Tax Now or Tax Later?

There is a lot of buzz on the streets about Roth IRAs / 401ks and whether that is the right investment vehicle. Well maybe not a LOT of “buzz”, but certainly enough to warrant some questions from our clients over the years. So is a Roth IRA or Roth 401k / 403b always the best option?

A quick refresh on the income and contribution limits for Roth IRAs:

In order to contribute to a Roth IRA, the account owner (or spouse) must have earned income no greater than $144,000 if filing single and $214,000 if filing jointly. IRA contribution limits remain at $6,000 for 2022 plus another $1,000 if the account owner is 50 or older. Contributing to a Roth IRA for a child is definitely doable and a great way to jump start tax-deferred savings for them, but contributions are limited to that child’s earned income.

As most know, the limits for a Roth 401k are much higher, but not all employer sponsored plans offer a Roth option. For 2022 pre-tax and Roth 401k contribution limits are $20,500 plus an additional $6,500 for those 50 and older.

One of the most attractive characteristics of Roth’s and why they get so much attention is the tax-free distributions down the line as well as special circumstances where Roth funds can be withdrawn without penalty or taxes before 59 ½. A few key caveats though to remember:

- If the Roth has been open five years or more and you’re at least 59 ½ all distributions are tax-free (i.e – contributions, conversions, earnings).

- If the Roth has been open five years or more and you’re under 59 ½ your contributions can be withdrawn tax-free, but earnings may be subject to taxes unless you use the withdrawal (up to $10,000 lifetime maximum) to pay for first-time home purchase or you become disabled.

- If the Roth has been open for less than five years and you’re under 59 ½, the earnings may be subject to taxes and penalties; however, you can avoid the penalties, but not taxes if:

- You use the withdrawal (up to a $10,000 lifetime maximum) to pay for a first-time home purchase.

- You use the withdrawal to pay for qualified education expenses.

- You use the withdrawal for qualified expenses related to a birth or adoption.

- You become disabled or pass away.

- You use the withdrawal to pay for unreimbursed medical expenses or health insurance if you’re unemployed.

- The distribution is made in substantially equal periodic payments.

Another attractive characteristic about Roth IRAs, there is currently no requirement to take distributions at a certain age, allowing the funds to continue to remain invested and grow tax-deferred for longer. However, this only applies to Roth IRAs. Roth 401ks require distributions at age 72.

So are Roth IRAs / 401ks always the right investment vehicle for you?

