The “Cash Trap”

With the Federal Reserve’s campaign to tame inflation pushing short term interest rates higher, cash yields have become more and more enticing. Frankly, we’ve never bought more CDs and Treasury bonds for our clients than over the past year. It’s been a welcome sight to see Treasury and cash yields in the 5% range!!

However, now we’ve been having harder conversations about investing in anything BUT cash and T-Bills! It’s very comfortable to earn 5%, relatively risk free!! 😊

The problem though, is that these rates are all short term in nature—when rates start to fall (whether that be next quarter or next year), these money market, CD, and Treasury rates will fall too, making it difficult to reinvest at something similar to today’s higher interest rates.

JP Morgan Asset Management coins this the “cash trap”. And in a small paper published this week, they outlined clearly why investors should be confident in building long-term portfolios…we liked their points so much that we wanted to share them with you…so, without further ado, here are several principles from JP Morgan to help investors think through and avoid the “cash trap”:

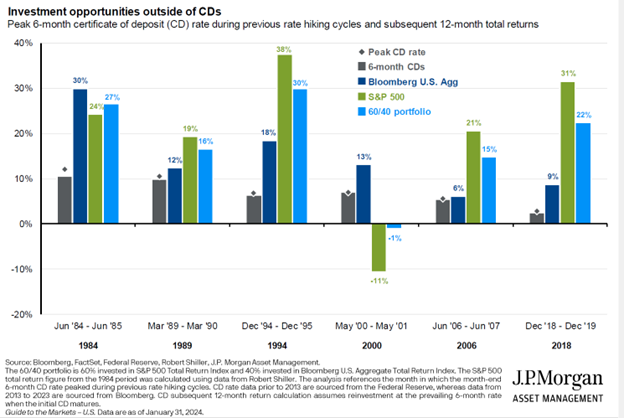

- Too much cash has significant opportunity cost

History has shown that when interest rates peak, stocks and bonds typically outperform cash over the subsequent 12 months. In fact, in the last six instances of peak rates, a 60/40 portfolio has outperformed cash 83% of the time by an average of 15%.

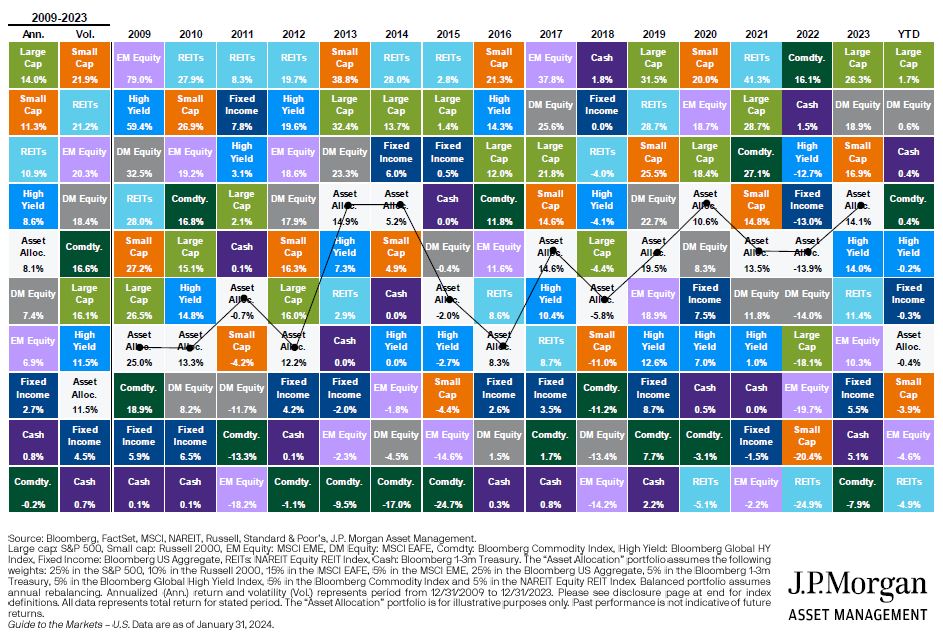

- Even when cash performs well, other assets perform better

2023 cash returns were the best seen since 2001. However, with the exception of commodities, investments across asset classes, geographies, styles and sizes all outperformed cash, in some cases by a significant margin.

