A Diversified Toolkit

If you know me and my husband, you know that we are serial renovators and DIYers. Yes, we are sick sick people. We are currently in the home stretch of our last … and I mean LAST… home renovation. While I’d like to think I am contributing as much as possible during the renovation, I am in awe of the diverse skill sets my husband has. For example, he single-handedly and successfully ran the electrical pretty much in the entire house (note: he is not an electrician by trade). His literal and figurative toolkit is incredibly diverse. However as skilled as Lewis is, he also knows that doing every part of the renovation ourselves doesn’t imply a better result. It’s a balance between utilizing varied skills that are working together towards the same goal or taking on too much, which in the end doesn’t provide a better result, just more of a headache.

Much the same can be said for the reasoning behind maintaining a diversified portfolio. The concept of diversifying is a fundamental principle of investing and the old age theory of “not putting your eggs in one basket”. The right amount of diversification lowers volatility where possible while enhancing expected return— the sweet spot in investing (technical term). Harry Markowitz, the founding father of the Modern Portfolio theory, developed an insight that the risk level of a portfolio is not just dependent on the individual risk of the holdings, but whether the assets are perfectly correlated (i.e – do they move in the same direction). The theory suggests that combining assets with lower correlations tends to reduce the volatility in the overall portfolio and even further, the lower the correlation between assets the bigger the benefit from diversification.