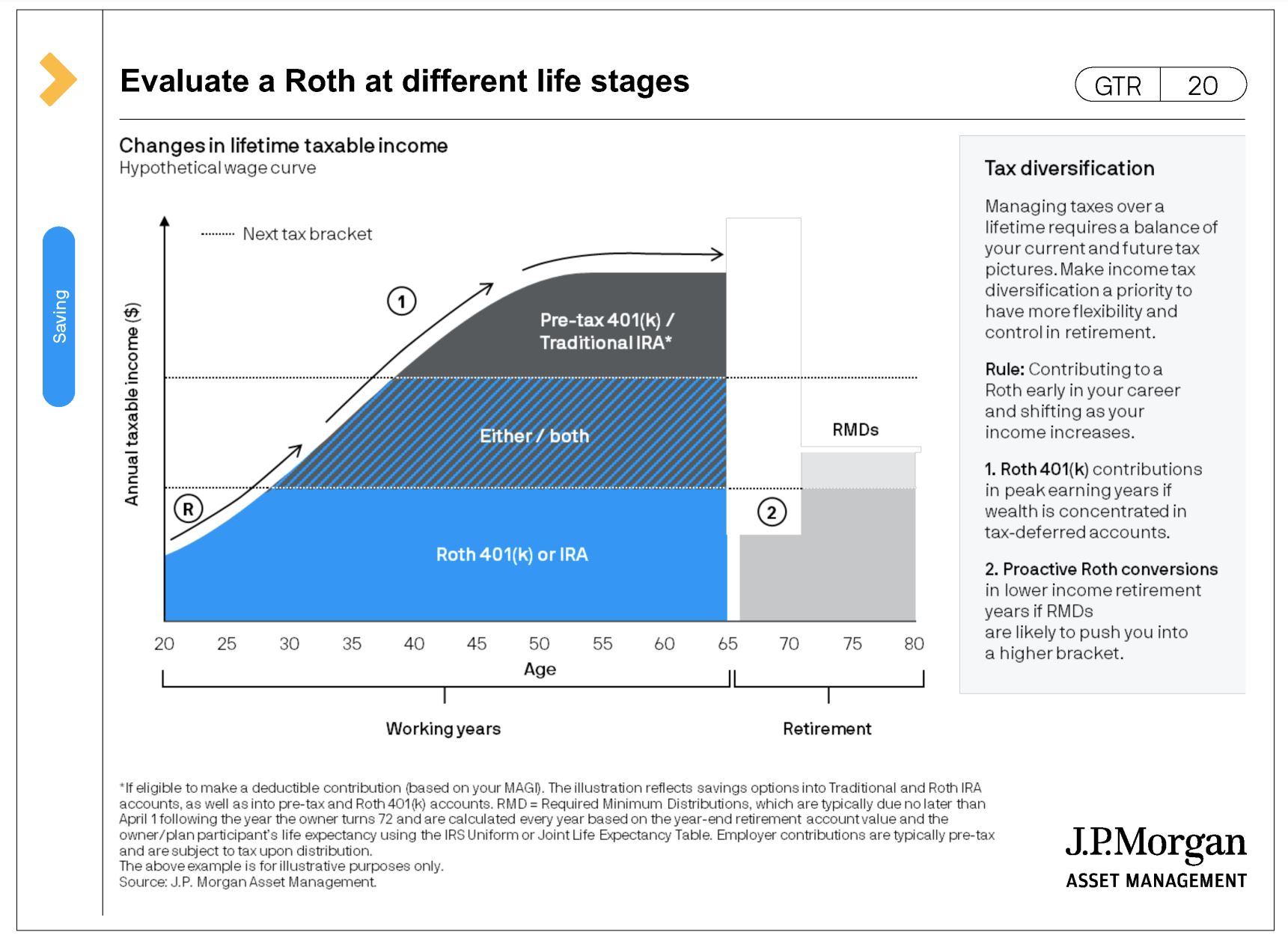

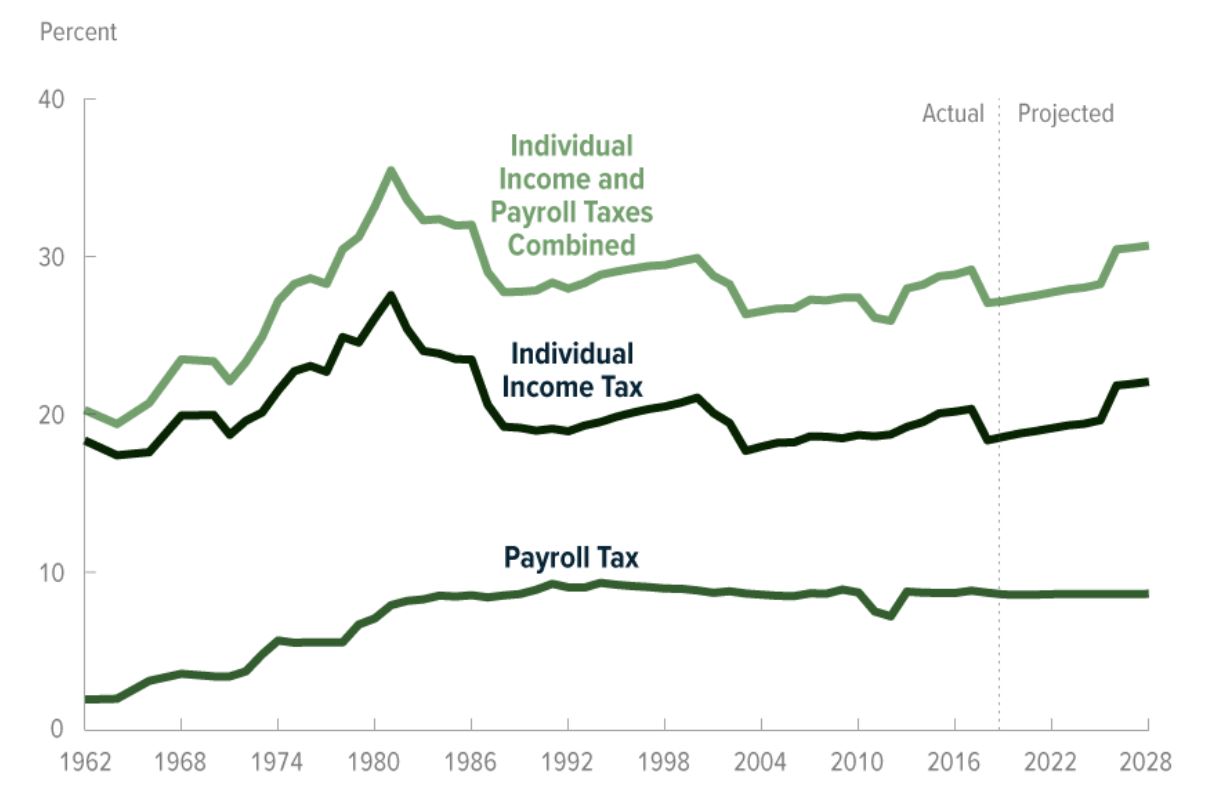

Back of the napkin advice is – contributing to a Roth early on in your career because it is likely that you are in a lower tax bracket now than you will be by the time you start distributions and therefore the tax impact will be much less now. This is also true if you feel that income tax rates will be higher in the future or you are expecting to be receiving more income at the age of distribution (i.e – pensions, social security, inheritance).

Better to rip the tax band-aid off now right?

But there are cases where contributions solely to a Roth may not be the best option.

- If you are currently at the highest tax bracket and expect income to decrease in the future. Maybe one spouse will retire much earlier than the other, or the expected income during retirement will be significantly lower than where it is now. Also depending on where you are in your current tax bracket, making pre-tax contributions instead may bump you into the lower tax bracket.

- If you are not at least maxing out your employer match in your 401k or 403b (and they don’t provide a Roth option), it’s recommended to bump up your contribution amounts before contributing to a Roth IRA.

- If you suspect you may need the funds in the near future, contributing to a taxable investment account or bulking up savings instead will be more tax efficient.

The good news though, is you don’t have to choose between either a Roth or pre-tax funds. If you are uncertain as to whether you will be in a higher tax bracket in the future or any the above scenarios apply, contributing to both Roth and pre-tax accounts is a great way to diversify future retirement income streams. Still not sure? Ask your financial advisor and accountant what is best for you and your situation.