(Hint on how to read this chart…for each year listed at the top of a column, the best performing asset type is at the top, and the worst performer is at the bottom. So, for 2023, the best performing asset type was large stocks at 26.3%, and the worst was commodities at -7.9%. Cash is towards the bottom at 5.1%. The long term averages for best to worst performers are in the far left column)

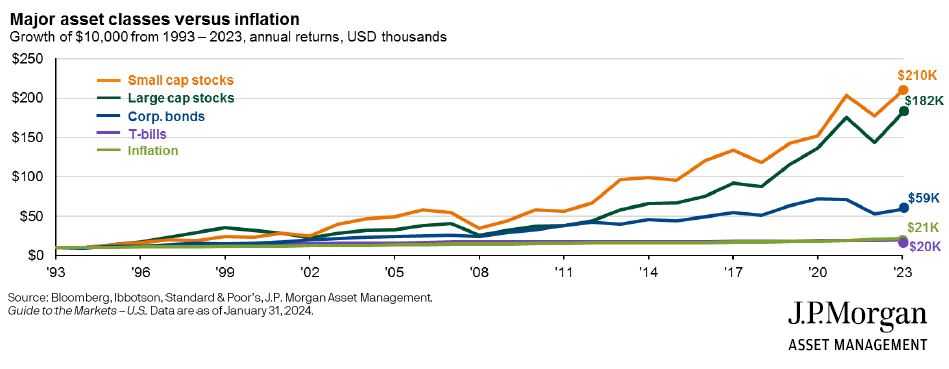

- In the face of inflation, investors need more from their portfolios

Over the last 30 years, cash has been unable to keep up with the creep of inflation. By contrast, other investments have been much better places to park capital. Moreover, for investors willing to take more risk, the reward has generally been worth it.

(See T-Bills about even with inflation?)

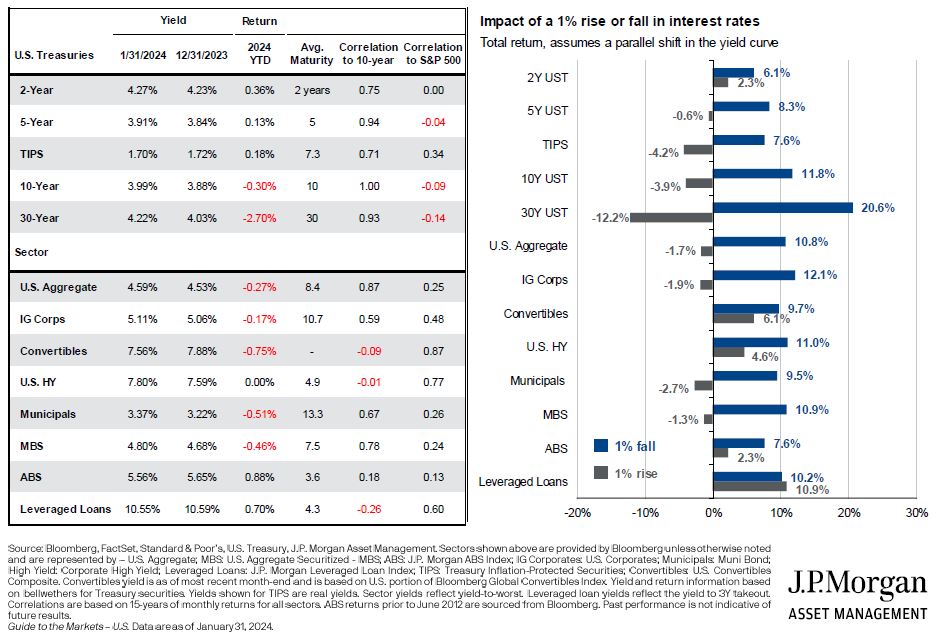

- Bonds provide income and portfolio protection

Coupons across the fixed income market have risen alongside cash. This allows investors to weather short-term rate volatility. In other words, there is more upside potential than downside risk in today’s bond market.

(Hint on this one…there are lots of numbers, so it is a bit hard to read! In the left table, you can see the current yield of different kinds of bonds…for example, a 2 year Treasury is currently yielding 4.27% (up from 4.23% as of 12/31). On the right, the blue bars show the PRICE increase if interest rates fall by 1%. The gray bars show the price decrease if rates rise by 1%. Across most bonds, there is very little price downside compared to the price growth potential. This is a good example of asymmetric risks…)