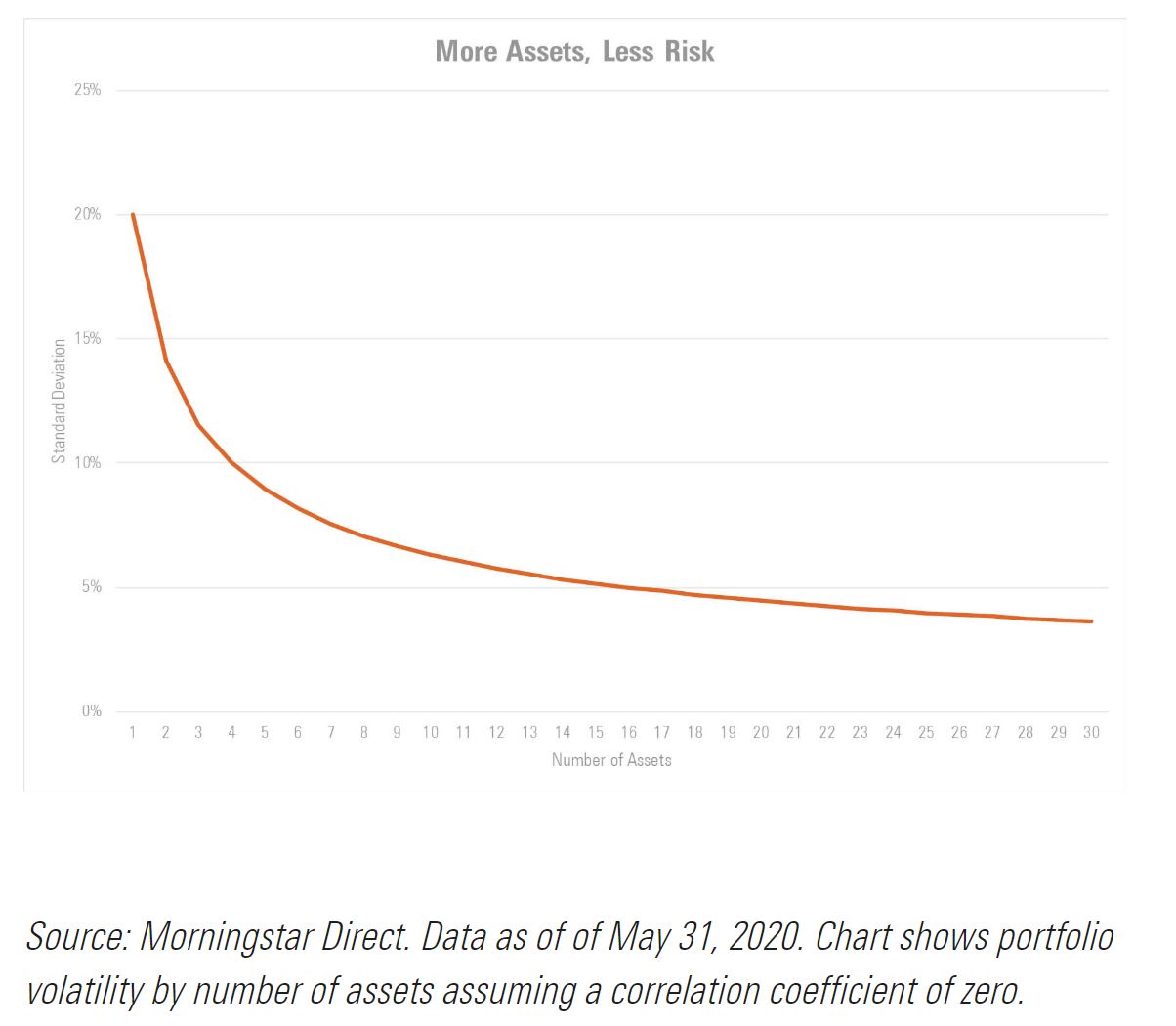

The chart below demonstrates the benefit to adding in more assets that have zero correlation – an increase in the number from 1 to 4 assets reduces portfolio volatility by 50%.

And while diversification in theory makes sense to most investors, it is the practice of it that can become more difficult, particularly if there is a heavy overweight to one stock that may have specific meanings or ties to the investor. Therefore prudent diversification, especially to newer investors is incredibly important for long-term planning and investing. It is easier to start out the investing journey with a diverse portfolio from the start rather than down the line struggling with how to alleviate an overweight holding in a portfolio.

