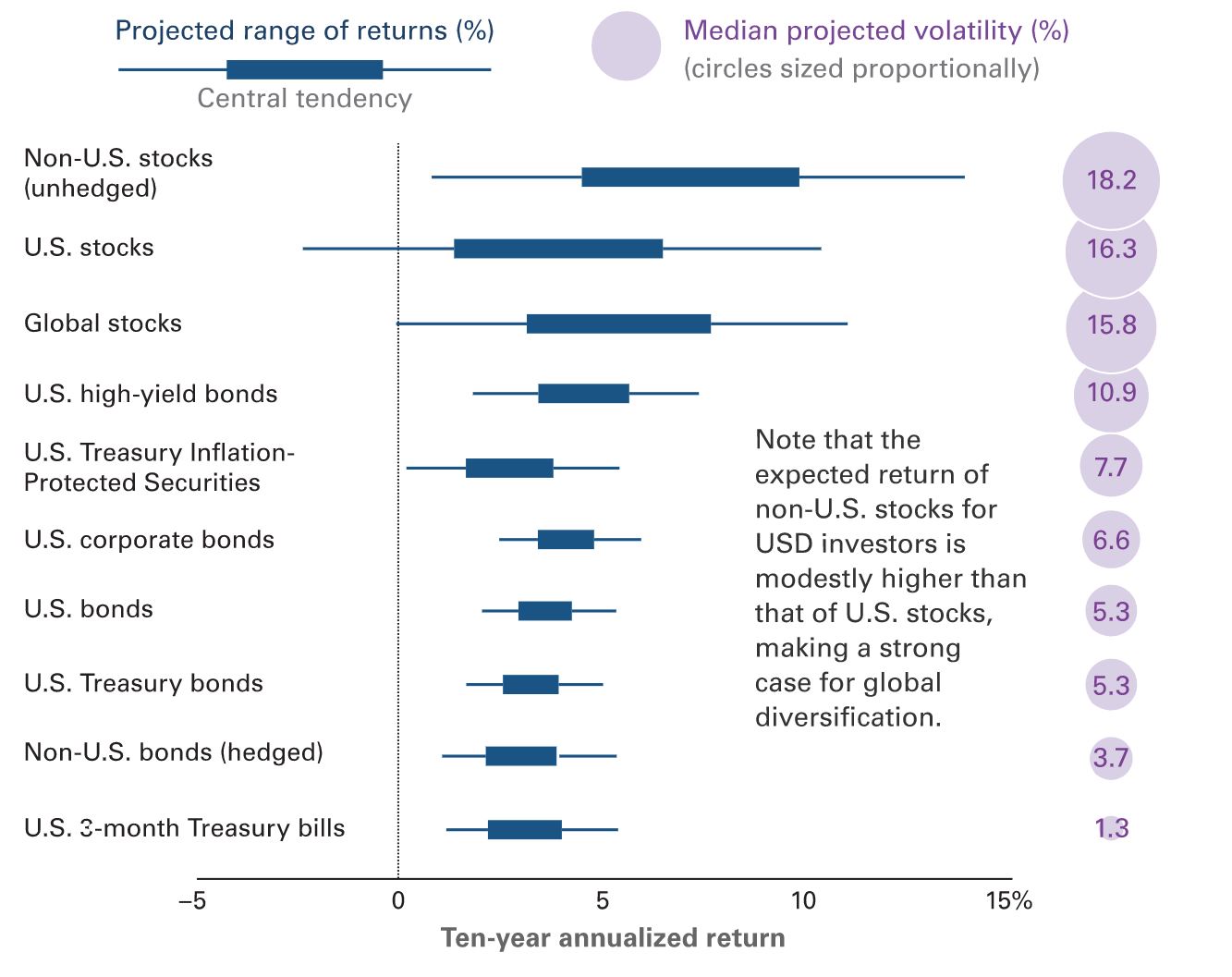

Risk as it relates to investments is defined as the “degree of uncertainty and / or potential financial loss inherent in an investment decision” (www.investor.gov). However, as any investor knows in order to reap reward aka return, some level of risk must be taken. Risk and return are always related. And the reality is, any investment whether it’s stocks (volatility), bonds (interest rates), cash (loss of purchasing power) has some sort of risk tied to it.

As investors, typically the first thing we want to know about an investment is “how much return can I expect?”. However before understanding how much return one can expect, we can reframe it by first looking at how much risk one is willing to take. It is easy to say “I want to take on more risk” when the markets are showing double digit annual returns, but what really defines risk preference and inevitably expected returns is how much loss can an investor stomach within a fixed period of time. A greater ability to handle volatility equates to a greater return over time.

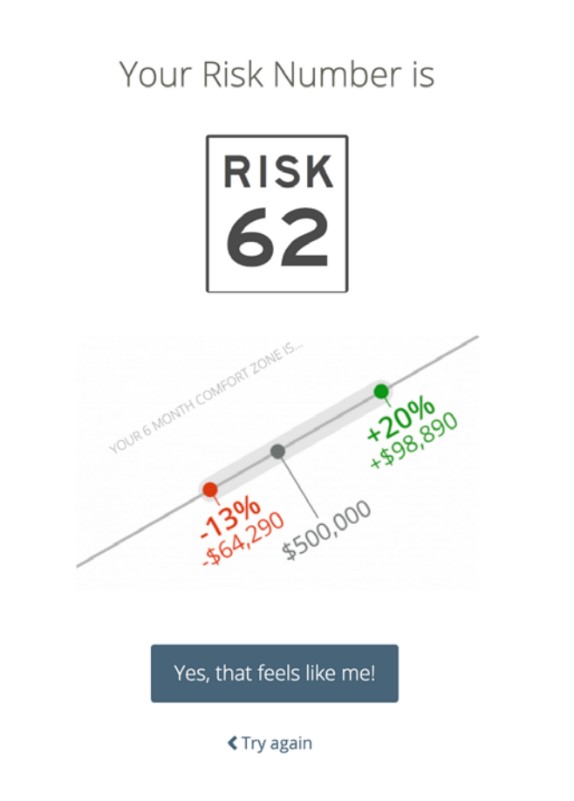

By establishing how much volatility one can handle, coupled with understanding an investor’s unique financial objectives, parameters can be drawn around how much return one can expect to gain or lose given different types of market environments. One of the tools Meridian uses is Riskalyze, which uses quantitative and objective questions to create a unique risk score that shows a range of returns on a portfolio a client would be comfortable with based on their answers to the questions.

From here based on an investor’s identified risk level, equity and fixed income investments are blended to create a portfolio with the desired risk exposure. All of this is keeping in mind again the individual’s unique financial objectives and timelines.

All of this goes to say that before we can look at expected returns, having a realistic understanding of and being comfortable with our own risk tolerance and timelines for the investment will make the bumpier roads hopefully a little bit easier to bear. Meridian finds this piece to investing extremely important right from the beginning – establishing a risk tolerance from the beginning of our relationship and revisiting it at least annually to monitor for any changes in risk appetite and therefore allocation across asset classes. We are always happy to revisit this discussion – let us know if you’d like to review and discuss your risk tolerance.

Risk has and will always continue to be around. Even with non-monetary assets do we sometimes take risk! My dad started a sheep farm post-retirement as a hobby and although taking on more sheep every year poses its owns risks, the return in form of cute (and healthy) lambs sure does pay off!