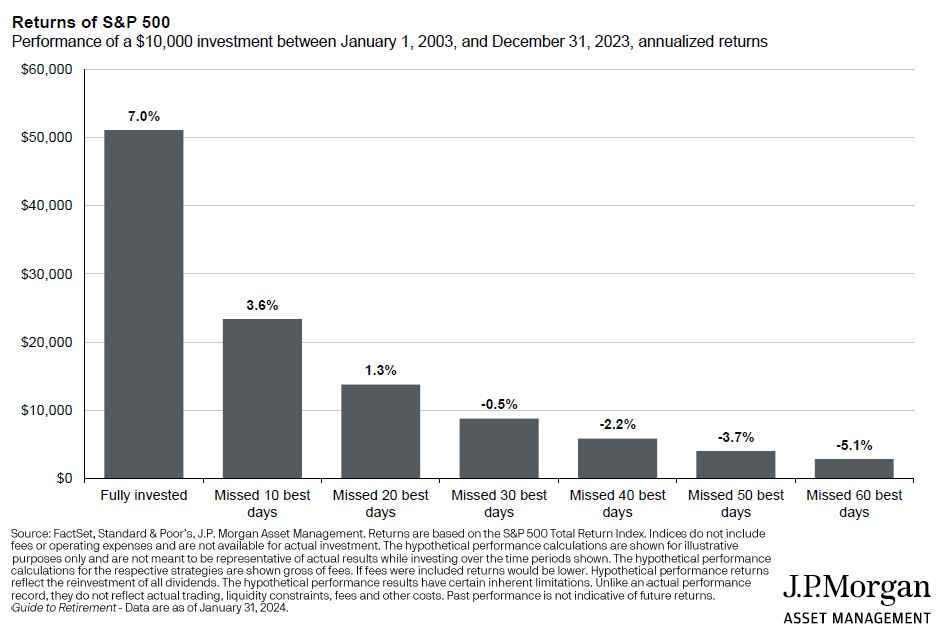

- Waiting to get invested can harm performance

History has shown that by missing only a handful of the best trading days, investment performance can suffer. In fact, an equity investor who missed just the 10 best days since 2003 would have seen their annualized performance cut nearly in half.

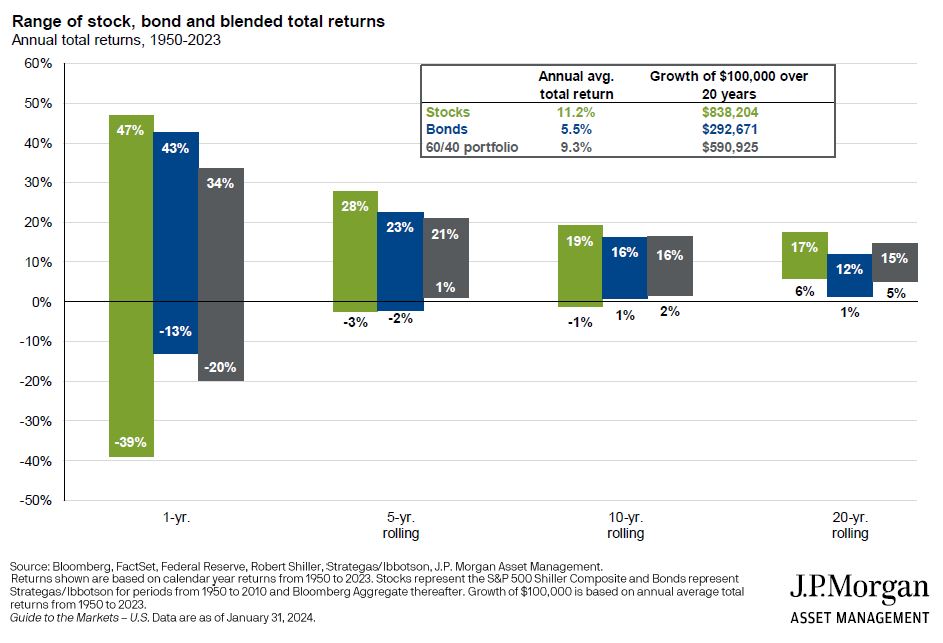

- Long-term investors have time on their side

Over the last seven decades, volatility has led some investors to think of investing as being unsafe. However, as time increases, portfolio volatility decreases. In fact, a 60/40 portfolio has not delivered negative returns over any 5-year rolling window over the last 73 years.

Some cash is always needed—emergency funds, near term expenses, short term goals. But long-term goals should be invested in long term assets, and helping folks decide how much to keep liquid in cash and how much to invest for the long term is what we love to do. We welcome a conversation if you’ve fallen into the “cash trap” and need some help (or confidence) to get out!

Not quite “cash traps”, but definitely “money pits”? 😉