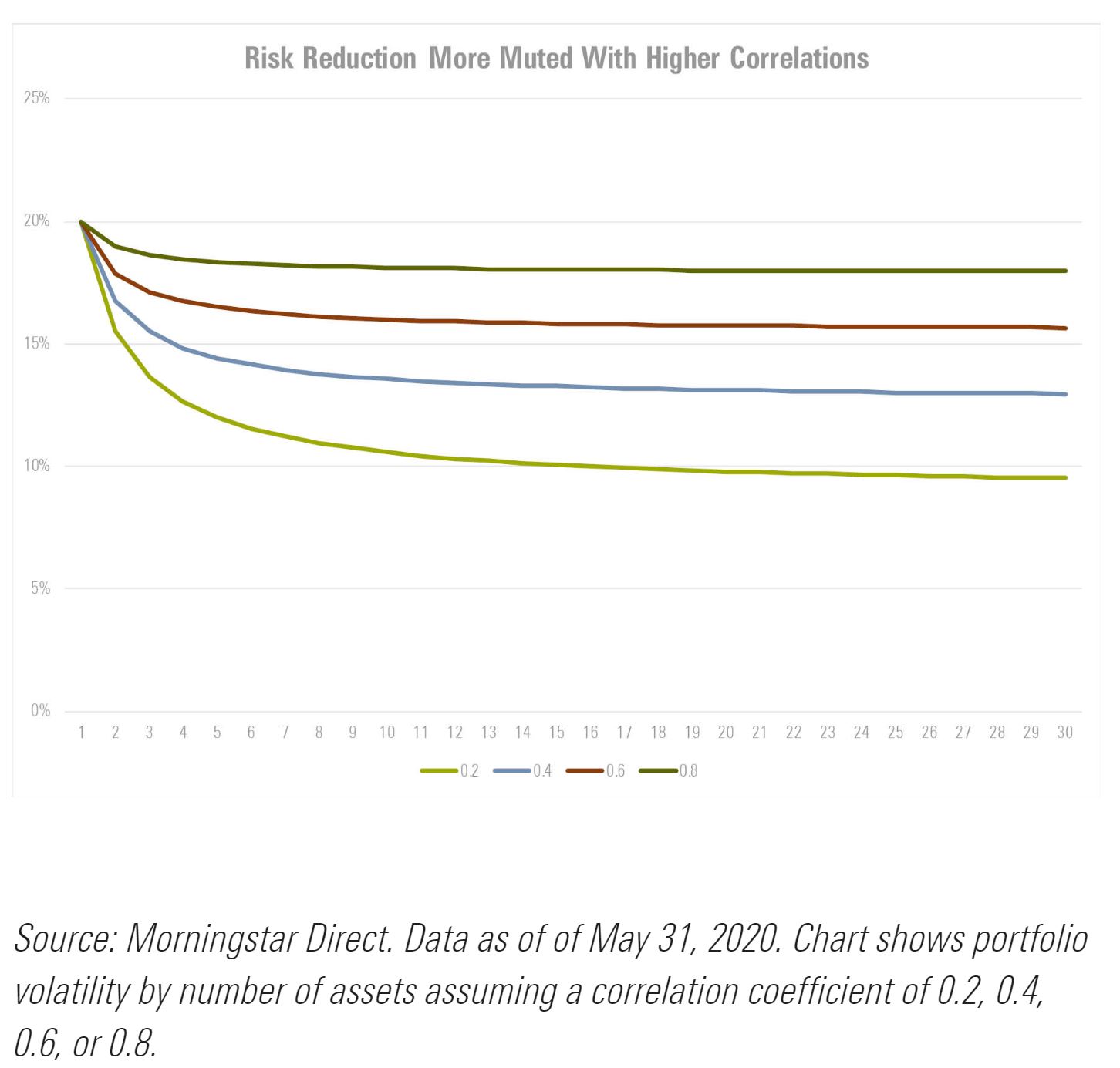

However, there is also scenario of being overly diversified. Too many assets not only overly complicates portfolio management but in the end waters down the benefits of diversification and therefore risk is only reduced by minimal amounts. The below chart shows how risk reduction starts to level off as the number of assets increases substantially, particularly if the assets are more closely correlated. (For frame of reference “1” indicates perfectly correlated assets). An efficiently diversified portfolio is much like goldilocks – just right.

I also feel it important to add that while Modern Portfolio Theory is the fundamental foundation for efficient portfolio structuring, prudent portfolio management does not use the theory in a vacuum. Fluctuating factors such as distribution / withdrawal needs, risk tolerance, and financial goals play an integral part into applying diversification and constructing an individual portfolio.

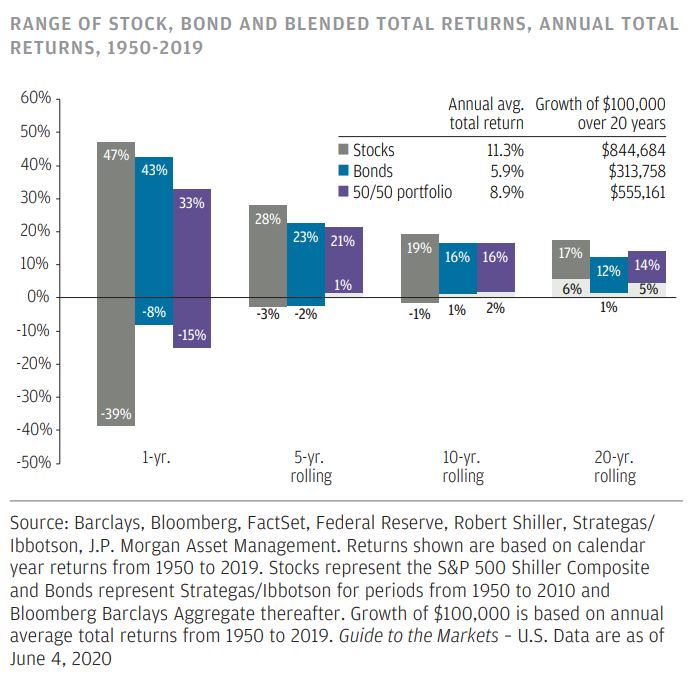

Particularly during this very uncommon time, Meridian continues to see the undeniable benefit of proper asset diversification not only in the shorter term, but also the longer term. The below chart from JP Morgan displays the range of returns between stocks, bonds, and a balanced 50/50 portfolio for 1 year, 5 years, 10 years, and 20 years. Over time, investment outcomes improve and the range of potential returns narrows.

Diversification will always continue to be a timeless investing principle, but it also means there usually is something in your portfolio that doesn’t excite you. However, as we saw in March of this year, it plays its part when necessary.

And most investors know diversification is not restricted solely to the allocation between equities and bonds. It encompasses active management vs passive management, growth vs value, domestic vs international, high yield vs treasury, etc.

The underlying message is having too little diversification in your portfolio “toolkit” can create unnecessary risk, and having too much can be counterproductive. While you might not always at one time use what is in your diverse “toolkit”, knowing you are prepared for the long-term to tackle your “projects” is worth the piece of mind.

I know me and my husband will have piece of mind when we are finished with our home projects. This picture just goes to show that we have been in constant renos … it is from 3 years ago!